The 2025 FMS/NGA Financial Study highlights how independent grocers responded to economic uncertainty, rising costs and shifting consumer spending.

Robert Graybill, president and CEO of FMS Solutions, brings decades of expertise in grocery financial performance. With the release of the 2025 U.S. Independent Grocers Financial Study – developed in partnership with the National Grocers Association, he breaks down the operational and financial realities of fiscal year 2024 and shares what independent retailers can learn from the data.

Q: What are the main themes of this year’s study?

Fiscal year 2024 underscored the adaptability of independent grocers in the face of significant economic shifts over the past five years.

Consumers are feeling the strain of prolonged inflation, which persisted from 2021 through 2024 and significantly reduced disposable income. Although inflation has begun to ease, the overall Consumer Price Index remains permanently elevated compared to 2020. Grocery prices alone have risen 38 percent in just over four years. Combined with record-high consumer debt and elevated interest rates, it’s no surprise that consumer sentiment had declined sharply in 2024.

To thrive in this environment, grocers must stay flexible and resilient. This is especially important as grocery stores and restaurants return to a more balanced share of food, and consumers continue to face financial pressure.

Retailers that acted quickly with well-timed promotions – particularly through digital circulars – were more successful in meeting shifting consumer demand.

Q: What operational hurdles did grocers have to overcome?

Independent grocers faced significant challenges in 2024, including flat sales and gross margins, combined with rising expenses due to inflation.

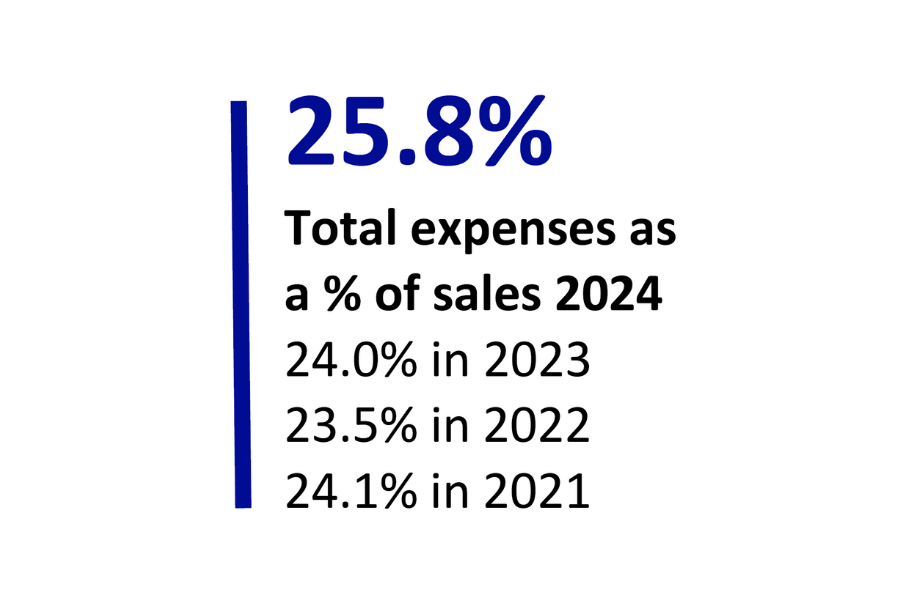

Total expenses reached 25.8 percent of sales – the highest in the history of the FMS/NGA Independent Grocers Financial Study.

Labor and benefits accounted for 16.3 percent of net sales, also a record high. Health insurance costs continue to be a major driver of inflation in this category. In addition, employee turnover remained elevated, with part-time associate turnover hitting an all-time high.

Q: How did financial performance vary between single-store and multi-store operators?

The data shows a sharp contrast. While overall net profit edged up to 1.9 percent, EBITDA varied widely by operator size. Single-store grocers reported EBITDA of 1.52 percent, while multi-store and higher-volume operators achieved a stronger 3.28 percent.

This gap underscores how scale and operational efficiency increasingly drive financial performance.

That said, EBITDA for single-store operators – at 1.52 percent – remains above pre-COVID levels, reflecting their continued resilience despite tighter margins.

Q: Were there specific categories that helped drive profitability?

Yes, perimeter departments – particularly deli and bakery – played a critical role in performance. As inflation pushed more consumers to cook at home instead of dining out, successful operators leaned into prepared foods to drive sales in higher-margin categories. These offerings not only helped maintain basket size despite reduced discretionary spending but also strengthened store identity. Well-run fresh departments continue to be key contributors to both sales growth and overall profitability.

[RELATED: NGA, FMS Solutions Partner On Policy, Profit Summits]

Q: What do the study’s regional findings tell us?

Regional cost differences had a major impact on financial performance. Operators in the Northeast and West reported higher labor and utility expenses, which compressed margins. In contrast, grocers in the South and Midwest benefited from more favorable cost structures and saw stronger bottom-line results. These geographic variations are important to consider when benchmarking and planning – strategies that work well in one region may not be financially sustainable in another.

Q: How did sales and e-commerce perform?

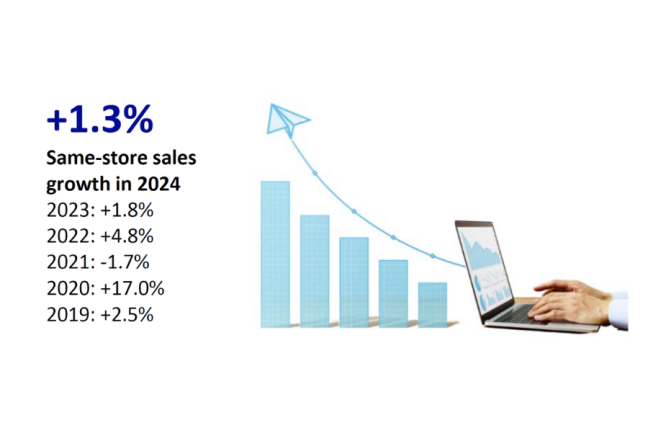

Total sales grew 1.3 percent year over year, though performance varied by store type. Multi-store operators posted a 2.2 percent gain, while single-store operators saw a 0.8 percent decline. E-commerce continued to expand in 2024, though it still accounted for just 1 percent of total sales. The upside? The average online order totaled $105 – three times higher than the $34 average for in-store transactions.

Q: Are independent grocers investing in growth, or taking a more cautious approach?

The study shows a modest increase in capital expenditures (CapEx) from the prior year, but fewer independents pursued remodels or new store development in 2024. With rising costs and tighter cash flow, this slowdown is understandable. CapEx was elevated during the COVID years – fueled by PPP and other government programs – which may have reduced both the need and capacity for similar investment today.

Q: What were some bright spots in the data?

Inventory turns improved to 17.8 – a key metric for controlling shrink and maximizing return on investment (ROI). For example, if $1 in inventory generates a 1.5 percent return per turn and turns 10 times annually, it yields a 15 percent annual return. In today’s high-interest environment, reducing cash tied up in slow-moving inventory is essential.

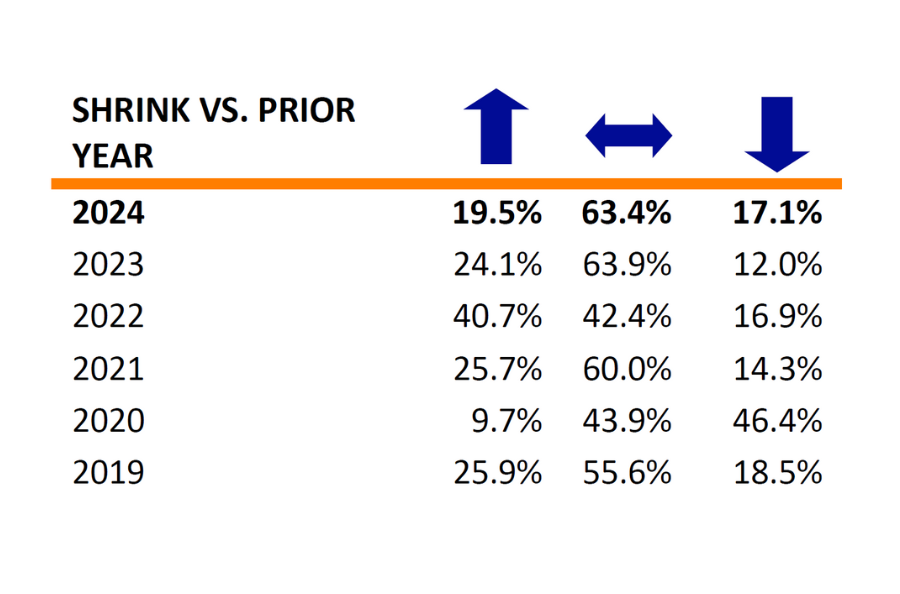

Shrink management also showed a positive trend. Despite the growth of perimeter departments – typically associated with higher shrink – overall shrink held steady at 3.5 percent.

Q: What role does benchmarking play in improving independent grocer performance?

Benchmarking is one of the most effective ways for grocers to assess and enhance performance. By comparing key metrics – like labor as a percentage of sales, inventory turns or EBITDA – to similar operators, retailers can uncover gaps, set meaningful targets and focus improvement efforts where they matter most. It transforms data into actionable insight.

Top-performing grocers don’t wait for annual reviews – they track benchmarks regularly to guide decisions on pricing, staffing, promotions and capital investments. Benchmarking can be done across your own stores, within your ad group, or by using this survey. You can also normalize results to reflect your region for more relevant comparisons.

Q: Are there any emerging trends independent grocers should watch heading into 2025?

One area to watch closely is the adoption of technology and AI in retail. While tools like self-checkout are being reconsidered by some, there’s rising interest in solutions that improve labor efficiency, inventory visibility, ordering accuracy, and customer engagement.

At the same time, financial forecasting and scenario planning are becoming essential skills. With continued market volatility, the ability to model outcomes and adapt quickly gives operators a clear edge. Grocers who take a proactive, disciplined approach will be far better equipped to manage uncertainty and stay ahead.

Q: What’s your advice to independent grocers going forward?

Stay agile – and stay informed. The most successful grocers in 2024 weren’t necessarily the largest, but they had a clear grasp of their financials. Strong performance came from those who understood their cost structure, monitored margins closely and planned ahead for shifts in consumer behavior. In a volatile market, the ability to make timely, data-driven decisions is what sets top performers apart.

About Robert Graybill

Robert Graybill is president and CEO of FMS Solutions, where he leads efforts to help independent grocers improve profitability through benchmarking, best practices and financial tools. With more than 25 years of experience in the grocery industry, he began his career at age 14 in a local meat market and later held roles in operations, IT, pricing and finance with A&P’s SuperFresh.

Since joining FMS in 2000, Robert has expanded the company’s services and international footprint. He is the author of the FMS/NGA Independent Grocers Financial Study and FMI’s Annual Financial Review, and a respected speaker and educator across the industry. He also teaches at the IGA Coca-Cola Institute’s Supermarket Management Program.

Robert holds an MBA from Loyola University Maryland and completed the NGA Executive Management Program at Cornell. He has served on academic and industry boards, including at the University of Baltimore, Babson College, and Elon University’s Business School. His leadership has also extended to the NGA Board of Directors and NGA Foundation, where he served as Treasurer.

A two-time EY Entrepreneur of the Year finalist, Robert is dedicated to helping independent, family-owned retailers succeed in a changing market.