Sponsored content

Research from Upside has shown that American consumers are pushing back against increased food costs, trading down from full-service restaurants to quick-service restaurants or hot buffets and salad bars. Even as inflation levels off, the rise in prices over the past three years has made consumers second-guess their spending, impacting retailers across all industries so dramatically that even national news outlets have covered it.

Are grocery stores safe from these new spending habits? New data says not quite.

In the grocery industry specifically, changes in buying behavior are marked by an increase in cross-shopping, where customers visit and spend at various stores with the same grocery budget.

Read on to see why that’s the case and how grocers can react.

The context for grocery stagnation

In 2020 as the COVID-19 crisis turned into a pandemic, life began looking different in a lot of ways. There were new health and safety considerations, of course, but one of the more surprising changes was that personal savings skyrocketed.

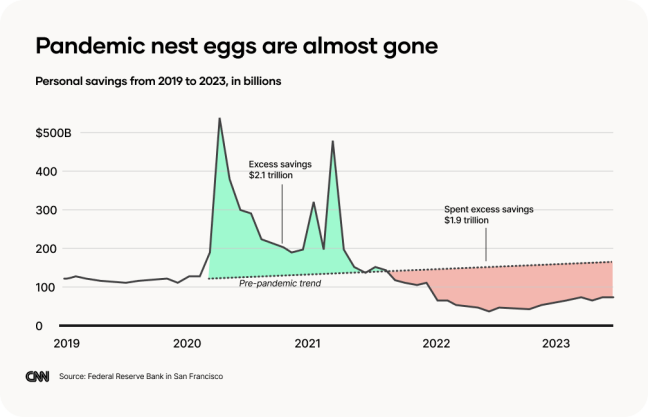

Thanks to both quarantine cutbacks and stimulus distributions, the average American suddenly had a lot more money to spend than usual. From spring 2020 through the summer of 2021, Americans socked up $2.1 trillion in excess savings compared to pre-pandemic trends. As social restrictions eased, those consumers were eager to spend their money rapidly; from September 2021 to June 2023, Americans spent $1.9 trillion more than expected, based on the pre-pandemic trend line. Soon after all that spending, those stockpiles of cash have begun to run low.

Despite this, the average American household on paper is doing very well for themselves. Unemployment remains low and per-person disposable income is higher than before the pandemic, even after adjusting for inflation. This in part explains why spending remains high—just not growing at the same rate as it had in the 2021-2023 period. However, this leveling off is drawing concern from some retailers.

On the hunt for value

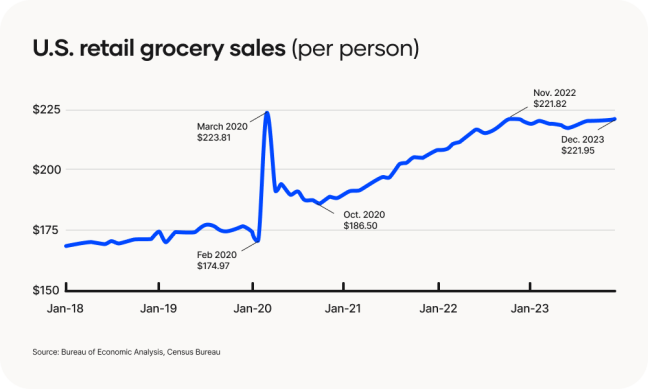

Additional figures support the idea that cash reserves are low and Americans are getting pickier about their spending. The data shown below from the Bureau of Economic Analysis and the Census Bureau outlines retail sales per person since 2018.

In analyzing this chart, we can see that there have been four distinct periods of spending over the last five-plus years:

- Up to February 2020: Slow, steady growth

- March 2020 – October 2020: A dramatic sales surge as households stocked up for quarantine, then elevated but declining sales

- November 2020 – November 2022: Fast, steady, sustained growth

- December 2022 – Present: Stagnant sales

That final period is most important for grocery retailers to consider. Monthly grocery revenue in 2023 ended about the same way it started — but just because shoppers spent the same amount as they did last year does not mean that they’re behaving the same way. In fact, other evidence points to consumers changing their behavior to pursue more cost-effective alternatives.

Consumer research firm Circana recently released a report that indicates that grocers are seeing higher foot traffic but lower unit volume as consumers trade down in the search for bargains. The report states that 94% of consumers are still concerned about food cost inflation; furthermore, 53 percent actively look for sales, and 46 percent are cutting back on non-essentials.

High-earning customers are driving the shift

Independent and regional grocers are facing increased competition from all sides — national retailers and big-box chains have continually expanded, while dollar stores have increased their grocery product mix, including more fresh items. The increase in options means that cost-conscious customers can compare prices across a wide variety of stores and shift their share-of-basket to lower-cost alternatives. Data shows that the average grocery shopper does just that, visiting up to five banners per month.

Perhaps the most surprising part of this value-seeking shift is being driven by high-earning customers, many of whom have household incomes well above six figures. A number of retailers saw impressive growth coming from this bracket of shoppers.

“We’re gaining share across income cohorts, including at the higher end,” said Walmart CEO Doug McMillon in a recent conference call with analysts. Walmart’s CFO, John David Rainey, recently confirmed that households making more than $100,000 make up a large portion of the retailer’s growth. And Walmart is not alone — representatives from Dollar Tree and Aldi shared similar sentiments in 2023.

Tight margins, few options

Given consumers’ price sensitivity, grocers are limited in how much they can raise their prices without encouraging even more shoppers to compare items across stores. Upside data shows this is where grocers and restaurants diverged in 2023 — whereas restaurants continuously raised menu prices, grocery prices are relatively flat.

At the same time, most grocers are not in position to lower their prices, either.

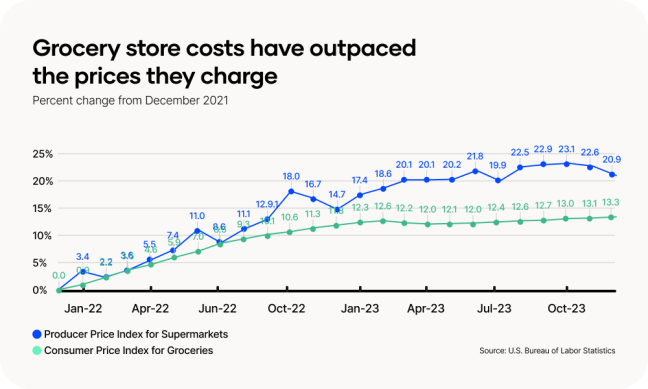

Consider the below graph, which plots the changes in the Producer Price Index (PPI) for supermarkets and the Consumer Price Index (CPI) for groceries since December 2021. In effect, the PPI represents the purchasing costs the grocer pays, and the CPI measures how much consumers pay at the grocery store.

From January to July 2022, the PPI and CPI increased at similar rates, but since that point, the two figures diverged and remained apart. As of December 2023, the PPI and CPI were still a full 7.6 percentage points different.

When the PPI is higher than the CPI, grocery stores face costs that are increasing faster than the prices they charge shoppers. Grocers face a difficult challenge in this situation: Hold or lower prices, and the gap grows wider; raise prices, and consumers abandon your store for cheaper options.

How grocers can close the gap

To navigate the shifts in costs and consumer behavior, grocers need a strategic approach that focuses on enhancing value without compromising margins. This could involve leveraging data to better understand customer preferences, optimizing supply chain efficiencies, and exploring innovative promotions that attract and retain shoppers.

The future of grocery retailing lies in the ability to adapt to these evolving consumer behaviors. By prioritizing value and maintaining flexibility, grocers can survive and thrive despite a competitive environment.