Publix vs. Trader Joe’s, Costco vs. BJ’s, Target vs. Walmart—ACSI scores show which retailers customers prefer

As industry analysts continue to debate the severity of the retail apocalypse—or whether or not it even exists—the American Customer Satisfaction Index (ACSI) says its 2017 Retail Report indicates that signs of the retail apocalypse have not been exaggerated.

“The latest customer satisfaction scores show just how bleak it is for brick-and-mortar retailers,” the organization says. But the news isn’t bad across the brick-and-mortar board.

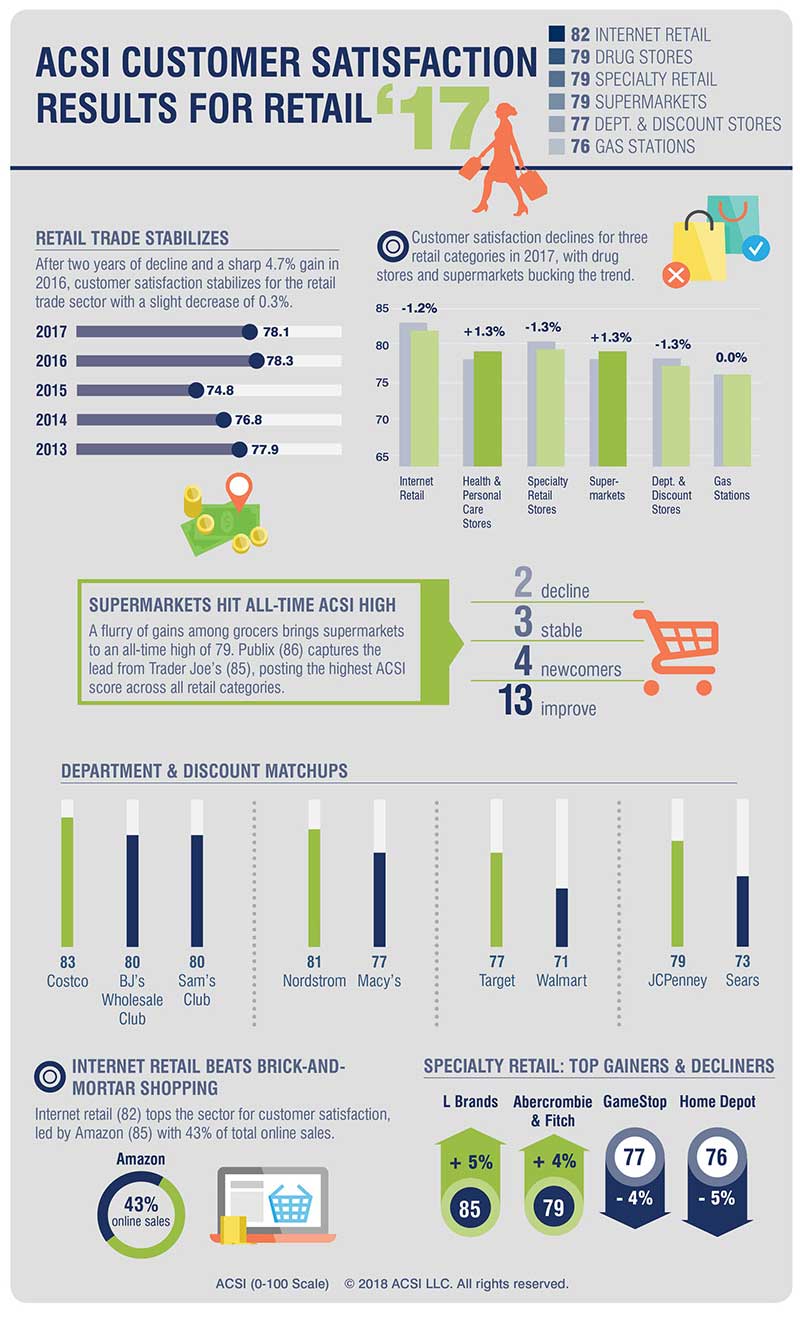

The ACSI Retail Report 2017 shows the retail sector as a whole remains steady, with an ACSI score of 78.1, down just a hair from an all-time high of 78.3 a year ago. A closer look at which industries are up and down shows two different stories. On the one side, supermarkets and health and personal care stores both gained a point for an ACSI score of 79. On the other hand, department and discount stores dropped a point to 77, and specialty retail stores fell one point to 79.

Internet retail sites also fell one point to a score of 82, suggesting that despite its place atop all retail industries, there are still improvements to be made.

“Amazon is nearly inescapable in retail right now as the e-commerce giant makes moves into grocery stores and pharmacies, expanding its footprint into multiple retail industries,” said David VanAmburg, managing director at ACSI. “The surge in customer satisfaction seen in some supermarkets and health and personal care stores shows how companies are focusing on customer satisfaction as one way to ward off Amazon’s push into new retail industries.”

Publix vs. Trader Joe’s: Who rules supermarkets?

Supermarkets were one of the strongest retail industries in 2017, with 13 of 22 stores improving on their 2016 scores.

Publix ruled the roost, surging 2 percent to a top score of 86, the highest score of any company in the retail category. Trader Joe’s was right behind it at 85.

“While Trader Joe’s was unable to sustain its record-high score from last year, customer satisfaction with the grocer is still extremely high for a brick-and-mortar retailer, on par with Amazon’s score in the internet retail category,” VanAmburg said.

Whole Foods stayed put at 81, and it’s too soon to gauge the effect of its acquisition by Amazon, which only recently began rolling out Whole Foods deliveries.

For the thirteenth consecutive year, Walmart had the lowest score among supermarkets.

Story continues below

CVS vs. Walgreens: Strength of health and personal care stores

Among the largest chains, Kmart pharmacies and Kroger were the highest-rated in this category, tied with a score of 80.

CVS was right behind them at 78 (a company best), while Walgreens and Rite Aid both scored 77, just one rung above last place, which was Walmart at 75.

“CVS was one of only two large chains to improve, gaining 3 percent over its 2016 score,” VanAmburg said. “The health care retailer may be trying to preempt the Amazon threat, shoring up both customer and employee satisfaction ahead of its planned merger with Aetna.”

Acquiring Target pharmacies also may be bolstering CVS’s customer satisfaction scores. When dividing CVS’s score into CVS and Target pharmacies, Target stands at a score of 80, while CVS sits at 77.

Target vs. Walmart: Department and discount stores struggle

Costco led all department and discount stores with a score of 83, over both Sam’s Club (80) and BJ’s (80).

Target dropped two points to a score of 77, but still trounced Walmart, which sat at the bottom of the category with a score of 71, down a point from last year.

Dollar Tree (77) was down nearly 4 percent, but still fared better than Dollar General (73), which sat in the second-to-last position after falling 6 percent in the past year.

Sears fell nearly as hard, losing 5 percent to hit a score of 73. The company closed 400 stores in 2017, with more closures planned for this year, reflecting its slow adoption of online retail and lingering customer satisfaction woes.

Lowe’s vs. Home Depot: Specialty retail stores

While Home Depot beat rival Lowe’s for the first time in 2016, their order reverted in 2017. Lowe’s sat around the middle of all specialty retail stores, earning an ACSI score of 78. Home Depot, however, was in last place with a score of 76.

L Brands (Victoria’s Secret, Bath & Body Works, Pink) led the category with a score of 85 and was among the most improved across all retail industries, jumping 4 points over last year. The company has been reinvigorating its brick-and-mortar stores, devoting 70 percent of its investments into renovations and expansions, and according to customers, it’s paying off.

AutoZone was down two points to 78, sitting one point behind Advance Auto Parts, which stood steady at 79. Both specialty retailers made strides in addressing customer complaints in 2017, with AutoZone cutting complaints by 61 percent, and Advance Auto Parts by 53 percent. It wasn’t enough, however, to beat O’Reilly Auto Parts, which debuted with a score of 81.

Internet retail sites dominated, but show room for improvement

Amazon topped all companies in this industry with a score of 85, one point off its 2016 score of 86. Newegg was second place at 83, followed by eBay, Overstock, and all others clustered at 81.

Internet retail sites’ 1.2 percent drop to an ACSI score of 82 could be attributed to several factors.

For the industry overall, customers say checkout and payment isn’t as easy as it was a year ago (87), but this remains the most satisfying part of the online experience. Product images aren’t as useful (84) nor are customer-generated reviews (down 2 percent to 79).

Variety (84) and availability of merchandise (82) are down, and buyers aren’t as happy with shipping options (down 2 percent to 81). The least-appreciated aspect of online shopping, site-generated product recommendations, dipped 4 percent to 75.

The ACSI Retail Report 2017, based on 50,186 customer surveys collected throughout 2017, is available for download here.

The ACSI has been a national economic indicator for almost 25 years. It measures and analyzes customer satisfaction with more than 300 companies in 44 industries and 10 economic sectors, including various services of federal and local government agencies. Reported on a scale of 0 to 100, ACSI scores are based on data from interviews with roughly 180,000 customers annually.

Keep reading:

Study: Amazon, Walmart Outscore Food Retailers On Online Satisfaction

https://www.theshelbyreport.com/2017/02/28/acsi-customer-satisfaction-with-supermarkets-improves-trader-joes-on-top/

https://www.theshelbyreport.com/2017/06/13/shoppers-demand-transparency/