In 2026, in-store bakery is becoming a “solution department” more than a “nice-to-have case.” Shoppers still buy baked goods with their senses, taste and price remain the top two purchase drivers, but the bar for what counts as a good indulgence is rising. Recent consumer research continues to show that taste drives purchase decisions first, but the gap between pleasure and practicality is narrowing: price, healthfulness, and convenience all remain major influences, which means bakery growth now depends on offering craveable items that also feel easy, smart, and worth it.

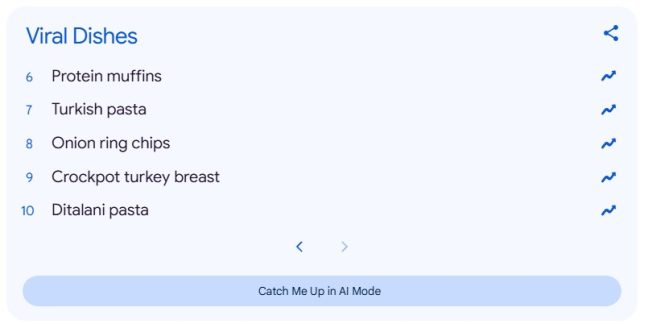

That shift is reshaping product development. The winning strategy isn’t to abandon indulgence; it’s to repackage it as “permission.” Protein is the clearest example. Americans increasingly report trying to consume protein, and one segment says they follow a high‑protein eating approach, creating demand for baked goods that can function as breakfast, snack or post‑workout fuel, not just dessert. Search behavior reinforces the point: Google Trends’ Year in Search highlights “protein muffins,” signaling broad curiosity around bakery formats that deliver familiar comfort with a functional halo.

At the same time, “viral bakery” has become a demand accelerator. When Google Trends named “Olympics chocolate muffins” a top trending recipe, it illustrated how quickly a single item can lift consumer expectations for bakery experiences, especially when the product is portable, photo‑friendly and indulgent. For in‑store bakeries, this doesn’t mean chasing every fad; it means building a flexible playbook: limited‑time flavors, small‑batch runs and an innovation pipeline that can move from test to scale without disrupting core production.

Operationally, 2026 is the year many bakeries formalize the shift from full scratch toward smart bake-off – without sacrificing the “fresh-baked here” promise. Industry workforce research released with IDDBA participation underscores that staffing challenges remain a central constraint, which in turn increases the value of standardization, training efficiency and selective automation. In parallel, baking‑industry equipment leaders are increasingly framing AI as a practical tool for quality, maintenance, forecasting and waste reduction – areas where even small improvements can protect profitability.

Finally, the in-store bakery is being rebuilt for omnichannel retail. Online grocery behavior is scaling into habit (not just crisis-era behavior), with record sales and rising order frequency. That creates a clear opportunity for bakery: planned purchases (cakes, platters, seasonal items) and repeatable weekly buys (cookies, breakfast pastries) perform better when preorder and pickup are frictionless. Kiosks and digital ordering can also improve production forecasting and reduce manual ticketing, if they are integrated with order management and back‑of‑house workflows. At the same time, compliance and sustainability move closer to the center of bakery operations: sesame is now a major allergen requiring updated labeling/disclosure practices, packaging policy is getting more state-specific and data-driven and food waste prevention remains the highest-impact sustainability lever.

[RELATED: Growing In-Store Bakery Sales]

Practical takeaways for in-store bakery operators

- Build a “healthy indulgence” set around what shoppers already crave (cookies, donuts, muffins), then ladder up with protein-forward variants and portion-smart minis.

- Treat omnichannel as a bakery growth channel, not just an IT project: connect preorder/kiosk demand to production schedules, pickup staging and inventory visibility so convenience becomes operational reality.

- Use bake-off strategically to protect “fresh” while reducing dependence on scarce scratch skills; standardize bake profiles and finishing routines and prioritize equipment features that reduce labor and improve consistency.

- Make allergen communication and training a merchandising advantage (clear labels, written notification where required, staff allergy awareness), especially as sesame requirements reshape “free-from” expectations.

- Reduce waste like a profit lever: measure shrink, tighten forecasting with digital order signals and right-size packaging – because upstream waste prevention yields the biggest environmental and cost returns.