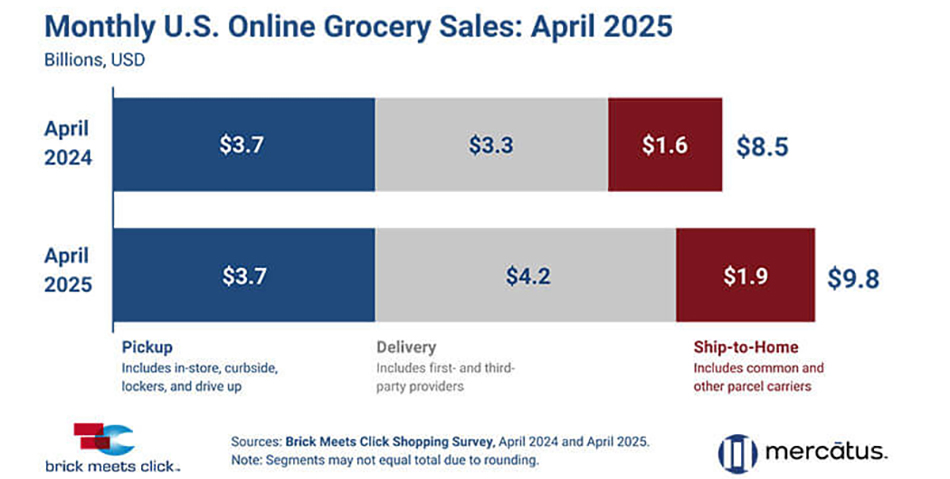

Robust growth continued for U.S. online grocery sales in April, with total sales reaching $9.8 billion, a 15.2 percent increase compared to last year and the ninth consecutive month above $9.5 billion, according to the Brick Meets Click Grocery Shopper Survey, fielded April 29-30 and sponsored by Mercatus.

This run of positive results, largely fueled by delivery, highlights how customer preferences are evolving due to a combination of aggressive promotions and the increased availability of services that help shoppers save time and money.

Delivery led the growth for April, reaching $4.2 billion in sales with a 29 percent year-over-year (YOY) increase and contributing nearly three-quarters of the sales lift for the month.

Ship-to-Home, which rose 22.1 percent, contributed $1.9 billion in sales. In contrast, pickup sales remained flat compared to a year ago at $3.7 billion as the method continues to face headwinds due to the dramatic rise in demand for delivery.

“Historically, memberships and subscriptions were considered more effective at building loyalty with regular customers, however, today we see that these programs are also attracting shoppers from rivals as households search for more savings,” said David Bishop, partner at Brick Meets Click.

“Regardless, Walmart+ has become a core component of its strategy as approximately two-thirds of the households ordering groceries online from Walmart during April 2025 were Walmart+ members.”

Mass leads the charge when it comes to attracting new customers, as it continues to expand its MAU base. Household penetration increased from 46 percent in April 2023 to 50 percent in April 2025.

Order frequency among Mass MAUs also has increased steadily over the last two years, illustrating how the potential to save more has motivated additional online grocery orders.

This is particularly true for Walmart. Walmart+ members spent 40 percent more than non-Walmart+ members who ordered online from Walmart in April. Increased order frequency accounted for most of the gap between the two customer groups, although Walmart+ members also reported higher average order values (AOV).

Loyalty remains a beneficial component of these membership/subscription programs, as members are more likely to use a specific service again within the next month.

For example, Walmart+ members are nearly 10 percent more likely to express intent to reuse the same service again compared to Walmart’s e-grocery customers who don’t belong to the program.

“Discounted memberships have put delivery in the spotlight, but lasting loyalty forms where speed, control and value meet,” said Mark Fairhurst, chief growth marketing officer, Mercatus.

“Regional grocers who combine fast, free pickup with a compelling subscription program, data-driven rewards and timely outreach to lapsed shoppers can turn trial orders into repeat business while protecting margins.”

For more information about subscribing to the full monthly report, visit the eGrocery Monthly Sales report page.

[RELATED: March Online Grocery Sales Jump 21% Versus Year Ago]