Two private brand companies have jointly launched a new benchmarking strategy to enhance the position of retail private brands for a new era.

Many observers believe food retail private brands will be in a stronger position in the post-coronavirus period. However, that is more likely to happen if retailers and suppliers adapt to quickly shifting consumer needs driven by the pandemic period and its aftermath.

Fort Worth, Texas-based Solutions for Retail Brands (S4RB) and Consumer Science have jointly launched a comprehensive new benchmarking strategy called “Consumer Experience Score.” This involves a novel, holistic metric incorporating attributes such as design, packaging, sustainability and healthfulness, as well as traditional sensory and performance measures.

Strategy improves retailer competitiveness

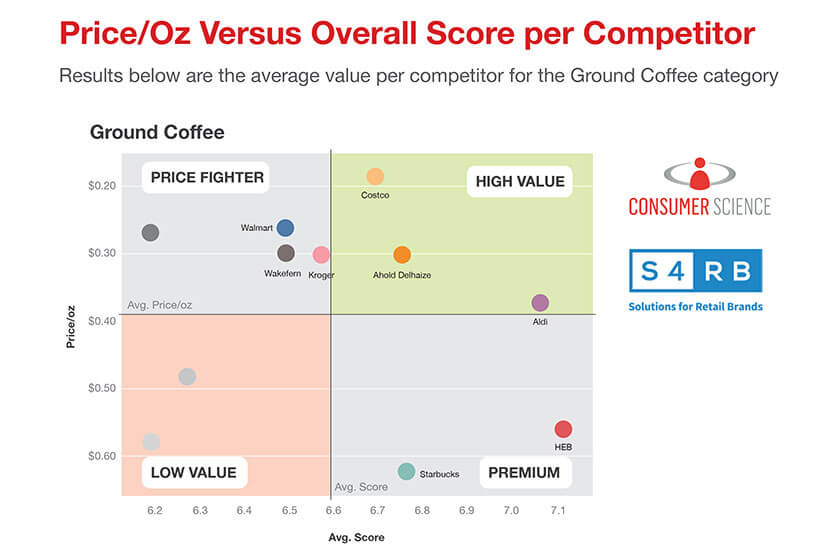

Retailers leveraging this strategy, coupled with price comparisons, will benefit from enhanced insights compared to traditional approaches, the companies say. Traditional strategies compare private brands primarily to national brands, or analyze only basic sensory attributes or just one category. The new framework will enable retailers to successfully test a broader range of attributes against a wider variety of private brand and manufacturer brand competitors. This will help retailers to pivot quickly for changing consumer preferences, whether for value, premium or other directions.

Private brands have benefitted from more consumer trial driven by manufacturer brand out-of-stocks during the coronavirus period. While the conventional wisdom is that consumers will seek more value items in the post-pandemic era, that’s not necessarily the case or it may not be true in all cases. Retailers will need to employ improved private brand benchmarking approaches to ensure that all products consistently deliver against their brand propositions.

Addressing consumer needs post-pandemic

“Consumers will be more interested in private brands going forward, so this is an ideal time for retailers to boost benchmarking and fine-tune their brand value proposition,” said Chandi Gmuer, VP of consumer research and product testing at Consumer Science. “New kinds of benchmarking are needed to make sure strategies are on target for consumers in this environment, as the discounters Aldi and Lidl did so well back in the financial crisis of 2008.”

James Butcher, CEO of S4RB, said the new approach will enable private brand teams to think differently by delivering against a clear brand value/quality proposition.

James Butcher, CEO of S4RB, said the new approach will enable private brand teams to think differently by delivering against a clear brand value/quality proposition.

“It brings a new standard strategy across multiple categories, to help brand owners understand and enhance their private brand propositions,” Butcher said. “This should all be done in a collaborative way so that suppliers can work with retailers to ensure products meet objectives.”

Research uncovers private brand insights

The new strategy benefits from Consumer Science’s testing expertise and S4RB’s ability to visualize results in a way that informs better decisions on private brand positioning. The companies used the benchmarking approach to conduct independent research across a number of private brands, including those from Aldi, Albertsons, Ahold Delhaize, Kroger, Target and Walmart. The research, available from Consumer Science, identified a number of key insights about the state of U.S. private brands through comprehensive testing across multiple categories.

Among the insights:

- The top scoring private brands are consistently providing the best overall consumer experiences at good prices across categories.

- Some retail brands are challenged by merely average experience scores coupled with higher pricing and disparity in brand value across categories.

- Some store brands aren’t getting credit for their strong consumer experiences because of less than inspired designs and too-few callouts on packages. For example, in ground Colombian coffee, a category often thought of as premium, products whose designs lacked innovation and seemed outdated received lower consumer experience scores.

- At times a single attribute, such as texture or presentation, makes a big difference in which private brand items provide the best overall experience in a particular category. For example, the inclusion of croutons in some private brand chicken caesar salad products represented a key differentiator by adding texture and crunch. In the hummus category, decorative toppings made the difference for some items by boosting presentation.

“Only through deeper testing and comparisons will retailers be able to fine-tune their private brand products to boost consumer experience,” said Gmuer.