by Diana Leza Sheehan

While many factors help to shape the state of grocery retailing in the Midwest, geography plays a critical role in how retailers have evolved and thrived over time.

National chains such as Walmart, Kroger and Aldi continue to hold a significant share in the market, yet the region features many small but innovative independent regional players that have tapped into the distinct consumer culture that prioritizes value, convenience and community. Geography also plays a role in how regional and independent retailers grow.

Eight of 10 consumers live in urban and suburban population centers such as Chicago, Cincinnati and Milwaukee, yet independent players in rural areas have found ways to innovate in unexpected ways in rural communities where they serve as multi-faceted hubs of community engagement.

Let’s take a closer look at the Midwest’s grocery aisles to understand the factors at play.

Exploring region’s grocery shoppers

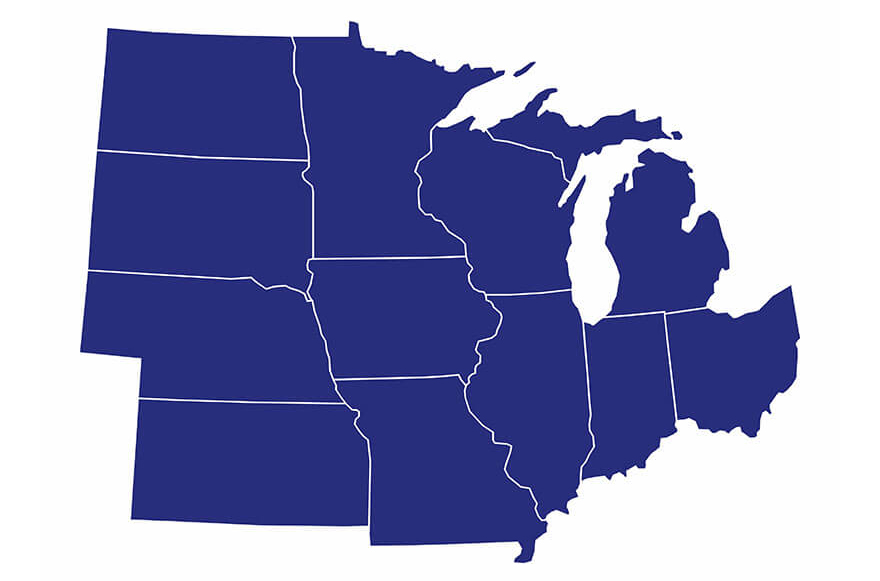

The Midwest accounts for 21 percent of the U.S. population – about 69 million people. However, with 12 states in the region that have quite different population trends, navigating where and how to grow can be a challenge.

As in the Northeast, the region’s net population is stable, but major cities such as Chicago, Indianapolis, Detroit and Milwaukee continue to see population declines. Residents move to suburbs and less densely populated areas that offer lower cost of living, more affordable housing and additional job opportunities.

Illinois, the most populous state, is shrinking slightly; however, other states in the region are growing, which allows the net population to stay stable. This region is unique in that one metropolitan area – Chicago – accounts for more than 10 percent of the total Midwest population density, with about 9.5 million residents in the city and suburbs.

Looking at the demographic makeup of the region, most states are not diverse. More than 70 percent of the population in all states but Illinois identify as White, compared to the U.S. average of 59 percent. There is significant diversity in the metropolitan areas, but that also differs by city.

Nearly 60 percent of the Chicago and Milwaukee populations identify as either Latino or Black, as does 78 percent of Detroit’s population. Cities such as Minneapolis and Detroit have large Muslim populations with dietary restrictions that require unique grocery offerings.

As we dig into these larger urban areas in the region, many also have large post-secondary education institutions that require unique retail expertise, targeting younger consumers who may not live full time in the area.

As we see in other regions, the suburban and rural population density in this region, paired with diverse populations and how those change from state to state and city to suburb, creates opportunities and challenges for national grocery retailers. However, it opens the door to independents that operate in these markets and have a clear advantage.

Local independents drive differentiation

Similar to the U.S. coasts, national players hold a significant share in the Midwest. Walmart, Kroger and Albertsons/Safeway maintain strong positions in the competitive landscape.

Founded in Ohio, Kroger has grown organically for decades in the region. It also has used acquisition to gain footholds in the Chicago and Wisconsin markets. By acquiring Roundy’s in 2015, Kroger expanded its reach beyond its main banner to include Mariano’s, Pick & Save and Metro Market, while maintaining its Food 4 Less discount banner.

Albertsons/Safeway competes through banners such as Jewel-Osco in the Chicago market. While its stores serve the mainstream grocery market and often win over consumers based on proximity and its loyalty program, it leaves room for local players to compete and differentiate based on assortment and service.

Walmart has strength in rural and suburban areas of the Midwest as well. It will always be a force; however, regional players have found ways to hold their own and grow.

As we have seen throughout the country, the increased focus on price/value also creates a path in the Midwest for growth for discount grocers such as Aldi and Dollar General.

In addition, many smaller independents break through at a market level with innovative approaches to retailing. Some are family owned, while many others are employee owned.

Woodman’s Market is an employee-owned chain that uses assortment to bring a supercenter feel with a local focus in southern Wisconsin and northern Illinois.

Festival Foods continues to thrive throughout Wisconsin, serving as a community-focused grocer owned and operated within the community.

Coborn’s is a well-established Minnesota-based independent that has transitioned from family- to employee-owned. It operates 77 stores in Minnesota, North Dakota, South Dakota and Wisconsin, as well as Michigan and Illinois, under multiple banners, tailoring assortment and focusing on local communities.

With a significant Latino population in the Chicagoland area, the Heritage Group competes with its Tony’s Fresh Market banner, which has expanded to about 20 stores in the region, serving as the largest independent ethnic grocery chain.

Most importantly in this region, merger and acquisition activity continues to have a potential impact. If the Kroger/Albertsons acquisition is finalized, the Mariano’s banner will evolve under new ownership and many Jewel-Osco stores will be sold off. This would create opportunities for other retailers in the Chicagoland market.

[RELATED: How Grocery Retailing Differs Throughout Midwest]

What consumers want: Financial health, retail impact

Consumer trends in the grocery space tend to be similar throughout the country.

Shoppers continue to lean into natural and organic brands and products. Value is a function of convenience, price and the “X” factor, which is tied specifically to a retailer’s ancillary offers and customer support.

Private label demand is strong across categories and states. Digital engagement drives loyalty for shoppers regardless of where they go. And the role of technology – both shopper-facing and behind the scenes to improve operational efficiency – continues to differentiate independent and national retailers.

However, some variations exist from region to region as we look at emerging themes that translate to retailer and brand preferences and consumer preferences. Age, income, race and ethnicity – and access to specialty retailers versus national players across channels – will impact what matters most to consumers.

When looking just at the Midwest, consumers prioritize similar things to the average U.S. consumer. According to an August survey by PDG Insights, consumers say prices, store location and assortment are the top reasons why they choose to shop at their favorite retailers for groceries.

This is similar to what we see among consumers in other regions. However, we did see 23 percent of Midwest consumers say one of the reasons they choose a grocery retailer is for its private label offering. That is much higher than in the Southeast and Southwest. In fact, one in 10 said a retailer’s private label offering was the most important reason to shop there.

More than nine of 10 (91 percent) Midwest consumers say they are buying private label at least occasionally, which translates into at least once a month. When probing further, we found that 70 percent are buying in three or more private label categories, so there is interest in those products across the store.

PDG Insights also explored how consumers are viewing their broader circumstances. Looking a little further than grocery shopping, one in three (32 percent) Midwest shoppers said their financial health was fair – that they manage to get by but often worry about stability. That is much higher than the average U.S. consumer. They also are more likely to worry about overall cost of living and daily expenses (53 percent versus 45 percent) than consumers in other regions.

When you look at the strength of private label, but also a preference for retailers such as Walmart and Aldi, household economics appear to play a role.

Diana Leza Sheehan, CEO of Evanston, Illinois-based PDG Insights, helps emerging brands and retailers make more effective strategic decisions. By leveraging data, she unlocks cost-effective consumer insights to plan retail sales narratives and brand strategies. Her 25-plus year career in the industry across sales, insight and strategy provides a unique perspective for clients.