by Terrie Ellerbee/editor-Midwest & Southwest

As food retailers know very well, the majority of consumers no longer eat three sit-down meals every day. They are snacking instead. It is no surprise, then, that the fastest-growing category in the check lane is snacks. Yet snacks only get about 8 percent of the space there, Rimsha Baig, associate category manager at Mars Wrigley, told The Shelby Report. She suggests retailers devote more room to snacks and rethink some of the other offerings at checkout.

Mars Wrigley is concerned about candy sales, of course, which makes the check lane area a priority. Eighty-five percent of all shoppers buy an item at merchandised check lanes each year and 80 percent of those sales come from beverages, candy, gum, mints and snacks. Check lanes are the seventh largest category for the entire store—larger than cold cereal, yogurt and frozen dinners. After extensive research, Mars Wrigley has developed a program for the check lane area that “instantly” brought retailers who tested it double-digit front-end sales growth, Baig said.

The plan calls for giving best-sellers more room. Beverages maintain their No. 1 spot for products purchased at the front end, with 34 percent of sales. Candy is the No. 2 category, accounting for 20.8 percent of total check lane sales; gums and mints garner 17.7 percent of sales.

One suggestion Baig has is to move gum and mints to the space above the conveyor belt at checkout and to put the best-selling chocolate candies—Hershey’s, Reese’s, Snickers, M&Ms—on the top three shelves at eye level. She shared several other tactics during the Associated Wholesale Grocers (AWG) Showcase in late March, including putting single-serving bars and King-sized chocolates next to each other.

“We found out from our research that consumers shop by flavor and brand, not really packaging,” Baig said.

Non-chocolates, like Starburst, Skittles, Twizzlers and Ring Pop, should be located on the bottom.

“Most retailers only use one shelf for non-chocolates. You just want to make sure you have the top seven SKUs, and if that means taking up two shelves, do it, because even though non-chocolate is a really small player at the front end, it still tends to sell,” Baig said. “Skittles and Starburst are among the top three brands of non-chocolate and that is just by having them in the front. You can’t completely take away the space for it.”

The space between the top and bottom shelves should be used for more chocolate items.

“People will want more choices with chocolate, so that’s why there are more shelves of different products,” Baig said.

To create more space for snacks, candy and HBC/GM products in the check lane, the research Mars Wrigley conducted suggests displaying only the top two or three best-selling magazines.

“I’m sure everyone knows this, but magazine sales continue to decline, so if a lot of space is used for the magazine section, we’re going to ask that you limit it,” Baig said.

Mars Wrigley can share with retailers who have Nielsen agreements the top and bottom 10 SKUs on the front end, whether it is magazines, beverages, HBC/GM or candy. The information also is available to retailers on a regional basis. If any of the bottom 10 products are on the shelves at the front end, they likely are collecting dust and definitely wasting valuable space.

“It doesn’t help you or the manufacturer if you just have items on your shelf that don’t turn,” she said. “So, if they ask, ‘do I need to increase magazines,’ absolutely not. Increase your beverages.”

Why candy sales growth slowed

Sales of snacks and beverages are increasing, but candy sales are not. Baig shared some key points that help explain the declining growth in candy sales.

First, there is a generational shift taking place as Millennials reach the stage in life where they are buying homes and having children. Their buying power is growing. They are the largest population in the U.S., and they are driving the snacking trend. For those reasons, Mars Wrigley is focusing on the young professionals with its marketing.

Second, channels are blurring. “Buy online/pick up in store” (BOPIS), for example, is a growing trend.

“People are not just going to grocery stores anymore,” Baig said. “They are shopping all over the market.”

Third, technology has changed consumer behavior. If shoppers are standing in line waiting to check out, chances are pretty good that they are looking at their smartphones and not the displays of candy and other impulse items.

Health and wellness is another significant trend. Candy is an impulse buy and considered a treat. Companies like Mars Wrigley are figuring out how to make its products more appealing to consumers. One way is to lower the calorie count.

“Our gum is all sugar free. We have smaller quantities of items now,” Baig said. “We’re pushing our share-size chocolate bars. Instead of just buying a single for yourself, we call it ‘Share’ so you can share it vs. calling it ‘King,’ because you think, ‘oh, it’s more for me.’ So, we are changing the verbiage around some of our items.”

Mars Wrigley refers to the check lane space as “Refresh, Reward, Remind.”

“You’re in line, you want to refresh, you want a beverage, you just want to relax a little,” Baig said. “Reward is, ‘you know what, I spent an hour shopping, I want to treat myself to a candy.’ And then Remind is ‘I forgot to get ChapStick or batteries.’ All that needs to be on the front end.”

She said to divide front-end space like this for optimal sales:

• Use 51 percent of the space for Refresh—That breaks down to 11 percent for gum/mints; 25 percent for snacks (bars, salty, jerky, fresh fruit and cookies); and 15 percent for beverages.

• Designate 39 percent for Reward—Limit magazines to just 20 percent of the Reward space. Use 15 percent for chocolate and 4 percent for non-chocolates.

• Use 10 percent of the area for Remind—These items include trending products like cell phone chargers and accessories as well as batteries, lip balm, facial tissues and medicines (pain, stomach and throat).

“By having the right assortment and the right merchandising, you’ll see a double-digit increase instantly,” Baig said.

Mars Wrigley bases that claim both on extensive research and trial runs. The company partnered with AWG to test solutions the research indicated would increase front-end sales. Baig could not disclose the specific account but shared that one retailer in the South followed Mars Wrigley’s best-in-class recommendations for the front end and sales immediately increased.

“They saw regular chocolate grow 12 percent,” she said. “They saw chocolate with nuts grow 9 percent and better-for-you item sales grew 19 percent.”

Candy aisle also counts

While Mars Wrigley now is focused mostly on front-end sales, there also are the in-aisle shelves to consider. The first advice Baig has is to ensure that shoppers know without a doubt that it is the candy aisle. It should be unmistakable. Making it as aesthetically pleasing has become easier as many bagged candies that used to lay horizontally on the shelf now are available in stand-up bags. Mars Wrigley has just transitioned its Dove and “mini” products to the stand-up bags.

“They used to have bags all over the place. With all the stand-up bags it looks so pretty,” Baig said. “You need to make it look like it is the candy aisle. Put all of your candy in one place. It’s not snacks.”

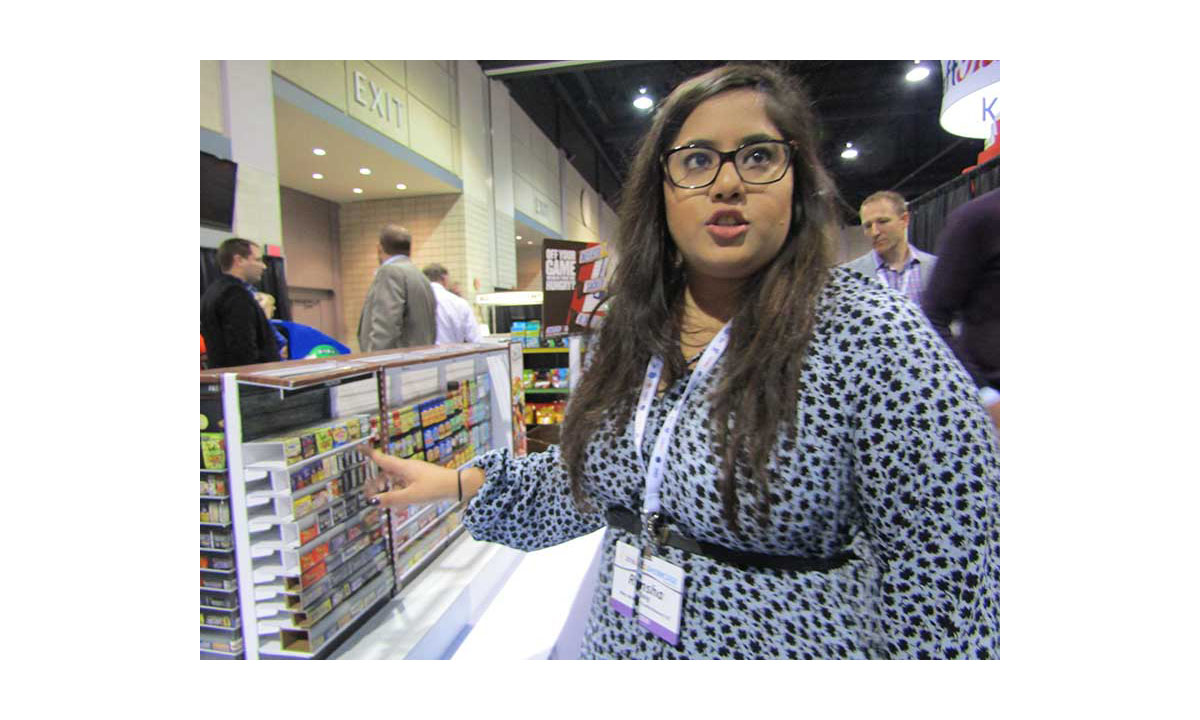

She had a small-scale model of the ideal candy aisle at the AWG event to demonstrate how it should look. It begins with grouping like items together. She said to arrange products by flavor, then brand, then manufacturer. Start with “everyday” chocolates then move to premium brands like Ghirardelli and Lindt.

“You want to lead with Reese’s or M&Ms because it makes the customer recognize that it is the candy aisle,” she said.

After everyday and premium, stock “fun-size” products on the bottom with large chocolate bars, which are referred to as tablets.

“We’re seeing a huge growth increase in tablet bars, so we’ll be introducing a few new items in the future,” Baig said. “Then as you move along the aisle, you get into the fruit-flavored candies, the non-chocolates. Start off with hard candy, then we go to gummies, sour and then private label and then we go into the gum and mints.”

The bottom line

Sales in the check lane account for 1 percent of total store sales and 1.3 percent of profitability, Mars Wrigley says. The results of following the plan it has developed speak for themselves. Having a balanced assortment and giving appropriate space to growing categories and best sellers enticed more shoppers to buy items in the check lane. The top performing retailer saw its front-end unit conversion rate (units sold per 100 customers) grow by 21.3 percent. Even the bottom performing retailer saw a 10.8 percent increase. Overall, top retailers converted 33 percent more shoppers at checkout. According to the company’s research, the value of converting those shoppers equals about one additional basket per day per store.

“It is working,” Baig said. “We just need more retailers to get on board. Our research has proven that these are the results.”

Keep reading:

https://www.theshelbyreport.com/2017/07/26/nca-confectionery-recap/

https://www.theshelbyreport.com/2018/04/26/health-happiness-drive-raleys/

IGA Is ‘Upbranding’ Before Switch To Digital-First Marketing