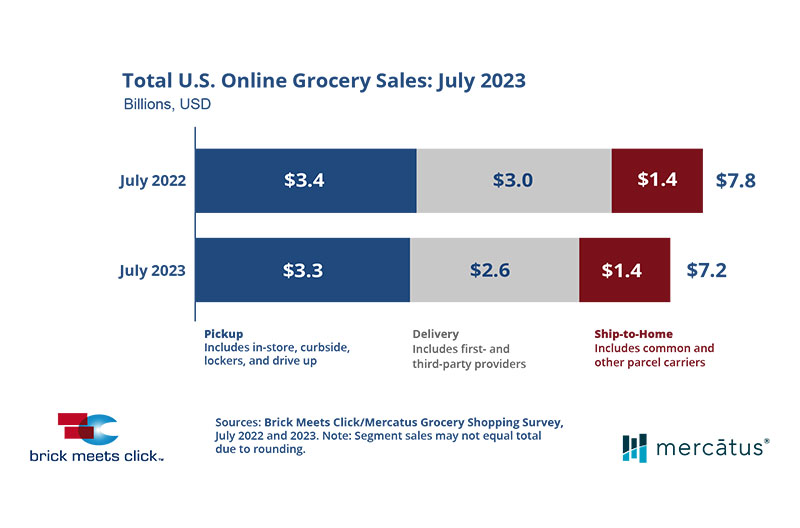

The U.S. online grocery market posted $7.2 billion in total sales, down 7 percent compared to last year, according to the latest Brick Meets Click/Mercatus Grocery Shopping Survey fielded July 29-30.

This month’s downtrend was evident across all three receiving methods, driven by a pullback in order frequency plus constrained spending, despite a larger base of monthly active users than the prior year.

For July, the overall monthly active users base continued to grow as the number of U.S. households that bought groceries online increased nearly 5 percent versus last year. This growth was driven by a more than 7 percent increase in the pickup monthly active user base, while ship-to-home’s base remained flat and delivery contracted 1 percent compared to July 2022.

Order frequency, which dropped 10 percent from last year, was the main contributor to the monthly sales decline, reducing the total number of online orders by nearly 6 percent for July. Delivery, which dropped 13 percent versus the prior year, accounted for about three-quarters of the drop in online orders.

Constrained spending in July was the other major factor impacting overall sales results. The average order value slipped about 1.5 percent versus July 2022.

“July’s results reflect the growing financial challenges many consumers are facing today,” said David Bishop, partner at Brick Meets Click.

“These challenges, along with evolving expectations, driven by experience engaging with mass, are contributing to the growing gap between conventional grocers and their mass rivals.”

The mass and grocery formats continue to perform differently. Mass experienced a surge in customers while grocery experienced only a modest gain in monthly active users during July, similar to the trend observed last month.

Order frequency also declined for both formats, although the drop for grocery was much greater than for mass. In addition, the average order value for grocery dipped by more than 5 percent, while mass finished up slightly.

Although the overall repeat intent rate of 63 percent was down just 50 basis points for July versus the prior year, the repeat intent rate for mass was nearly 18 points higher than for grocery.

The gap between the two widened by 730 bps, resulting in the largest gap since the surveys started tracking this metric in January 2021.

Much of the monthly gain for mass can be attributed to a strong improvement in its repeat intent rates for delivery. Mass also made slight gains in the already large gap it has historically enjoyed with pickup.

“To drive continued engagement, regional grocers need to offer their customers value for their money and more convenient ways they can save, such as encouraging repeat purchases with promotional offers and easy-to-use digital coupons,” said Sylvain Perrier, president and CEO, Mercatus.

“Loyalty programs should be thoughtfully integrated so that rewards are easily accessed and prominently positioned to remind customers of the monetary value they’re receiving.”

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on July 29-30 with 1,795 adults, 18 years and older, who participated in the household’s grocery shopping.

Check out the Brick Meets Click eGrocery Dashboard for July or visit the eMarket/eShopper page for additional insights and information about the full report.

Read more technology news from The Shelby Report.