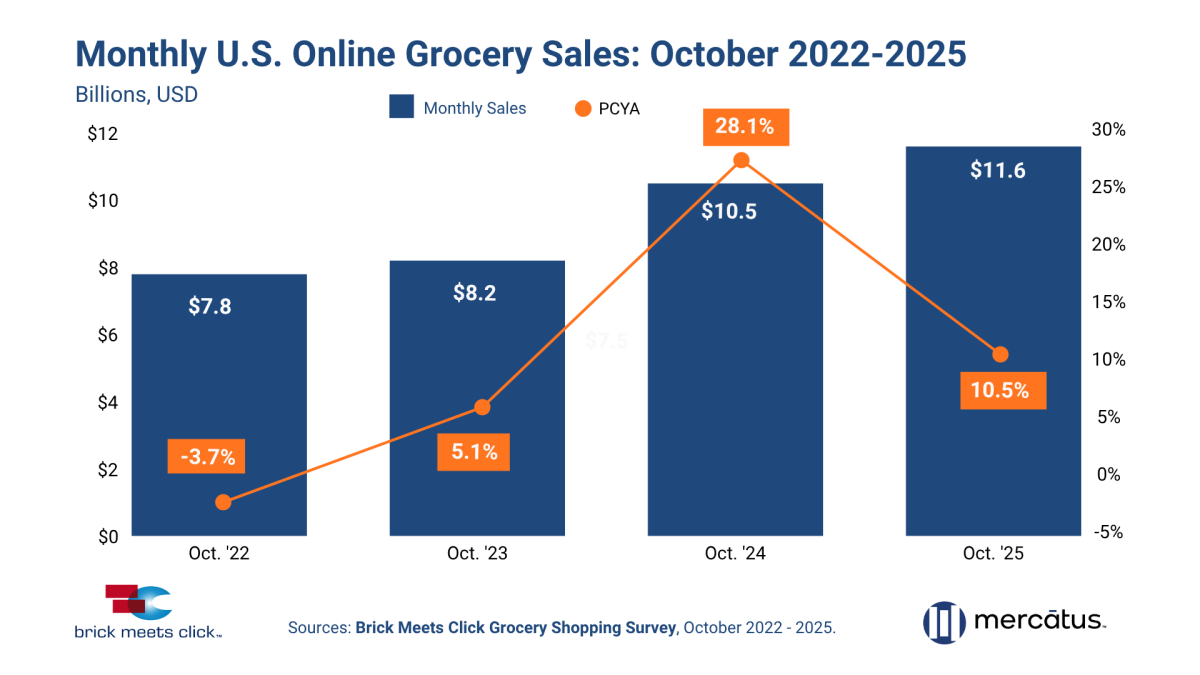

U.S. monthly online grocery sales totaled $11.6 billion in October, a 10.5 percent increase over the previous year, according to the Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus.

October’s moderate growth rate compared to the 2024 surge was the result of an expanding base of monthly active users (MAUs), tempered by anemic gains in order frequency and pullback in average order values (AOV).

The overall base of online grocery MAUs grew almost 13 percent year-over-year (YOY) to finish October with 83.3 million households, surpassing the record high set last month. Most of the MAU growth came from reengaging infrequent users who last bought groceries online two to three months ago, but some of the gain came from households that have never shopped online for groceries before, causing the total user pool to expand at its fastest YOY rate since February 2022. All three receiving methods posted gains in their MAU bases versus last year, and the MAU base for pickup set a record high.

The average number of online grocery orders completed per MAU during October climbed for the 14th consecutive month, but the YOY gain was limited and under 1 percent. Order frequency in large metro markets declined versus last year, limiting overall growth, as MAUs in medium metro, small metro and rest of market posted strong gains that ranged from 7-15 percent. By age group, only the 60-plus-year-old households increased online grocery ordering activity for October versus last year; order frequency per MAU declined YOY across all the younger age groups.

The combined average order value (AOV) for delivery and pickup in October fell by almost 3 percent YOY as spending per order at supermarkets was essentially unchanged compared to a year ago, and spending at mass posted a mid-single digit drop. Meanwhile, ship-to-home’s AOV rose about 5 percent during the month compared to last year, fortified by increased spending rates with mass retailers and Amazon’s pure-play segment, which includes Amazon’s same-day fresh grocery service.

Online’s share of weekly grocery spending in October ended the month at 16.3 percent, climbing 110 bps versus last year. The share expansion was fueled by higher spending rates in medium metro markets as well as predominantly with the youngest age group.

“The October 2025 results are a reminder that online grocery sales growth is not on autopilot,” said David Bishop, partner, Brick Meets Click.

“Customers choose how to receive online grocery purchases based on many factors, including cost and convenience, and the impact of Amazon’s same-day grocery service – which offers customers a lower-cost alternative – is becoming visible.”

For more information, visit the eGrocery Monthly Sales report page.