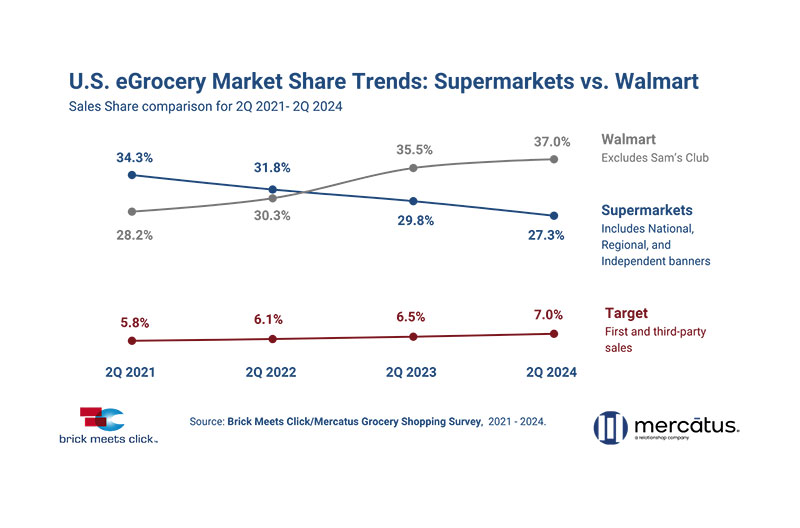

Walmart, excluding Sam’s Club, captured 37 percent of the U.S. online grocery sales in the second quarter of 2024, climbing 150 basis points (bps) versus last year. This marks its highest share level to date, according to a new edition of U.S. eGrocery Market Share Report – 2Q24, powered by data from the monthly Brick Meets Click/Mercatus Grocery Shopping Survey.

Walmart’s year-over-year gains for Q2 2024 build on a multi-year uptrend for the retailer, fueled by economic conditions and key strategic moves.

In contrast, supermarkets continued to cede online grocery sales share, losing 250 bps in the recent quarter versus a year ago to finish Q2 2024 with 27.3 percent. Walmart’s sales share sales (excluding Sam’s Club) began gaining on supermarkets in early 2022, after the expiration of the expanded child tax credit at the end of 2021 and as overall and food at home inflation was growing faster than wages. This led to dramatic drops in the personal savings rate and rapid growth of outstanding credit card balances while households were further challenged by rising interest rates.

“Walmart’s reputation for low prices helped to attract households that wanted both the convenience of shopping online and ways to save money in this market,” said David Bishop, partner at Brick Meets Click. “The execution of its omnichannel strategy, plus the operational efficiencies aided by incredibly high order demand, has enabled Walmart to consistently deliver the type of experiences that customers expect and to lower its cost to serve online orders at the same time.”

Meanwhile, Target has made more moderate sales share gains over the last several years, gaining 120 bps of share versus Q2 2021 and finishing Q2 2024 with 7 percent of online grocery sales. Strong execution – especially in fulfilling pickup orders – and a price gap halfway between supermarkets and Walmart likely offered Target a degree of defense for its online grocery business.

Walmart’s focus on building its first-party delivery business has produced notable shifts in how delivery and pickup sales fall between the mass and supermarket formats which impacts profitability, given the higher costs related to fulfilling delivery orders compared to pickup.

Overall, the mass format captured nearly half of all delivery sales in Q2 2024, driven by Walmart’s nearly 8 percentage point jump in delivery share versus Q2 2023. During the same period, supermarkets went from leading mass in delivery sales share by about a point to trailing by nearly 10 points, although recent promotional pushes by Instacart helped to boost supermarket sales share between Q1 and Q2 this year.

In pickup, supermarkets ended Q2 2024 with about 28 percent of the segment’s sales compared to mass, which claimed almost 58 percent. In fact, mass lost 100 bps of pickup sales share versus a year ago, while supermarkets lost 210 bps. Even with these shifts between the retail formats, pickup continues to remain the dominant receiving method for online grocery sales in the U.S. with a 45.5 percent share, down 110 bps versus Q2 2023.

[RELATED: June Online Grocery Sales Total $7.7B, Up 8% From 2023]

Comparing order mix results by format shows divergent trends. Supermarkets’ order mix still skews slightly toward delivery, which accounted for 49.3 percent of the format’s orders in 2Q 2024. However, pickup has continued to gain order share as more supermarkets introduce the service, capturing an additional 700 bps of share since Q2 2021 and finishing the most recent quarter with 47.5 percent.

Meanwhile, the opposite trend is occurring in the mass order mix, as the dominant method continues to be pickup, accounting for 51.8 percent of the orders but with a significant shift toward delivery. This is fueled in large part by Walmart’s increased focus on driving more volume through its first-party services and reliance on first-party distribution for delivery orders.

Looking at repeat intent levels segmented by format and receiving methods shows how Walmart’s strategic shift likely contributed to mass’ stronger performance. The gap in repeat intent rates for delivery services between supermarkets and mass expanded 120 bps versus last year, giving mass over an 11-point advantage. For pickup services, mass enjoys a 15-point gap versus supermarkets, but that gap narrowed by 60 bps in the latest quarter compared to a year ago.

“Regional grocers can safeguard their online business by targeting budget-conscious households with a convenient, seamless and personalized digital experience,” said Mark Fairhurst, chief growth officer at Mercatus. “This includes boosting loyalty with points, discounts and exclusive deals; highlighting unique products and offering bundled deals for savings; and using targeted promotional campaigns like ‘Journey to Five’ to encourage repeat online purchases.”

The competitive pressures on supermarkets don’t appear to be letting up as an increasing share of its current online customers are also buying groceries from mass online. The share of supermarket customers who also shopped with mass during the quarter rose 370 bps, reaching more than 32 percent in 2Q 2024 with roughly one in five doing so with Walmart. This gain was fueled by increased dual usage within the middle two income groups ($50-$99K and $100-$199K) while both the lowest (>$50K) and highest income ($200K+) groups decreased cross-shopping versus last year.

About this report and analysis

The U.S. eGrocery Market Share Report – 2Q24 is a quarterly report created by Brick Meets Click and sponsored by Mercatus. The report is designed to help grocery retailers and their suppliers understand the how the eGrocery market is shifting by providing market share estimates across several retail formats (supermarkets, mass, hard discount, etc.) and receiving methods (delivery, pickup and ship-to-home) over a three-year period, running between April 2021 and June 2024.