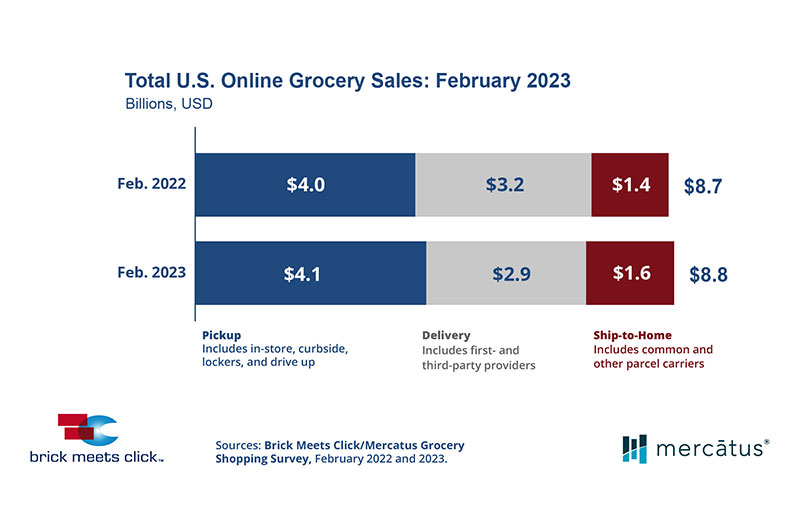

The U.S. online grocery market finished last month with $8.8 billion in total sales, up 1.5 percent compared to last year, according to the monthly Brick Meets Click/Mercatus Grocery shopping survey fielded Feb. 26-27.

Excluding ship-to-home sales, the core online segments of delivery and pickup slipped 1.2 percent compared to last year, reflecting a drop of 9 percent in delivery sales and a gain of nearly 5 percent for pickup during the month.

The year-over-year growth in online sales was partly driven by an increase in monthly active users, which climbed more than 5 percent in February compared to the same period in 2022. This marks the second straight year-over-year expansion of the user base as it grew more than 10 percent between February 2021 and February 2022.

“The expanding user base for online grocery illustrates its growing reach, but the changing role it plays is evident from contractions in the use of multiple receiving methods and average order frequency, which mostly muted the gains in reach,” said David Bishop, partner, Brick Meets Click.

The research showed that more U.S. households used only one of the three receiving methods for online orders in February, jumping nearly 8 percentage points versus last year and returning to levels similar to February 2021, which hovered around 72 percent.

In addition, the number of orders completed by MAUs fell to its lowest level since the onset of the pandemic in March 2020, finishing the month at 2.49 and down almost 9 percent on a year-over-year basis. While all three receiving methods experienced this downtrend to some degree, delivery posted the largest and most dramatic drop in order frequency.

Looking at specific formats, mass continued to attract more customers on a year-over-year basis while grocery contracted again. In February, the mass MAU base surged more than 20 percent versus 2022 after a similar surge last month. In contrast, the grocery MAU base contracted in the mid-to-upper single digits for at least the second straight month.

“The changes in the mass and grocery user bases illustrate what could be characterized as a ‘flight to value’ as shoppers deal with persistently higher grocery prices,” Bishop said. “Another sign of inflation’s impact on…ordering patterns is the continued growth that pickup has experienced over the last few months while delivery has encountered a pullback in users.”

For February, the likelihood that a customer will use the same service within the next 30 days finished at nearly 65 percent, an improvement of over two percentage points compared to last year and nearly seven points higher than February 2021. Even so, repeat intent rates among first-time customers has declined each February since 2021, highlighting a continued opportunity to better retain new customers.

Online’s share of total grocery spending fell 30 basis points to 12.9 percent in February. Excluding ship-to-home, since most conventional supermarkets don’t offer it, the adjusted contribution from pickup and delivery dropped 60 basis points and finished at 10.5 percent for the month.

“Given that ongoing price inflation is clearly influencing shopping behaviors, grocers should promote ways customers can save more money,” said Sylvain Perrier, president and CEO, Mercatus.

“Grocery retailers can consider highlighting store brands, offering pricing promotions, creating personalized digital coupons, and implementing variable fee structures that lower fees for customers and reduce the cost to assemble.”

For additional insights and information about the full report, visit the eMarket/eShopper page.