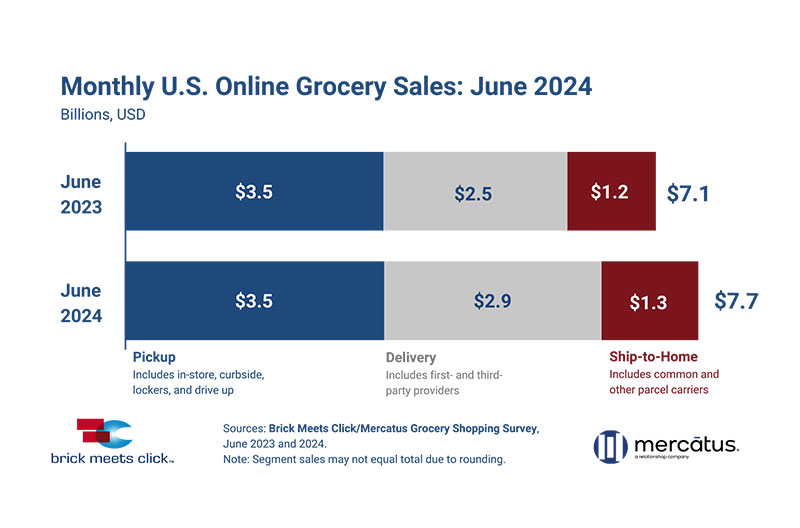

The U.S. online grocery market finished June with $7.7 billion in monthly sales, an 8 percent increase over last year. Delivery sales surged after aggressive promotions last month, ship-to-home posted strong results due to increased spending per order and pickup held steady year-over-year, according to the Brick Meets Click/Mercatus Grocery Shopper Survey, fielded June 30-31.

During June, delivery sales jumped to $2.9 billion, up 18 percent compared to a year ago. The gain was driven by surges in the monthly active user (MAU) base and higher order activity, although the average order value (AOV) fell.

The month’s strong performance enabled delivery to gain 325 basis points (bps) versus last year, capturing 38 percent of online grocery sales for June.

“Delivery’s strong performance in June likely benefited from the promotional offers made last month, first by Instacart and then by Walmart,” said David Bishop, partner at Brick Meets Click. “These promotions focused on delivery and offered deep discounts on each service’s annual membership fees, which helped boost both MAUs and order frequency for Delivery and for Walmart.”

The month’s pickup sales of $3.5 billion remained unchanged on a year-over-year basis even though the MAU base for pickup expanded in the mid-single digit range.

A combination of slightly lower AOV and a decline in order frequency offset the positive effects of a larger MAU base. As a result, pickup’s share of online grocer sales fell 352 bps on a year-over-year basis to finish at 45 percent in June, but it remains the share leader.

Ship-to-home sales climbed nearly 10 percent versus last year to $1.3 billion for June, marking its fourth straight month of year-over-year sales gains. Higher AOVs drove the sales lift despite a 1 percent contraction in its MAU base and a dip in order frequency. Ship-to-Home finished June with nearly 17 percent of online grocery sales, up 26 bps compared to a year ago.

[RELATED: June Online Grocery Sales Slip From Last Year]

The overall eGrocery MAU base expanded nearly 4 percent versus last June, driven almost entirely by reactivating lapsed users. In contrast, the total pool of households that have ever bought groceries online grew just 14 bps over the same period.

The gap between these two measures highlights the fact that the increase in customers during June is largely due to less-frequent users making another order or lapsed customers giving the service another chance.

Cross-shopping rates for June remained elevated as nearly one in three customers bought online from grocery and mass formats during the past month.

The share of grocery customers (which includes both supermarkets and hard discounters) that also received an online grocery order from a mass retailer in June finished at 31.6 percent. The share of grocery customers who received online orders from Walmart reached nearly 22 percent, up 150 bps versus last year.

June’s overall repeat intent rates (a measure of the likelihood that a customer will complete another online order in the next 30 days with the eGrocery service used most recently) dropped nearly seven percentage points, to 56 percent compared to last year.

The lower overall rate is concerning because the year-over-year drop was driven by the most frequent users of a given service – those who completed 4 or more orders during the past three months.

This frequent-user cohort, which represents about half of the online customer base, posted a nearly 10-point drop versus last June. Another concerning trend is that grocery’s repeat intent rate dropped by twice as much as the mass repeat intent rate on a yearly basis.

In terms of where households report buying most of their groceries, whether in-store or online, the mass format expanded its share by about 190 bps, to 42 percent in June versus last year, while the supermarket format dipped 250 bps, to 39 percent.

Most of the share shift was the result of an uptick in households with annual incomes under $50,000 doing their grocery shopping primarily at a mass retailer.

“Regional grocers need to stem the tide and regain market share by leveling the playing field against mass merchants, despite these rivals having a price advantage,” said Mark Fairhurst, chief growth officer at Mercatus.

“Integrating personalized and targeted promotions into their first-party platform experience will be key to re-engaging lapsed customers and improving repeat purchase rates. Additionally, incorporating high-level, in-store customer service into the digital experience – a strength that regionals are known for – will be crucial and can give them an advantage over their mass competitors.”