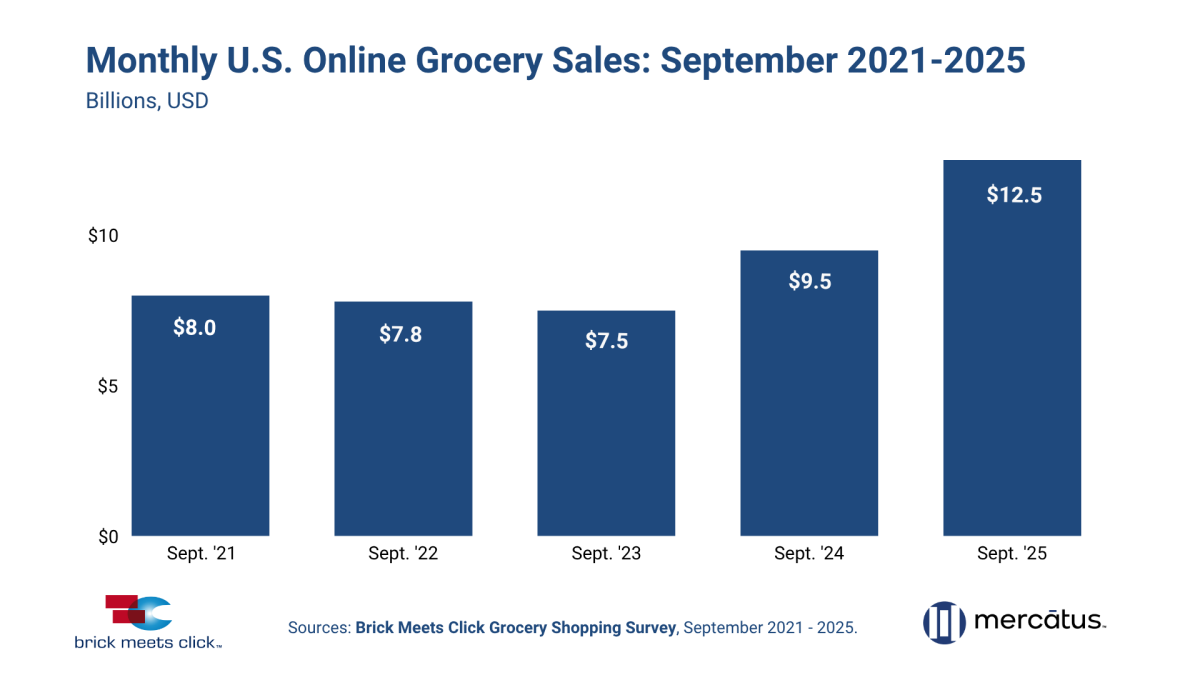

U.S. online grocery sales surged to a new high of $12.5 billion in September, marking a 31 percent increase over the previous year and the second consecutive month a record was set, according to the Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus.

Driven by a record-setting number of monthly active users (MAU), sustained gains in order frequency and solid increases in average order value (AOV), online spending for September captured its highest share since early during the COVID-19 pandemic.

The overall base of online MAUs hit a new high during September, up nearly 13 percent year over year (YOY). The vast majority of the increase came from re-engaging less frequent customers who most recently bought groceries online two to three months prior.

All three receiving methods posted gains in their respective MAU bases versus last year, with delivery setting a new high as well. In addition, all age groups reported more MAUs YOY, with the 60-plus groups contributing nearly half of the YOY gains.

The average number of online orders per MAU during the month climbed 9 percent versus year ago, marking 13 consecutive months of YOY gains in frequency.

This increase was fueled by a jump in the share of MAUs completing three or more online orders during September. Small metro markets posted the strongest relative gains in frequency, climbing at a rate nearly twice that of the other market types.

The combined AOV for delivery and pickup grew by nearly 8 percent YOY. Gains were recorded across supermarket, mass and dollar, along with larger surges in spending at hard discounters and club.

In addition, Ship-to-home’s AOV finished up by nearly 11 percent YOY, driven primarily by Amazon’s pure-play services and the firm’s ongoing expansion of same-day fresh grocery.

The share of weekly grocery spending that went online in September jumped 400 basis points (bps) versus last year, ending the month at nearly 19 percent. This is the second highest contribution level recorded for online grocery sales behind only May 2020.

Online growth continues to negatively impact in-store performance. From January through September, in-store sales growth YOY slowed to under 1.5 percent compared to 3 percent during the comparable period in 2024.

“A sign of the growing challenges facing regional grocers is the sharp increase in the share of grocery MAUs that also completed at least one online order with mass during September versus the two prior years,” said David Bishop, partner at Brick Meets Click.

“The results reveal cross-shopping rates with Walmart continued to expand significantly in 2025, and the rate for Target also increased YOY, even though it remains significantly lower than Walmart.”

About this consumer research

The Brick Meets Click Grocery Shopping Survey is an ongoing independent research initiative created and conducted by the team at Brick Meets Click and sponsored by Mercatus.

Brick Meets Click conducted the most recent survey on Sept. 28-30 with 1,493 adults 18 years and older, who participated in the household’s grocery shopping, and a similar survey in September 2024.

Results are adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys.

[RELATED: August Online Grocery Sales Hit Record High Of $11.2B]