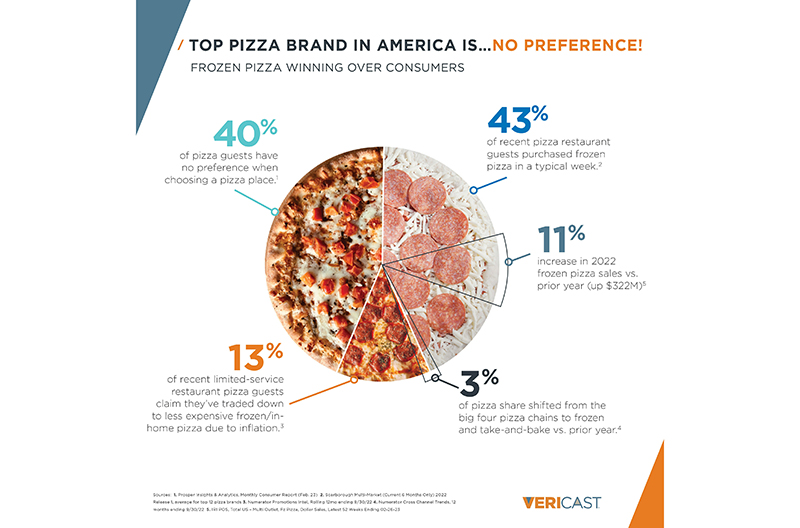

According to research conducted by San Antonio-based Vericast, about 40 percent of consumers have no preference when choosing a pizza place, and due to inflation, 13 percent of recent pizza restaurant guests are opting for frozen or non-restaurant pizza.

“Based on sales and traffic numbers, some believe the big four pizza brands (Dominos, Pizza Hut, Papa John’s and Little Caesars) are consumers’ first pick, but when we dig a little deeper, we found that the top choice is actually no preference,” said Dana Baggett, client strategy director, restaurant division at Vericast.

“This lack of preference and loyalty means consumers can be swayed to change brands with incentives.”

With inflation top of mind, consumers are more price conscious and grocery stores are elevating their pizza incentives. Over the past two years, retailers have increased their frozen pizza brand promotions 214 percent and consumers have noticed.

In a typical week, 43 percent of recent pizza restaurant guests purchased frozen pizza. This swing to at-home pizza options is further evidenced by a 11 percent growth in frozen pizza sales over the last year. As a result, retailers are cashing in, boosting share and wallet.

“The pizza battle is on, and grocery stores are winning,” Baggett said.

“Consumers are shifting to at-home pizza, resulting in the big four pizza players losing 3 percent share of wallet compared to same time last year, according to Numerator. If they convert just 5 percent of their guests who purchase frozen pizza each month, they could earn roughly $500 million collectively. Brands who deliver targeted offers across digital and print channels will win loyalty and business.”

Rising prices continue to affect consumers. Vericast’s 2023 Restaurant TrendWatch report, which surveyed 2,000 adults in the U.S. to assess shifting consumer behavior, found about half are eating out less often due to inflation. In addition, 18 percent of consumers are opting for less expensive brands of pizza or restaurants. This behavior increases among frequent pizza restaurant customers – those that order from restaurants once a week or more – with 25 percent selecting less expensive options.

Other key report findings include:

- Consumers weigh their options as eating out becomes more expensive:

- Most consumers (64 percent) surveyed agree rising prices are making restaurant dining too expensive. However, 41 percent of those surveyed note that with food prices rising at grocery stores, it is not necessarily cheaper to eat at home.

- As a result, consumers are trading down and looking for deals. Half say coupons and discounts help them choose between restaurants, and these same savings can entice 53 percent of consumers to try a new restaurant.

- This presents an opportunity for pizza brands – and grocers and restaurants alike – to offer incentives to be top of mind when hunger strikes.

- Brands can win customers with coupons and loyalty rewards:

- Forty-two percent of those that order from restaurants once a week or more use “Save Direct Mail” to decide where to dine, and about 80 percent say they spend more at a restaurant when they have a coupon or discount.

- Fifty-eight percent of frequent pizza consumers said that in the past 30 days a coupon or discount changed where they decided to dine or order.

- If a restaurant does not reward loyalty with coupons and discounts, consumers will switch to one that does. This has increased since 2021, driven by a nine-percentage-point increase among Gen Z consumers.