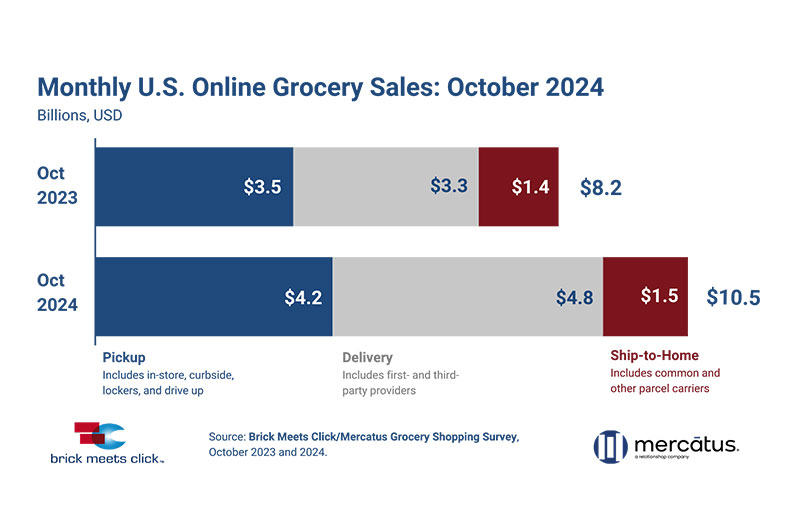

The U.S. online grocery market ended October with $10.5 billion in monthly sales, a 27.9 percent increase over last year as all three receiving methods posted solid year-over-year (YOY) sales growth, according to the Brick Meets Click/Mercatus grocery shopper survey.

October’s total monthly sales set a record high and marked the second straight month in which YOY online grocery sales gains exceeded 20 percent, as the impact of ongoing deep-discounted offers, predominantly for delivery, affect key metrics such as monthly active users (MAUs) and order frequency.

Delivery experienced another increase, with YOY sales climbing 46 percent to $4.8 billion, a record-setting high for the segment. The MAU base for delivery expanded much faster than for either pickup or ship-to-home, growing 16 percent versus 2023, with most of the gains coming from households between the ages of 30-60.

Combined with increased order frequency, this user-base growth drove delivery’s order volume up 24 percent versus October 2023 and widened delivery’s order share lead over pickup for the second consecutive year in large metro areas, which represent about 60 percent of U.S. households.

In addition, delivery’s average order value (AOV) climbed by more than 15 percent, partly due to a growing share of customers who use the services more frequently and tend to spend more as their usage increases.

The overall MAU base for online grocery sales grew by 1.6 percent year over year, as 54 percent of U.S. households completed at least one online grocery order during the month through delivery, pickup or ship-to-home. At the same time, the total pool of households that has ever shopped online for groceries expanded by 0.6 percent in October, representing about 79 percent of U.S. households. The gap in expansion rates reveals that most of the MAU growth in October was the result of reactivating light or lapsed users.

“Delivery is riding its next growth curve, fueled not simply by subscriptions or membership offers, but by promotional pitches that incent the customer to commit for a year,” said David Bishop, partner at Brick Meets Click.

“While firms occasionally revert to their standard ‘free trial’ offers, the surge of new discount tactics seem to have a broader appeal that extends beyond the existing customers of the retailer or provider offering it.”

[RELATED: July Online Grocery Sales Climbed 9% Versus Year Ago To $7.9B]

Since May, several retailers and third-party providers have stoked the market by periodically offering deep discounts for their annual subscriptions or membership plans in lieu of standard free trial offers. These discounts ranged from 20 percent at Kroger and 50 percent at Walmart to 80 percent off an annual plan from Instacart. And there were more firms offering similar deals.

Some traditional retailers also have experimented with promoting limited time offers that waive the delivery fee on large orders that exceed a specified purchase threshold, such as $100. Other providers newer to grocery delivery, like DoorDash and Uber, have introduced 30-day or four-week free membership trials, respectively, to drive demand, and Amazon extended its free trial from 30 to 90 days around the most recent Prime Day period.

The growth in delivery connected with subscriptions and memberships may create headwinds for retailers without a competitive offer due to the increase in cross-shopping behaviors. The share of households that ordered online from a grocery format in October and that also received an online grocery order from mass during the month rose more than five percentage points versus last year to 40 percent in 2024.

“As national giants like Walmart accelerate growth with aggressive membership offers, there are effective ways for regional grocers to adapt and better connect with their core customers,” said Mark Fairhurst, chief growth officer at Mercatus.

“By improving loyalty programs and enhancing the relevance of digital initiatives to leverage targeted and personalized campaigns that integrate online and offline promotions, regional grocers can seize new opportunities to strengthen their position in a competitive market.”

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by the team at Brick Meets Click and sponsored by Mercatus.

Brick Meets Click conducted the most recent survey on Oct. 30-31 with 1,847 adults, 18 years and older, who participated in the household’s grocery shopping and a similar survey in October. Results are adjusted based on internet use among U.S. adults to account for the non-response bias associated with online surveys.