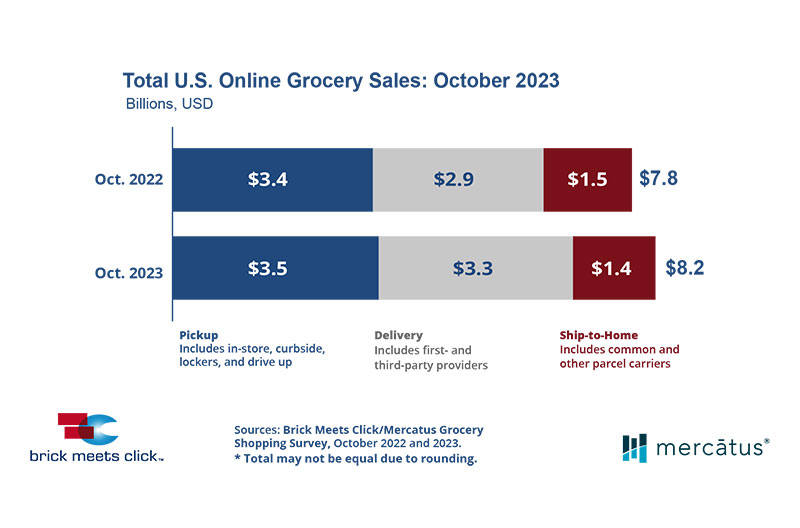

The U.S. online grocery market increased by 5 percent versus last year, ending October with $8.2 billion in sales, according to the latest monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded Oct. 30-31.

Higher average order values, especially in delivery, offset a slowdown in total order volume for the month. In addition, mass continued to experience gains in its monthly active user base, AOV and order frequency versus a year ago, illustrating how current financial conditions are likely affecting households’ online grocery shopping behaviors.

While the number of households receiving one or more online grocery orders during October was relatively unchanged versus a year ago, formats offering pickup and/or delivery performed better than those offering ship-to-home. Pickup expanded its MAU (monthly active user) base the most, climbing 6 percent, versus 2 percent for delivery, and ship-to-home contracted by 6 percent.

The mass MAU base surged, growing 29 percent on a year-over-year basis, continuing a “flight-to-value” type of shopping behavior which has been seen for the last several months.

Grocery’s MAU base also expanded during October, increasing 6 percent versus 2022. The over-60 age group was the largest contributor to the MAU growth for mass and grocery in October.

“The Mass format, and particularly Walmart, continues to attract a larger share of MAUs as U.S. households search for ways to save money,” said David Bishop, partner at Brick Meets Click.

“The share of MAUs who bought from Mass has grown over 11 percentage points since last year, finishing at more than 50 percent this October.”

The total number of e-grocery orders placed during October fell 3 percent versus last year, brought down by a drop in ship-to-home volume and a more modest dip in pickup orders. Delivery bucked the downward trend, growing in the month, fueled by stronger volume coming from mass.

Strong growth in the cross-shopping rate between mass and grocery (supermarkets plus hard discount) is another sign that many U.S. households may be attempting to economize.

In October, the percentage of customers who bought groceries online during the month set a record high, jumping 680 basis points compared to last year as more than 34 percent of grocery’s MAU base also shopped for groceries online with a mass retailer.

Although the composite repeat intent rate for pickup and delivery in October improved to about 62 percent, up 390 bps versus 2022, mass continued to outperform grocery. Mass finished the month with a nearly 10 point lead over grocery, expanding its lead by 220 bps versus 2022, driven by improvement in repeat intent rates related to delivery orders compared to last year.

“As today’s regional grocers focus on improving operational aspects of their online grocery services, they continue to face stiff headwinds from economic and competitive pressures,” said Sylvain Perrier, president and CEO, Mercatus.

“To mitigate these challenges, grocers should identify ways to differentiate their online shopping experience, such as highlighting private label products, amplifying personalization efforts and/or offering unique rewards and promotions that include product sampling.”

Online sales across all formats accounted for 12.5 percent of total weekly grocery spending during the last week of October, increasing 90 bps versus last year. The combined contribution of pickup and delivery, since most conventional supermarkets don’t offer ship-to-home, also grew 90 bps to finish the month at 10.3 percent.

Read more technology news from The Shelby Report.