Rising grocery prices are influencing American consumption habits, compelling consumers to embrace recipes, private labels and more economical protein choices to maximize their spending. New data from Chicory reveals that inflation and economic uncertainty, exacerbated by tariffs, are shaping what consumers are buying and preparing for meals in 2025.

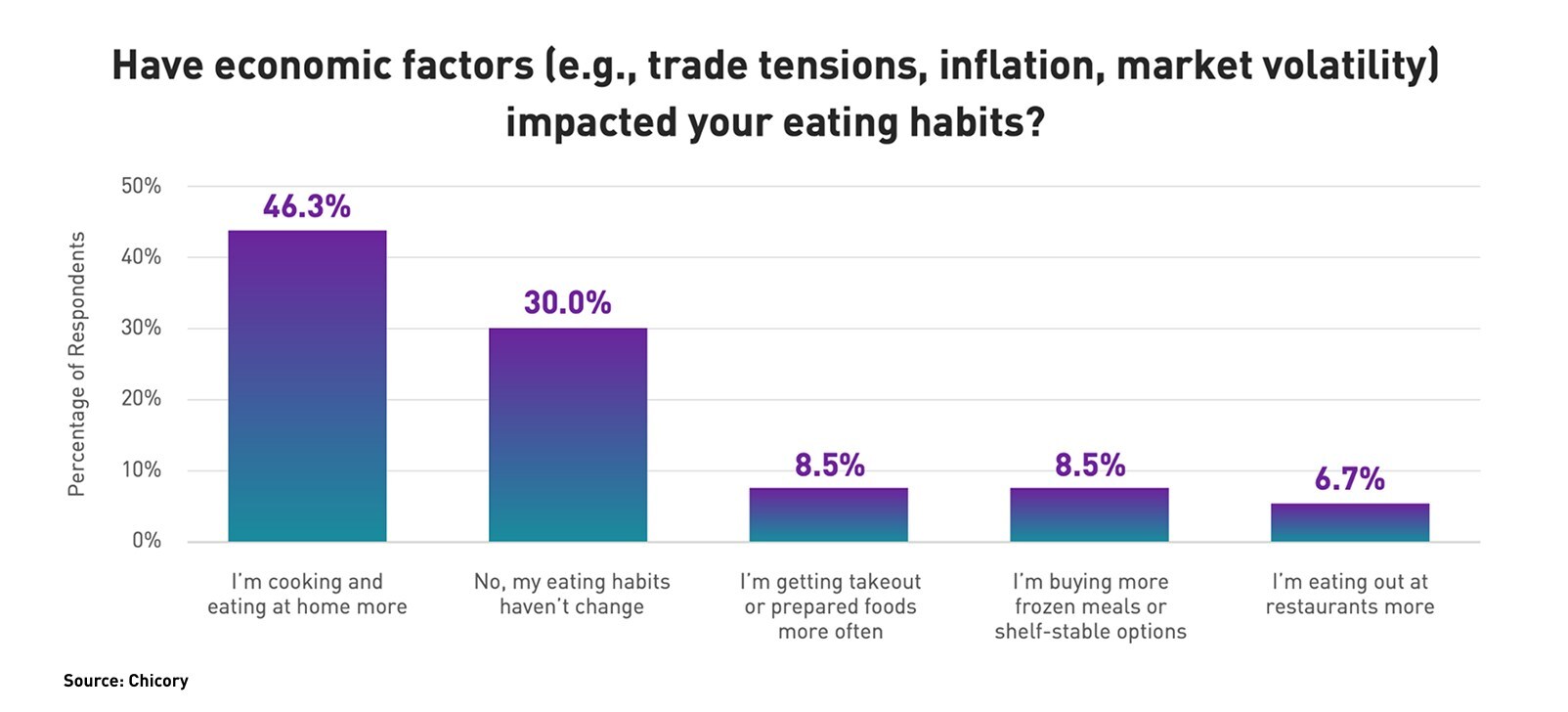

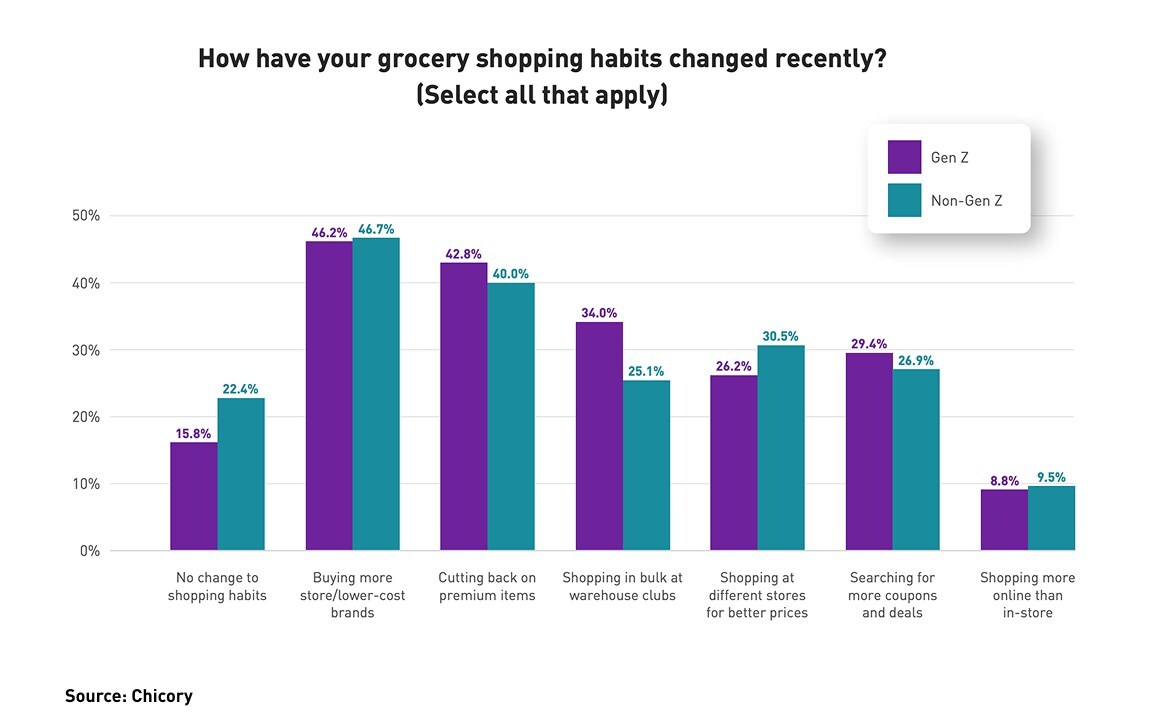

According to Chicory’s “Economic Sentiment Report,” derived from a national survey of 1,000 U.S. consumers, a clear trend toward increased home cooking is evident, with nearly half (46 percent) of respondents indicating they are preparing meals at home more frequently. This behavior is pronounced among younger demographics. Some 34 percent of Gen Z shoppers have reportedly cut their grocery budgets, a higher proportion compared to 29 percent of non-Gen Z consumers.

Furthermore, Gen Z is using digital resources for economical meal solutions, with 72 percent using online recipes to plan low-cost meals. This reliance on recipes extends to product discovery across all demographics, as 80 percent of all shoppers state that recipes have helped them uncover new products or ingredients.

Protein remains a dominant search category, as Chicory observed a 450 percent spike in protein-based recipe searches in January compared to December. However, consumers are seeking more affordable options. Seventy-seven percent of shoppers report buying less meat or opting for more budget-friendly proteins such as tofu, beans or less expensive cuts.

Adding to this trend, Gen Z is embracing the concept of “fakeaways,” with 71 percent having attempted to recreate their favorite takeout dishes at home.

These shifts are also driving an increase in the adoption of store-brand and private label products, with nearly half of consumers indicating they have traded down to save money.

“Consumers aren’t giving up on good food, but they are getting smarter about how to afford it,” said Yuni Baker-Saito, co-founder and CEO of Chicory.

“We’re seeing recipe content boom in popularity, and it may come as a surprise to some brands and retailers just how much they guide purchases and shopping habits. I think we’ll start seeing brands lean into more promotional activity as a result, or working harder to convince consumers why their product is a luxury that should stay in their basket.”

[RELATED: Study Finds Consumers Cutting Grocery Spend Due To Tariff Concerns]