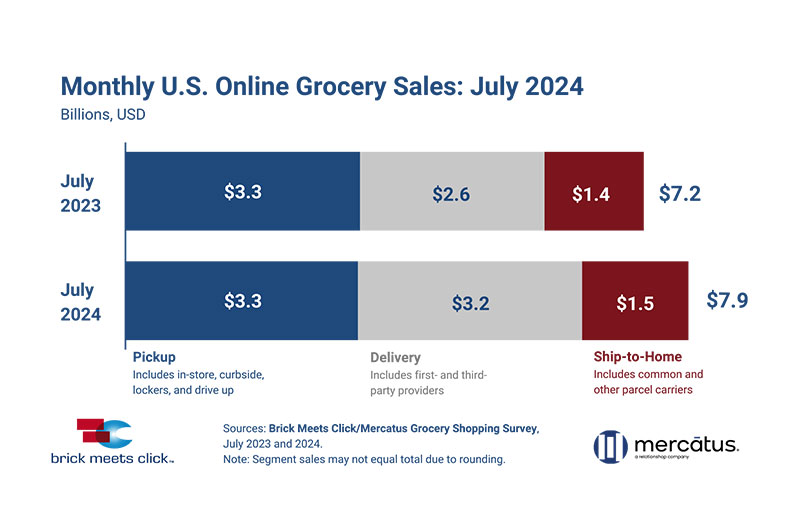

The total U.S. online grocery market ended July with $7.9 billion in monthly sales, a 9.2 percent increase over last year.

Delivery sales surged 22 percent in July, aided by continued promotional efforts. Ship-to-home also posted strong results, climbing 6 percent, and pickup held steady year-over-year, according to the Brick Meets Click/Mercatus Grocery Shopper Survey, fielded July 30-31.

Delivery’s gains in July benefited from ongoing efforts by key players to grow their delivery businesses over the last several months. Walmart promoted a 50 percent discount on its Walmart+ membership in mid-July that lowered the annual fee from $98 to $49, after offering the same deal in May. Meanwhile, Instacart promoted an 80 percent discount on its annual membership. Both offers are contributing to growth in delivery users and order frequency.

“Walmart and Instacart aren’t the only players using deep discounts to boost delivery demand,” said David Bishop, partner at Brick Meets Click.

“Amazon, for example, in July offered a 90-day free Prime membership trial instead of the usual 30 days, along with unlimited grocery delivery. Similarly, DoorDash and Uber Eats are maintaining low or no delivery fees to increase their market share.”

Looking at trends in monthly active users by format and receiving method shows how the market is shifting. Both supermarkets and mass saw year-over-year increases in their MAU bases in July. Supermarket’s base grew twice as fast as last year, up about 7 percent, and mass posted a nearly 8 percent increase. Trends across the three receiving methods were mixed. Delivery’s MAU base expanded by more than 10 percent versus last year, ship-to-home’s expanded by almost 4 percent and pickup’s contracted slightly, down by less than 2 percent.

[RELATED: Report: Walmart Captures 37% Of Online Grocery Sales In Q2]

Overall, online grocery order volume for July rose about 5 percent compared to the prior year. Delivery orders surged nearly 20 percent in the month, due to both more users and more frequent ordering by those users. Meanwhile, pickup order volume fell 3 percent versus July 2023 due to lower order frequency among a contracting MAU base. Growth in ship-to-home’s user base offset a dip in order frequency, resulting in a 2 percent gain in order volume during the month.

Analysis of the monthly results also found that households with annual incomes under $50,000 reported declines across the three key metrics – MAU base, order frequency and AOV – bucking the broader online grocery growth trends and illustrating how financial pressures are affecting online buying behaviors.

“Intense competition in grocery delivery promotions is eroding regional grocers’ control over customer interactions. While third-party marketplaces may boost short-term order volume gains, they also make it harder for grocery retailers to achieve the economies of scale needed to reduce operating costs,” said Mark Fairhurst, chief growth officer at Mercatus.

“I’m not sure many grocers would jump at the opportunity to put a farmer’s market in their store parking lot, yet many are willing to do something similar when it comes to relying on marketplaces for their online business.”

Cross-shopping rates for July 2024 remain elevated, as nearly one in three customers continued to buy online from both grocery and mass formats during the past month. The share of grocery customers (which includes both supermarkets and hard discounters) that also received an online grocery order from a mass retailer finished at 32.1 percent in July.

The share of grocery customers who received online orders from Walmart reached nearly 22.5 percent, up 430 bps versus last year, the highest level seen so far in 2024. For Target, the share climbed 100 bps, reaching 14.9 percent, which is the highest level reached for that retailer during the last two years.