2018 NGA Financial Symposium Workshop

Editor’s note: HR & Benefits News is a monthly column by Chris Cooley, co-founder of MyHRConcierge and SMB Benefits Advisors.

Independents face so many conflicting choices about employee health benefits. It’s crucial to control escalating benefits expense, but if you reduce benefits or cut hours, you risk losing workers, customers and profits.

There’s a better way, and I was excited to share it during the FMS Financial Symposium Workshop that took place at the 2018 NGA Show last month. (You can download a copy of the presentation here.)

There was a lot of interest during and after the show about level funded plans and how they can reduce benefits costs for independent grocers. Here are some key points to keep in mind.

Challenge: Costs rise and benefits decline

While the cost of benefits has increased for both employers and workers, benefits have declined.

| Benefits Cost Rising | Increase 2012 – 20171 |

| Family premiums | + 19% |

| Worker contributions for family plans | + 32% |

| Employer contributions for family plans | + 14% |

| Declining Benefits | Increase 2012 – 20171 |

| Increase in average deductibles | 2012: $802

2017: $1,221 |

| Higher co-payments for services | 2012: 51% co-payments over $20

2017: 60% co-payments over $20 |

To top it off, a 6 percent increase in benefits costs is anticipated in 2018, according to the “National Survey of Employer Sponsored Health Plans, 2017” by Mercer. This is the highest increase since 2011.

Level funded plans gaining in popularity

Increasing premiums for traditional health plans, also known as fully funded health plans, are boosting the popularity of level funded plans among employers. This type of plan can be a very good option for healthy groups with 5-250 participants.

Here are five ways a well-designed level funded plan can help you curb rising costs and protect your business:

- Your costs are predictable and consistent

- You can realize savings if your claims for the year are less than anticipated

- Your business is exempt from many ACA rules. For example, providing certain essential healthcare coverages.

- “Excess stop-loss coverage” minimizes your exposure to large claims

- You can simplify benefits and program administration

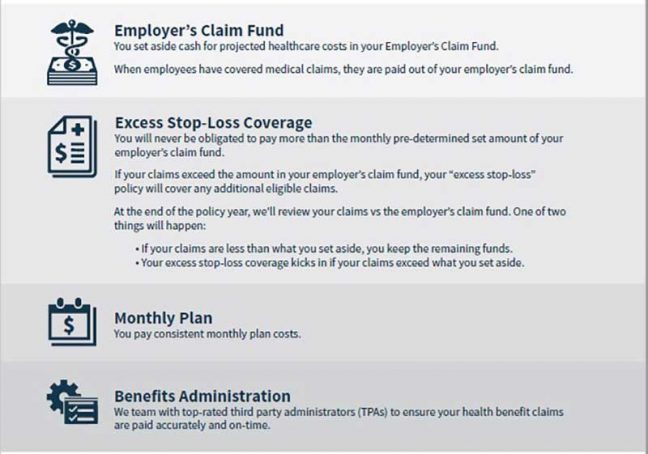

How level funded plans work

Here’s a simplified view we share with our grocery clients to explain the basic components of level-funded plans:

Is level funded for your company?

If you have relatively healthy group with 5 to 250 participants, it’s highly likely the right level funded plan can help you.

As a next step, I suggest you obtain a proposal and quote for a level funded plan as part of your upcoming renewal process. Then, evaluate how well level funded helps you control escalating health benefits costs, offer attractive benefits for workers and simplify administration of these benefits.

Chris Cooley is co-founder of MyHRConcierge and SMB Benefits Advisors. Clients rely on him for employee handbooks, HR compliance and administration, workforce management and benefits advisory solutions. Cooley’s companies specialize in helping small to mid-sized grocers throughout the U.S. He can be reached at 855-538-6947, ext. 108 or at [email protected].

Keep reading:

https://www.theshelbyreport.com/2018/02/19/hr-benefits-risky-employment-practices/

https://www.theshelbyreport.com/2018/01/15/hr-benefits-aca-non-compliance-risks/

https://www.theshelbyreport.com/2017/12/18/hr-benefits-sexual-harassment-hazards/