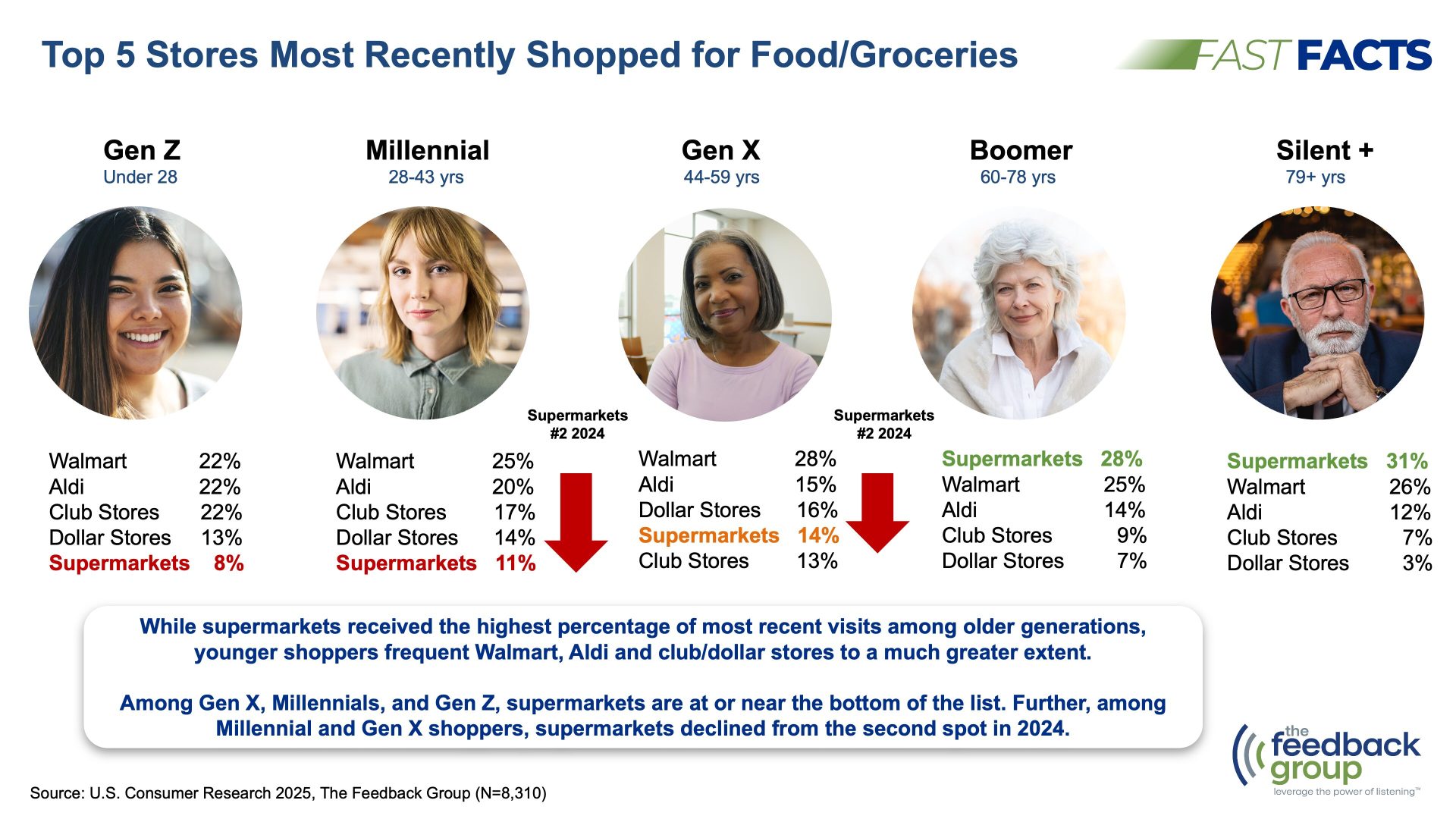

The latest study from The Feedback Group finds that supermarkets continue to win favor with older generations but are losing ground with younger shoppers. When considering their most recent visit, among Silent Generation and Boomer consumers, supermarkets register as the top destination for food shopping.

However, Gen Z, Millennials and Gen X prefer other retailers, including Walmart, Aldi, dollar stores and club stores. Notably, supermarkets slipped from the second-most shopped format among Millennials and Gen X in 2024 to near the bottom in 2025.

Based on 1,100 supermarket shopper interviews nationwide, “U.S. Food Shopper Research 2025: The Supermarket Experience” offers a comprehensive view of evolving in-store consumer perceptions, behaviors and satisfaction drivers.

“A generational reshuffling is under way, with younger shoppers gravitating more toward other food formats, leaving supermarkets to reevaluate how they engage this critical audience to remain relevant,” said Brian Numainville, principal at The Feedback Group.

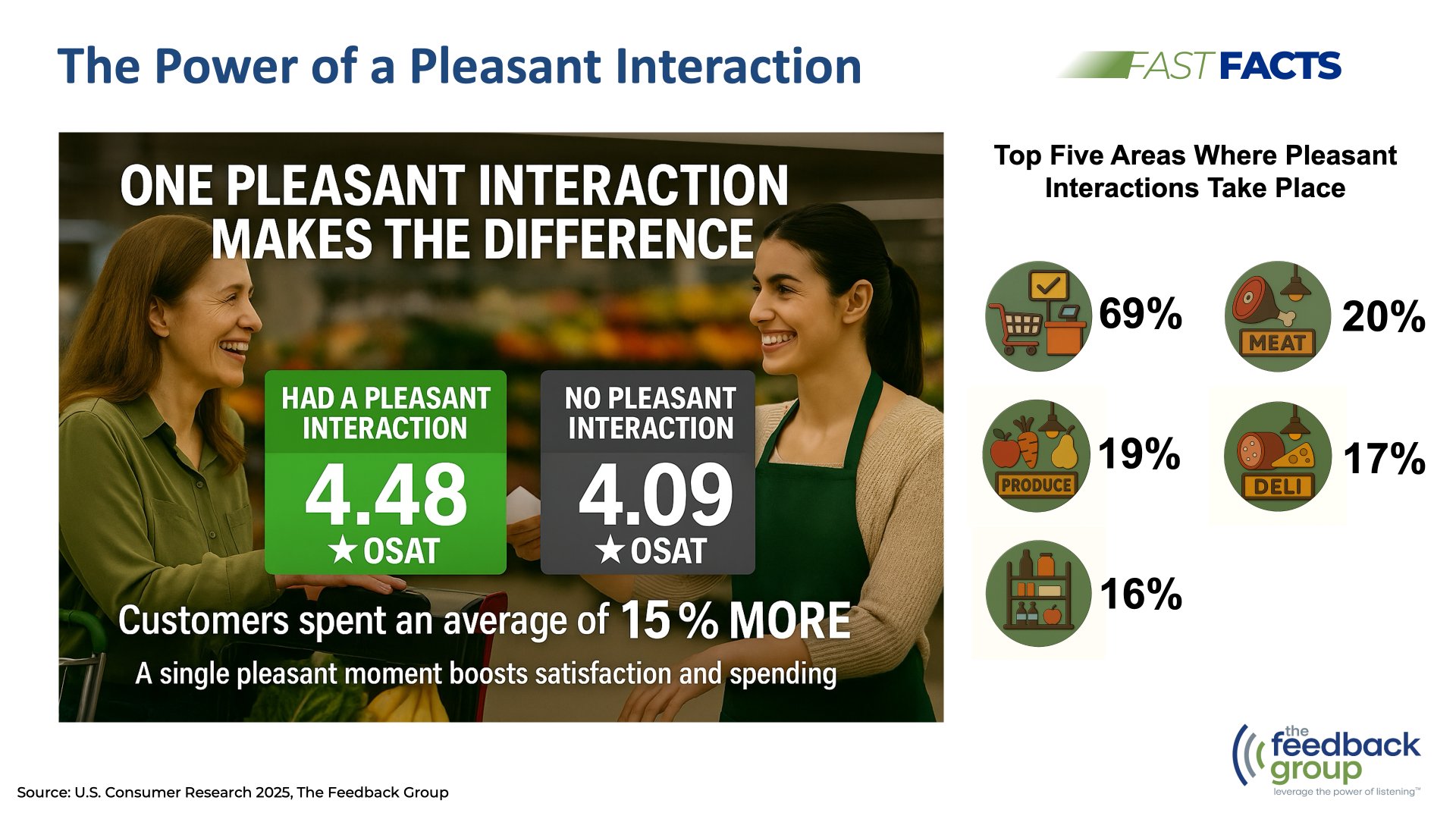

According to the study, supermarket satisfaction remains high overall (4.39 on a 5-point scale), with older shoppers and younger shoppers rating satisfaction more favorably than middle generations. Shoppers using cashier-assisted lanes report higher satisfaction (4.45) compared to self-checkout users (4.29), emphasizing the continued value of human interaction.

Food quality (4.48) and cleanliness (4.47) lead supermarket performance ratings, while value for money (4.19) receives the lowest score. Considering departments throughout the store, when expectations aren’t met, the causes are mostly pricing, product availability and variety offered.

Shoppers unable to find all intended items rate their satisfaction significantly lower (3.99) than those who find everything (4.47). Sensory elements like pleasant aromas, enjoyable music and food sampling correlate with increased spending – shoppers who notice food aromas spend 25 percent more, those who notice enjoyable music spend 35 percent more, while those who try samples spend 67 percent more.

[RELATED: Study Finds Shoppers Stressed By Rising Prices, Inflation, Tariffs]

Digital circular use again surpasses print, with 52 percent of shoppers now using a digital ad, up from 48 percent in 2024. In-store mobile use remains strong, with one-third of shoppers using phones for tasks like finding specials and accessing loyalty programs.

Despite strong social media use (88 percent), just 25 percent of shoppers are connected to their primary supermarket on any platform – an area of continued opportunity, particularly among younger consumers.

About 45 percent of shoppers feel their supermarket seeks feedback, and 59 percent believe their store values them personally as customers. In both areas, stores perceived as responsive show significantly higher Net Promoter Scores. Further, when a shopper indicates they had a pleasant interaction, their overall satisfaction is much higher and they spend more.

“Our research makes it clear that sensory experiences, pleasant interactions, personalized recognition and perceived listening by supermarkets directly contribute to loyalty and higher spending,” said Doug Madenberg, chief listening officer at The Feedback Group. “Retailers that close this gap will build stronger relationships and drive greater performance.”