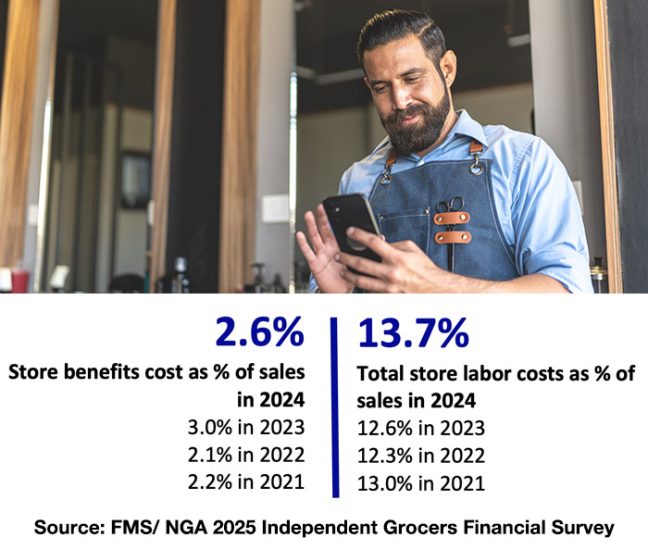

Labor has always been essential to operations and one of the biggest factors influencing the bottom line. However, in fiscal 2024, labor and benefits costs climbed to new highs, putting even more pressure on already thin margins. According to the 2025 Independent Grocers Financial Study by FMS and NGA, total expenses increased to 25.8 percent of sales, with labor and benefits accounting for the largest share.

In today’s tight-margin environment, grocers aren’t just looking to survive – they’re looking to grow smarter. And how they manage labor may be the single biggest factor in whether they do.

Labor: The Largest and Fastest-Growing Expense

Labor and benefits costs reached historic highs in 2024, accounting for 13.7 percent and 2.6 percent of sales, respectively. Multi-store operators, in particular, reported higher labor and rent/CAM costs, reflecting the demands of their larger footprints.

While pandemic-era sales spikes helped mask some inefficiencies in past years, 2024 brought a return to cost clarity. And the message is clear: independent grocers must optimize their labor to stay competitive.

One independent operator shared: “We used to schedule based on habit or feel. Now, we’re looking at sales by hour, department activity, and even weather data. That shift alone helped us reduce overtime without cutting coverage.”

Not Just Wages: The Rise of Hidden Costs

The labor story isn’t just about hourly pay. Grocers also reported sharp increases in benefits, credit card fees and interest payments. In fact, many spent more on credit card processing fees than on marketing and advertising combined.

These compounding costs make traditional cost-cutting insufficient. What’s needed is a strategic, data-backed approach to labor – one that balances service, efficiency and morale.

By identifying when and where labor hours are being underutilized or overutilized, grocers can make precise adjustments that improve profitability without compromising customer service.

A Deeper Look: Single-Store vs. Multi-Store Challenges

The study highlights how single-store and multi-store operators experience costs differently. While multi-store grocers face higher labor and CAM expenses, they benefit from lower percentages in utilities, supplies and credit card fees – suggesting efficiency gains through scale.

But scale without strategy can backfire. Multi-store operators managing from a distance often struggle with visibility and consistency across locations. That’s why both types of retailers are turning to centralized labor tools to reclaim control.

Single-store grocers, on the other hand, may find their flexibility to be an asset. “It’s easier for me to try new ideas quickly,” said one owner-operator. “When I saw how much we were overspending on Sunday coverage, we reworked shifts within a week.”

From Hours to Insights: The Evolution of Labor Management

Today’s labor challenge requires more than spreadsheets and hope. It demands actionable insights and smart technology.

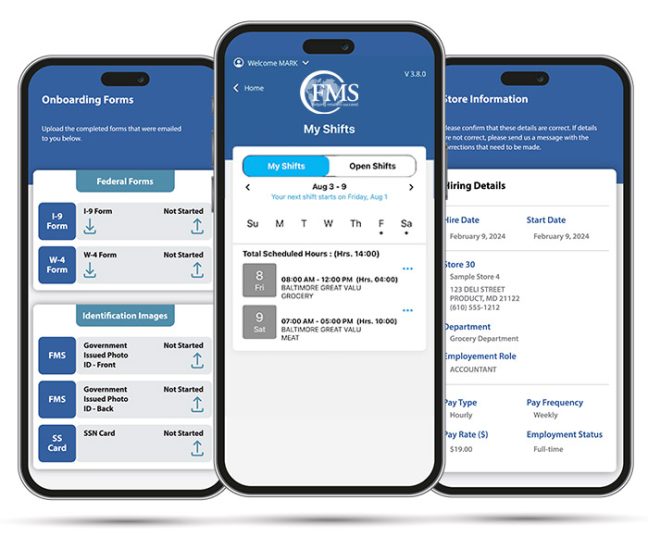

Tools like Workhappy and Labor Saver, developed by FMS Solutions, are helping grocers take a proactive stance. These platforms empower operators to:

- Forecast demand and schedule accordingly;

- Track labor as a percentage of sales in real time;

- Boost employee satisfaction with fair, transparent scheduling;

- Identify efficiency gaps across departments and stores; and

- Adjust labor deployment based on sales patterns, not just tradition.

Rather than cut corners, grocers are cutting confusion – using insights to align staffing with actual foot traffic and productivity. And the results can be immediate.

One retailer shared: “We discovered we had three people clocked in on weekday mornings before we saw any real customer traffic. A quick fix saved us 10 hours a week.”

Smart Scheduling: The Power of Precision

Data from FMS shows that grocers who implement scheduling optimization tools can reduce excess hours by 3-7 percent on average. Even modest improvements add up fast – especially for high-volume locations or multi-store groups.

That’s why operators are shifting from reactive scheduling to proactive workforce planning. By looking at trends across departments and stores, grocers can determine:

- What times of day generate the most sales;

- Which team members are most productive at which stations; and

- Where labor hours can be reallocated for better ROI.

Grocers are also using better onboarding and training processes to reduce turnover, which drives up labor costs long-term. With tools like Workhappy, employees can access schedules, request time off and communicate with managers all in one place – reducing no-shows and boosting engagement.

Efficiency Is the New Margin

In an era where every 0.1 percent matters, grocers are rethinking how they deploy their most valuable resource: their people.

Whether it’s cross-training staff to fill multiple roles, automating back-office scheduling tasks or utilizing labor dashboards to optimize shift coverage, grocers are finding innovative ways to reduce costs without compromising service.

And in a competitive labor market, doing so not only saves money – it improves retention and morale. As one operator put it: “When employees know they’re scheduled fairly and have input, they’re more likely to stay – and perform better.”

The Bottom Line

Independent grocers are navigating a new normal – where margins are thin, costs are rising, and customers expect more than ever. In this environment, labor isn’t just an expense to manage – it’s a lever for growth.

By shifting from reactive scheduling to proactive labor strategies, grocers can improve efficiency, boost team morale and protect their bottom line. With the right tools, labor becomes not just manageable, but a competitive edge.

Every tenth of a percent counts. The FMS Labor Management Suite helps you plan with precision, optimize staffing and reduce unnecessary costs – without compromising service.

Let’s talk about how smarter labor management can drive your store forward.

The FMS Labor Management Team

FMS Solutions