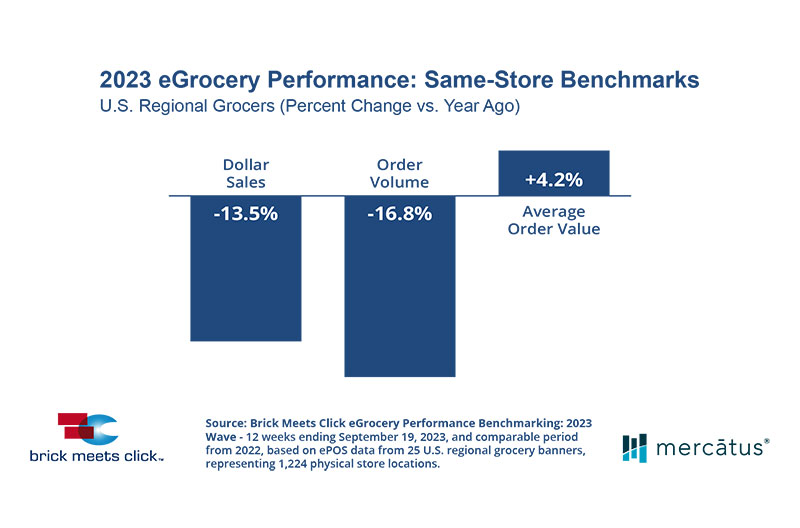

Composite-level sales across 25 U.S. grocery banners dropped 13.5 percent during a 12-week period ending Sept. 20 versus the same period last year, according to the “eGrocery Performance Benchmarking” report from Brick Meets Click and sponsored by Mercatus.

The year-over-year sales decline was driven by a higher rate of lapsed customers who shifted back to in-store or switched to a rival’s online service.

Of the 25 banners that participated in the Benchmark study, just three bucked the downward trend, reporting a positive change in same-store online sales versus the prior year.

This result highlights how challenging the environment is for most regional grocers while other formats, such as Walmart’s eGrocery, experienced a surge in year-over-year sales growth in 2023.

“These eGrocery benchmarks are extremely valuable to regional grocers who want to better understand how their banners’ performance and KPIs compare,” said David Bishop, partner at Brick Meets Click.

“This study not only helps grocers identify opportunities to improve, but also reveals the stark realities related to growing an online grocery business in a post-COVID environment where customers have greater access to and higher expectations for eGrocery shopping.”

The study is based on transactional-level ePOS data linked to non-personally identified information from a diverse range of U.S supermarket banners that sell eGrocery via a first-party website and/or mobile application.

The analysis examines key differences among banners that may affect their respective first-party performance metrics, including online versus in-store pricing, third-party versus first-party price gaps, and the contribution of third-party to total eGrocery sales.

Total order volume on a same-store basis in 2023 was down 16.8 percent compared to a year ago. The decline was the result of a shrinking base of active customers overall.

The number of customers who completed one or more eGrocery orders in the 12 weeks during 2023 declined by 19.8 percent versus the same period in 2022.

A comparison of retention rates for different customer cohorts in 2022 versus 2023 highlights that it has gotten more challenging for regional grocers to keep their online customers active.

The year-over-year drop in overall order volume was offset by the base of active customers completing more orders and spending more per order as these key metrics both grew, climbing 7.6 percent and 4.2 percent, respectively, in 2023 versus the prior year.

“Given these shifts, improving customer retention rates is vital for regional grocers. The analysis determined that it requires 2.5 new customers to replace the current value associated with one of the longest-term customers,” Bishop explained.

“However, a more realistic replacement number is 3.5 new customers, given the fact that only about 30 percent of new customers will age to the comparable level of one lost long-term customer.”

The report also showed that value accrued by keeping current online customers engaged is significant. The longest-term customer cohort rang up nearly 30 percent higher average order values and completed twice as many orders as the newly acquired online customers.

“Insights from this report reinforce that with customer acquisition growing ever more challenging, retention has become the name of the game,” said Sylvain Perrier, president and CEO of Mercatus.

“To drive growth, grocers must invest in strategies that increase basket size and the frequency of orders. Helping online customers to save time with personalization, discover new products through intelligent promotional pairings, and get more value for money, such as through loyalty programs, are just some of the ways to ensure customers stick around.”

The new eGrocery Performance Benchmarking report provides composite-level and masked banner views of how pickup and delivery perform, plus business trends for sales, order volume per average store week, average order values, online versus in-store pricing gaps, customer engagement, etc.

About the report

The Brick Meets Click eGrocery Performance Benchmarking is an annual initiative based on ePOS data provided by participating retailers that began in 2016. The study examines the critical business questions related to improving strategy and execution when operating a first-party ecommerce shopping service.

In 2023, the study analyzed 25 banners, representing sales across 1,224 physical stores in the U.S., who operate a first-party online grocery website and/or app.

Read more technology news from The Shelby Report.