by Michael Uetz / Managing principal, Midan Marketing, meat marketing specialists since 2004

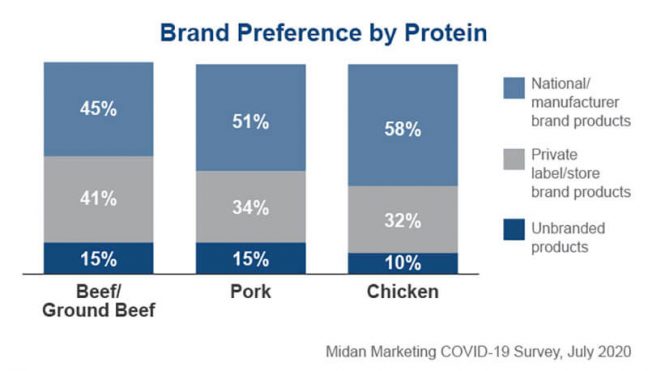

Historically, fresh meat – especially beef – has been sold as a commodity with no brand labeling. Today, the meat case has more brands in it than ever – national brands (like Tyson, Hillshire or Perdue), private label brands (including store-branded products) and unbranded products all serve a purpose for retailers. Preference for branded fresh meat has been on the rise since 2007.1 Among consumers who look for one type of labeling over another, 30-40 percent of shoppers now say they prefer private label fresh meat and poultry.2 Preference for national brands has also been gaining traction – in July, national brands were preferred over private label brands for beef and pork.2 By taking advantage of branding – both private label and national – the meat case can highlight product differentiators and command a higher price.

According to data from IRI, private label has been fueling fresh beef category growth for several years. Between 2015 and 2019, private label fresh beef saw volume share grow from 18.1 percent to 25.2 percent. During that same time, share of non-branded products shrank from 75.6 percent to 69.5 percent.3

“Given the historical numbers, it is perceivable that the presence of non-branded labels in beef will continue to shrink in the coming years in favor of beef with national or private label branding,” said Erkin Peksoz, IRI consultant.

Additionally, IRI data shows that for fresh chicken and fresh pork, the dollar share for private label and national brand products was higher than the volume share in 2019. This indicates a price premium for branded products and represents the equity in the brand.4 Because the branding of beef has lagged behind other proteins, retailers aren’t able to fully capitalize on this opportunity in beef.

“Dollars per volume performance of private label and national brands is stronger than non-branded products both in fresh chicken and fresh pork,” Peksoz said. “This dynamic implies the value generated by brand equity. Currently, fresh beef isn’t reaping the benefits afforded by branding at an optimal level. Because we know that differentiated or branded products command a premium over commodity products, it is conceivable that fresh beef would benefit from increased presence of private label and national brands.”

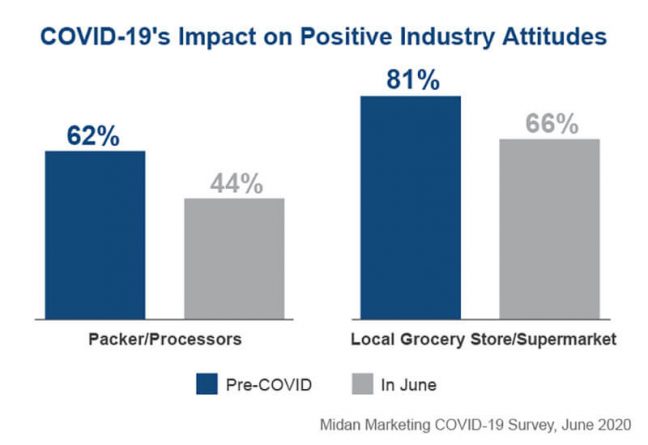

During the past several months as COVID-19 has disrupted the meat supply chain and shopping behaviors, many factors have come into play making now the time for increased attention specifically to your store brand fresh meat products. Midan Marketing’s June survey of meat consumers asked about feelings and attitudes toward different meat-related industries. In June, 44 percent of consumers had a positive impression of packer/processors. At the same time, 66 percent of consumers saw their local grocery stores in a favorable light.5 Use this positive perception to build loyalty toward private label/store brands in the meat case.

Leveraging private label brands can build trust and increase revenue. It’s important to remember, though, that grocery retailers aren’t one-size-fits-all, and neither are brands. Customers are becoming very discerning, and it’s important that brands target the retailer’s actual customers and the attributes that are important to them. This extends to messaging and using valuable on-pack real estate to communicate the benefits and selling points of the product.

Calling out purchase drivers, like nutrition and health information, on meat packages is helpful to many consumers. Having protein amounts highlighted on the package is a feature that’s important to 87 percent of shoppers, yet is a hugely missed opportunity in the meat case.1

“Look up and down the grocery store aisle and you will see all kinds of categories and brands marketing their nutritional benefits – especially protein claims,” said Shalene McNeill, executive director of nutrition research for the National Cattlemen’s Beef Association. “Plant-based proteins and carbohydrate-rich categories like cereals and grains have capitalized on consumers’ interest in protein-rich foods, often highlighting their protein content front of pack. But fresh meats, one of the very best sources of protein, have lagged in leveraging this nutrition benefit. According to the National Cattlemen’s Beef Association’s 2020 Consumer Beef Tracker, funded by Beef Checkoff, more than 85 percent of consumers agree beef is a great source of protein. Beef Checkoff research also shows that ‘a great tasting protein’ is one of the top reasons consumers choose to eat beef more often. Highlighting the nutritional benefits from key nutrients like protein, iron, zinc and B-vitamins right at the meat case reminds shoppers that the beef they love is good for them, too.”

In addition to nutrition, a brand’s story also can be told on-pack, focusing on elements that shoppers are concerned about, like animal welfare. Six in 10 Americans believe animal welfare is important, while 43 percent say animal welfare concerns impact their purchase decisions. When shoppers start looking for information on animal welfare, 42 percent of them are looking for it directly on the package, in the forms of production or transparency claims or the logos of third-party animal welfare verification programs.1

Building a private label brand in the meat case doesn’t have to be difficult. Many packers and processors will collaborate directly with their retailer customers to create a brand that works for the store’s consumers.

“We work with our customers to develop long-term relationships based on trust and the ability to deliver products and services that meet their needs,” said Frank Tarantino, president of Thomas Foods International, USA. “Our private label program is based on adaptability. For example, since the beginning of the COVID-19 pandemic, we have been working with clients on packaging that provides a better experience for the increased curbside pickup grocery retailer business and developing meat kits they can brand. We work with them from concept to finished product on brand development.”

Packer/processor partners also can assist in building a more robust brand story or help with marketing to the specific consumers a retailer is focusing on.

In today’s competitive retail environment, there is power behind brands. Unlabeled fresh meat products are underperforming and not helping retailers build equity or loyalty. Leverage brands in the meat case to target consumers who are looking for differentiation. Make sure shoppers know about your brand and its story to increase revenues and customer loyalty.

1 The Power of Meat 2020

2 Midan Marketing COVID-19 Survey, July 2020

3 IRI POS Syndicated Data, 2015-2019

4 IRI POS Syndicated Data, CY 2019