The U.S. online grocery segment sustained its turbo-charged growth in March 2025, ending up 21 percent versus a year ago with $9.7 billion in monthly sales, according to the Brick Meets Click Grocery Shopper Survey fielded March 30-31, and sponsored by Mercatus.

Delivery continued to be the main driver of the topline increase, as it surged more than 30 percent year over year, due to expansion of its monthly active user (MAU) base.

The latest monthly performance gains for online grocery sales reflect the ongoing impact of aggressive promotions and deep discounts on annual memberships and/or subscriptions that began around May 2024. These promotions have been offered by a broad range of grocery retailers, across Mass, Supermarkets and third-party providers, and predominantly benefit delivery although pickup gets a boost that’s largely confined to supermarket services.

“Delivery’s remarkable year-over-year rebound highlights the potency of promotional strategies that help customers save more money,” said David Bishop, partner at Brick Meets Click. “And, memberships/subscriptions are becoming essential for retaining customers and driving more recurring revenue via gains in order frequency and average order values.”

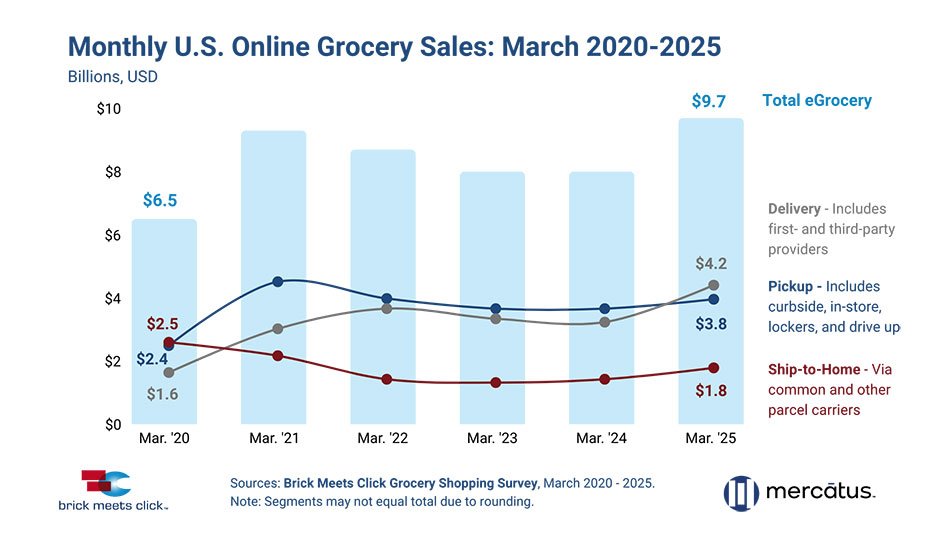

March 2025 also marked five years since the COVID-19 pandemic was declared, which produced a rapid and profound impact on how U.S. households purchased their groceries. In August 2019, eGrocery rang up $2 billion in monthly sales in the U.S. Then seven months later in March 2020, eGrocery sales skyrocketed to $6.5 billion, a more than 200 percent increase. This initial surge accounted for about 60 percent of the total gains for eGrocery since the pandemic.

After peaking in early 2021, total online grocery sales rebalanced through mid-2024, contributing another 20 percent of overall gains. More recently, there has been another 20 percent in gains driven by the uptick in subscriptions and memberships promotions, with March 2025 representing the eighth consecutive month of sales of over $9.5 billion.

Beyond the jump in sales, online grocery has also experienced a significant shift in consumer demand by receiving methods. Prior to the pandemic, ship-to-home dominated. It currently trails the other two methods – delivery and pickup – by a significant gap.

In addition, more households are now likely to use multiple methods to receive their eGrocery orders during the month.

Overall, the pandemic motivated more households to try online grocery shopping. The share of U.S. households buying groceries online jumped from under 25 percent before COVID-19 to 57 percent in March 2020, and while it has gone as high as nearly 61 percent (February ’25), it ended March 2025 at 57 percent as well. At the same time, MAUs are now more active online as the number of monthly eGrocery orders received has increased from 2.0 pre-pandemic to 2.6 as of March 2025.

For more information about March 2025 results, visit the latest Brick Meets Click eGrocery Dashboard or the eGrocery Monthly Sales report page.

[RELATED: February Online Grocery Sales Jump 31%: How Subscriptions Reshape Retail]