A new five-year forecast from Brick Meets Click reveals that eGrocery sales growth in the U.S. will far exceed in-store sales through 2029.

While overall grocery spending is projected to slow, online grocery sales – including pickup, delivery and ship-to-home – are forecast to grow at a compound annual growth rate of 8.9 percent, compared to 1.7 percent for in-store sales.

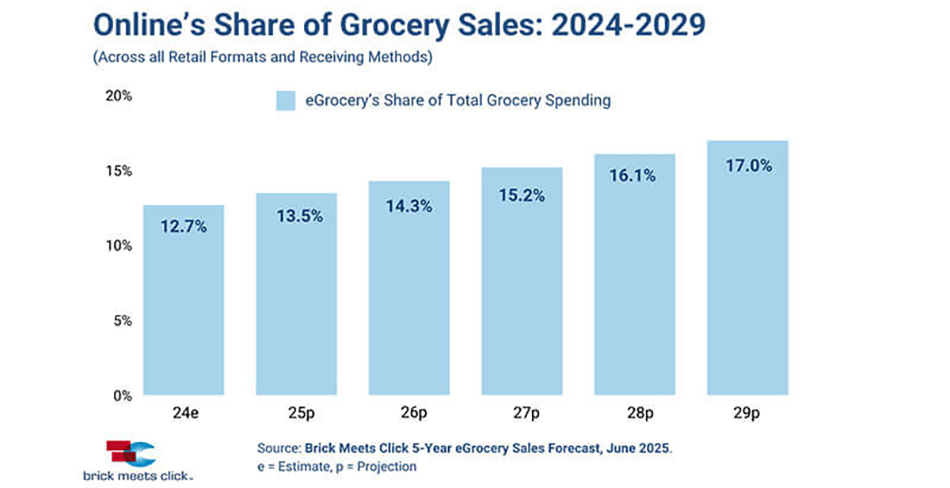

According to the report, U.S. Grocery Sales 5-Year Forecast: 2025–29, eGrocery is expected to capture 17 percent of total grocery sales by the end of the forecast period. In fact, it will drive nearly half of the grocery market’s absolute dollar growth during this time, reshaping how and where Americans shop for groceries.

“As firms, especially grocers, review our new five-year forecast, it’s important to keep in mind that mass and Walmart (excluding Sam’s Club) now account for nearly 50 percent and 40 percent of today’s eGrocery sales, respectively, and that the topline view includes ship-to-home, a service that most grocers don’t offer,” said David Bishop, partner at Brick Meets Click.

“Given these factors, we encourage firms to leverage this national forecast as a guide for examining their regional trade areas in terms of competitive set, household demographics and growth opportunities.”

In 2024, eGrocery sales rose more than 9 percent compared to 2023, with growth concentrated in the latter half of the year due to aggressive promotions. That momentum has continued into 2025, with delivery leading the year-over-year gains.

Key findings from the forecast include:

- Online grocery sales will grow 5.2 times faster than in-store sales;

- eGrocery will account for nearly 40 percent of the grocery market’s total absolute dollar growth in 2025, rising to over 50 percent by 2029; and

- Changes in government assistance (SNAP), immigration policy and inflation rates are key variables likely to influence spending and shopping behaviors.

For instance, policy shifts reducing SNAP eligibility or benefit amounts could affect spending among the 22 million households currently receiving assistance. Meanwhile, restrictive immigration policies could curb population growth, further moderating demand.

The report also projects that grocery-related inflation will range from 2.7 percent to 1.2 percent annually through 2029, covering a wide range of products including food at home, personal care, pet products and household supplies.

“Grocery retail has always been a dynamic business, but the rate of change over the last five-plus years has disrupted shopping patterns, especially for delivery and value formats, like Walmart, and that disruption is not disappearing anytime soon,” Bishop said.

“Before the pandemic, eGrocery’s draw was largely about saving time; during the pandemic, it was about protecting your health; today, it’s often more about saving money and time.”

About Brick Meets Click

Brick Meets Click is a strategic insight and analytics firm focused on the grocery industry. With decades of experience, the company helps grocery retailers and brands navigate market changes and develop actionable strategies based on robust, data-driven insights.

[RELATED: April Online Grocery Sales Jump 15% Versus Year Ago To $9.8B]