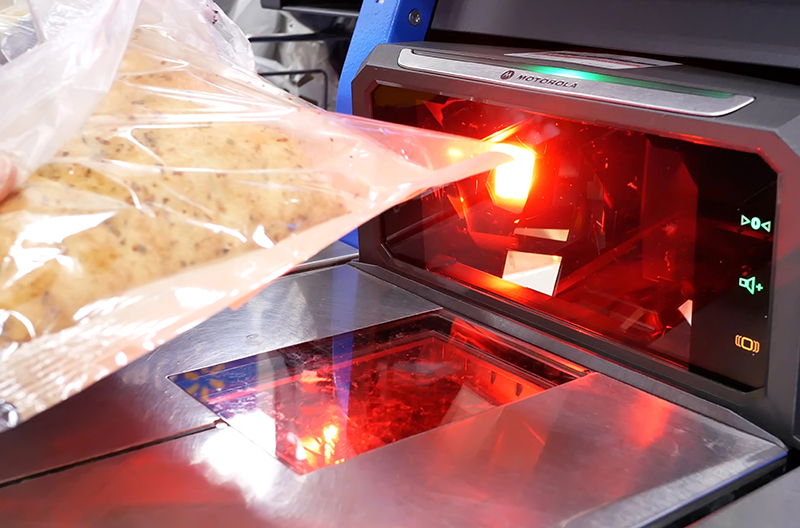

Self-checkout continues to gain traction in grocery, with 43 percent of consumers expressing a preference for it over traditional checkout, according to a recent report from NCR Voyix Corp.

The company’s first Digital Commerce Index found that the preference gap is reflected in the projected growth of self-checkout installations. RBR Data Services’ Global EPOS and Self-Checkout 2023 study forecasts 450,000 installations in the U.S. in 2028, up from 280,000 in 2022.

A generational snapshot of responses from the survey – which explores how dining, grocery and fuel convenience purchase behaviors are changing among U.S. consumers – indicates that 53 percent of younger shoppers (ages 18 to 44) prefer self-checkout. Of those consumers who do, speed, shorter lines and privacy are the most important factors.

Shoppers ages 45 to 60 prefer traditional checkout, but the top reason behind their choice is that they often have many products and may find a regular lane less time consuming.

“Self-checkout is evolving to offer a quicker and more user-friendly experience,” said CEO David Wilkinson of NCR Voyix.

“The reality is shoppers want more control over their checkout experience and self-checkout delivers that flexibility. For retailers, self-checkout enhances operational efficiency in a time when many are struggling to retain staff and are combatting unprecedented levels of shrink.”

In-store sweeps online grocery shopping

While online grocery shopping may be more convenient for those who don’t have time to shop in person, two-thirds of survey respondents prefer to shop in-store.

Challenges such as out-of-stock items (62 percent), incorrect deliveries (52 percent) or unfulfilled orders (38 percent) contribute to poor online ordering experiences. Nearly two in five respondents (37 percent) said they abandoned an online order due to high service fees.

Some consumers also prefer to hand-select specific items like produce (59 percent) or meat (51 percent).

Inflation, tech power more comparison shopping

With inflation driving higher grocery prices, 74 percent of consumers surveyed have changed how they shop.

Most are looking for less expensive items (56 percent), buying less overall (49 percent) or making a more deliberate decision to shop where they find the best deals (46 percent).

Consumers rely on technology to navigate smarter ways to shop. When asked how technology has changed their shopping experiences, consumers cited the ability to compare prices more frequently, research products before purchasing and use more digital payment options.

Tipping tiffs

In the restaurant industry, consumers want the best customer service – but the surge in tipping prompts may be pushing them the wrong way. Thirty-six percent reported that they don’t like tipping prompts and therefore don’t tip at all.

Loyalty

As with grocery shopping, inflation has impacted consumer restaurant dining habits. Forty-eight percent said they dine out less because of higher prices. More than half (58 percent) have boughta meal at a gas station one or more times in a year.

Although some consumers may be slowing down on traditional dining out, they still want to keep up with their favorite restaurants and access deals. Signing up for a loyalty rewards program, downloading a restaurant’s app and receiving email updates are among the top three actions consumers have taken.

Patrons go direct

Eager to stay in the know and gain access to special deals and rewards, half of consumers prefer to use a restaurant’s app or website to place their orders, while 23 percent prefer to call ahead.

Consumers cite their top reasons for going to the app or website for order and delivery as convenience, ability to customize orders and lower or no service fees.

Future of restaurants

As consumers look to the future and consider new technology in restaurants, they hope to see customized digital menus personalized per diner, full meal vending machines and robot delivery service.

“The results are in, and it’s clear consumers want ease, speed and innovative experiences whether they are at the grocery checkout, gas pump or favorite restaurant,” Wilkinson said.

“As retailers and restaurants consider their technology investments for 2024, these consumer insights can help prioritize and deliver what consumers want.”

About the study

NCR Voyix is a global provider of digital commerce solutions for the retail, restaurant and banking industries. It commissioned a blind survey of U.S. consumers in November to understand how dining, grocery and fuel convenience purchase behaviors are changing. Respondents to the online survey included 1,133 American consumers.

Read more grocery store equipment news from The Shelby Report.