Hershey is keeping its focus on consumer demand with a lineup of new innovations across confections, snacks and better-for-you products.

Lindsay McCabe, manager of corporate communications and brand PR for Hershey, recently spoke with The Shelby Report about some new offerings from the company.

“One area that we were missing within our confection space was the bark category,” she said. “So we launched a Reese’s Pieces Bark with peanuts and then a Hershey’s Bark with pretzels and almonds. That’s more of a snackable, multi-texture experience.”

Both products feature resealable six-ounce bags, designed for sharing.

Hershey also continues to expand its Reese’s portfolio. McCabe pointed to the Reese’s Chocolate Lava Big Cup, first launched in August 2024 and later supported with a push for the Big Game.

“Lava is our second generation of the layering technology and followed caramel, but they’re side by side in performance right now,” she said. “Caramel is still doing great, but lava, as our newest innovation, is doing really well. That was more to satisfy a decadent dessert-like experience.”

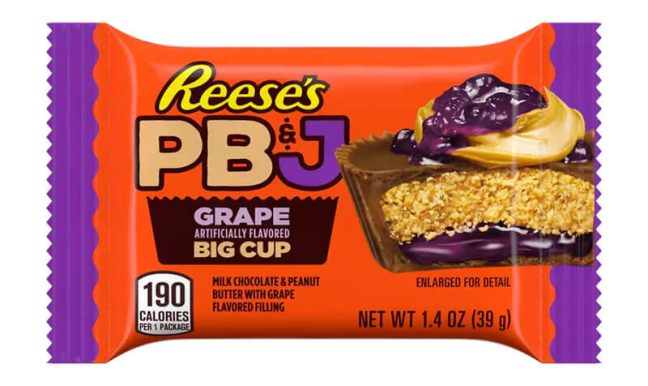

McCabe said consumers have been quick to embrace other new Reese’s products, including the Peanut Butter & Jelly Big Cup.

“We launched Reese’s PB&J Big Cups, and that had a very successful sell-through rate within the first few weeks – I think over 86 percent,” she said. “Fans have been asking for a PB&J cup for years.”

The company also introduced Reese’s Peanut Butter Pie Miniatures, featuring graham cookie pieces.

“This is the first time in a while that we’ve innovated with the miniature portfolio,” McCabe said. “This one has been really popular, too. Great portion control, good variety, easy to snack on.”

Hershey also is investing in other categories, including salty snacks. Reese’s recently launched a filled pretzel featuring its peanut butter, while Dot’s Homestyle Pretzels, acquired in 2021, continues to drive growth.

“Dot’s is one of our fastest-growing brands since we acquired [it]. We’re now the No. 2 pretzel in the category and hit over $500 million in sales,” McCabe said. “Buffalo [seasoning] is [out] … which [is] great timing for fall football. And then we also launched BBQ.”

In addition, the company is leaning into partnerships, licensing and acquisitions.

In addition, the company is leaning into partnerships, licensing and acquisitions.

“You get an exclusive with the Shaq-A-Licious XL Gummies,” McCabe said, noting new sneaker-shaped varieties developed with NBA Hall of Famer Shaquille O’Neal.

Bubble Yum, a popular 1990s brand, is being reintroduced in resealable pouches to appeal to younger consumers, and last year Hershey acquired Sour Strips, the social media-driven brand created by Maxx Chewning.

On the Jolly Rancher side, Hershey is capitalizing on flavor equity to launch new formats.

“It’s been a big year for JR … We leaned into freeze dried,” said McCabe, adding that this was a category that “we definitely want to play in … It’s been a great product thus far.”

The company also has introduced Jolly Rancher Chewy Poppers and Ropes to meet textural trends.

In the better-for-you category, Fulfil protein bars rolled out three innovations co-branded with Reese’s, while the ONE brand launched a Hershey’s Double Chocolate protein bar.

“Chocolate is the No. 1 requested flavor for protein enthusiasts,” McCabe said. “We have the ONE Hershey’s Double Chocolate, literally doubling down on the chocolate.”

Looking ahead, McCabe said Hershey is investing heavily in technology and artificial intelligence to improve retail execution and consumer engagement.

She added the company is using virtual reality and augmented reality capabilities.

“We have a new chief technology officer that started last year, and he is ramping up his team,” she said. “I think the next two years, you’ll see more within the technology space. But AI is something that we’re heavily involved in.”

McCabe said consumers are being thoughtful about their purchases, from a budget perspective but also nutrition. The dollar store channel has been identified as an area of opportunity and growth for the company.

“We need to show up stronger there, because that’s where our consumers are getting those … more snackable items. The reputation of dollar stores has changed so drastically,” she said.

McCabe added that Hershey also is “keeping an eye on and making sure that we’re meeting the demands of shoppers with SNAP benefits.

“The good thing about our portfolio and the variety that we offer is that we have so many different sizes and value packs that we can meet that consumer wherever they are in their life and spending habits.”

[RELATED: The Hershey Co. Names Next President, CEO]