In its latest CPG, FMCG & Retail report, Nielsen says that although e-commerce represents just 4 percent of grocery sales today, it accounts for nearly one-third of total growth. And Americans are increasingly heading online to shop for nonperishables, household items and pet products, making the concept of stock-up grocery trips a thing of the past for many shoppers. Yet the fresh departments (bakery, deli, meat, produce and seafood) still lure people into physical stores; in fact, online grocery shoppers spend 1.5 percent more in-store on fresh food than the average consumer does. As more category sales continue to shift online, retailers need a way to differentiate themselves in stores, and fresh is the perfect place to do it. Fresh is the growth engine of the store, as gains in these perimeter departments translate to total store success.

Retailers with well-established fresh departments provide a glimpse into the future and a roadmap for others.

Fresher fresh departments

Nielsen segmented stores based on the percentage of overall store sales from their fresh food departments, and top performers generate 43 percent of overall sales from perishable foods (compared to an average of 32 percent for the same measurement across all retailers). They’re succeeding by taking “freshness” to the next level.

For the most successful retailers, deli and produce departments provide the greatest contribution to total perishable sales. This debunks the long-standing belief that the meat department contributes the highest impact to the success of the perimeter of the store. And it likely reflects consumers’ changing wellness needs, as well as their growing demands for convenience. With more than three-fourths of deli sales coming from random weight items, top fresh retailers have honed a more authentic, ready-made feel.

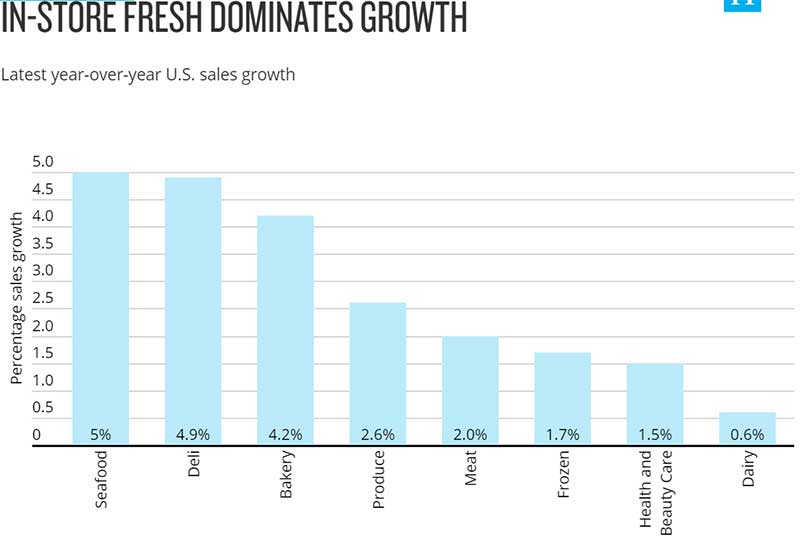

For retailers as a whole, the fresh seafood and deli departments continue to rise in-store. Meanwhile, the health and beauty care department is seeing its fortunes shift online, and the dairy department is struggling overall. So while the latter departments still have strong in-store value, investment in fresh should take priority.

Variety with purpose

For fresh retail superstars, success hasn’t come from necessarily carrying more (or fewer) items, but from having the right items.

Today’s consumers value health-conscious food options, and top performing fresh retailers have responded by featuring nearly three times as many different plant-based meat alternative offerings as lesser performers—a savvy move, considering nearly 60 percent of U.S. consumers value dietary balance between animal and plant foods.

Produce purchasing remains a necessarily tactile, in-person experience for many consumers. Leading fresh retailers understand this, significantly outperforming lesser performers in avocados, tomatoes, apples, herbs and berries. These produce items in particular are ones where consumers look or feel to confirm freshness.

Across all U.S. retailers, avocado sales are up 8 percent, and vegetables are succeeding even more than fruit (up 4.9 percent in sales vs. a slight increase of 0.3 percent in sales for fruit). As a result, investing in a stronger vegetable supply chain is a smart business strategy.

Shopping experiences vs. shopping trips

For fresh retailers, it’s about consumers craving a destination, not for stocking up. Experience, personalization and convenience win. In fact, food service offerings are up 10 percent in sales year over year. Within the bakery department, winners are focusing on pulling consumers in for more than just special occasions. Too many stores only focus on the sweets portion of their bakery, missing out on the opportunity to bring consumers in on a daily basis for breads and rolls.

Fresh is the last stronghold for brick and mortar. Retailers that want to win across the store need to focus on fresh, Nielsen says.

The insights in this article were derived from Nielsen Total U.S., all outlets combined, 52 weeks ended Aug. 24, 2019, and Nielsen Total Food View, Total U.S., 52 weeks ended July 27, 2019.