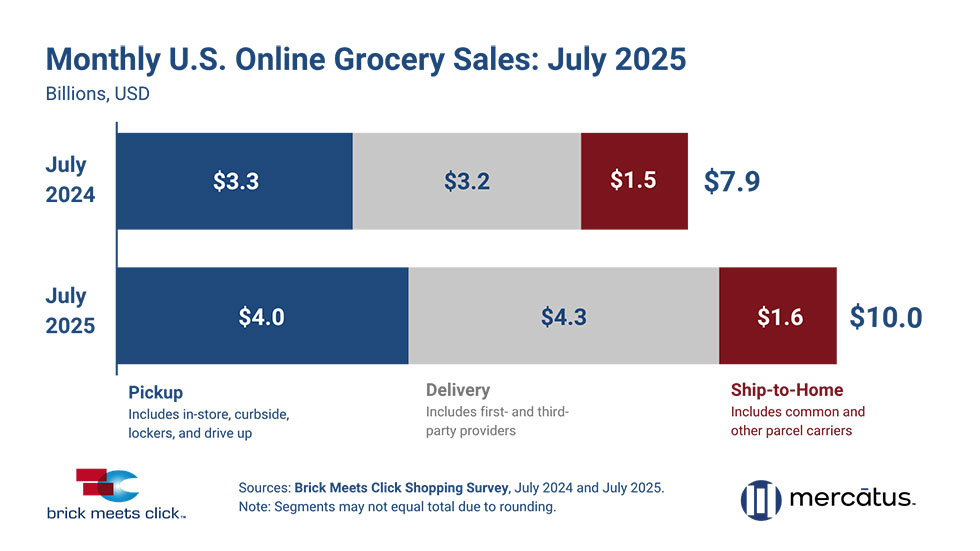

U.S. online grocery sales totaled $10 billion for July, a 26 percent increase from the prior year, according to the latest Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus.

Record-high household penetration, strong order activity and solid gains in spending rates contributed to the strong growth that helped online capture more than 17 percent of total grocery spending during the month.

All three receiving methods posted strong monthly results during July. Delivery sales drove more than half of online grocery monthly gains, jumping 36 percent on a year-over-year (YOY) basis to finish July with $4.3 billion.

Pickup posted $4 billion in monthly sales, growing 24 percent versus last year and contributing 38 percent to online grocery YOY sales growth. Ship-to-home ended July with $1.6 billion in sales, an increase of 10 percent compared to last July, generating the balance of online’s sales growth this year.

“The elimination of explicit fees, like the standard delivery cost, via a membership or subscription program, removes a top barrier to increased usage and customers are taking advantage of it,” said David Bishop, partner, Brick Meets Click.

“This tactic is unlocking latent demand for delivery, which is typically viewed as the more convenient but also the more expensive option when compared to pickup.”

July set a record for online grocery penetration as 81 million, or about 61 percent of U.S. households, bought groceries online during the month, whether the order was shipped, picked up or delivered.

Compared to a year ago, the overall number of MAUs climbed nearly 11 percent, fueled by infrequent and/or lapsed users re-engaging with this shopping mode as the total pool of households who have ever bought groceries online inched up 35 basis points.

The average number of online grocery orders completed by MAUs during July grew 6.5 percent versus 12 months ago. The two middle age groups (30-44 and 45-60) generated the gains as the youngest and oldest groups reported slight pullbacks in activity.

And, while mass saw order frequency among its MAUs grow in the mid-single digits, supermarkets saw order rates decline slightly versus July 2024 – largely due to a strong YOY expansion of its MAU base.

Although all methods posted gains in their respective average order values (AOV), delivery was the main driver of the 7 percent YOY increase in online grocery’s overall AOV. Delivery’s AOV climbed 8 percent, pickup’s AOV grew under 5 percent and ship-to-home expanded by less than 2 percent.

Another factor affecting delivery and pickup AOVs is the shift in the mix of their respective MAU bases toward households that have completed four-plus orders with the same online shopping service during the past three months. This more-engaged user segment consistently reports spending about 50 percent more per order than first timers.

“In an era where ‘free’ delivery is setting new customer expectations, and Walmart’s retail media revenue fuels its competitive edge, regional grocers face mounting pressure to profitably serve shoppers online,” said Mark Fairhurst, chief growth marketing officer at Mercatus.

“Grocery retailers that own and activate their customer data to target and personalize offers – especially for infrequent or lapsed shoppers – can turn renewed engagement into lasting loyalty, defending both sales and margins.”

Total grocery spending in July grew 2.7 percent versus a year ago while online grocery spending climbed 26 percent YOY. As a result, online grocery’s share of total spending jumped more than 300 bps to finish July at 17.2 percent, or 14.4 percent if including only delivery and pickup.

About this research

The Brick Meets Click Grocery Shopping Survey is an ongoing independent research initiative created and conducted by the company’s team.

Brick Meets Click conducted the most recent survey on July 28-31 with 1,499 adults, 18 years and older, who participated in the household’s grocery shopping, and a similar survey in July 2024.

Responses are geographically representative of the U.S. and weighted by age and income to reflect the national population of adults, according to the U.S. Census Bureau.

[RELATED: Online Grocery Sales Continued To Surge In June]