Dunnhumby has released its sixth annual Retailer Preference Index, a nationwide study that examines the U.S. grocery market.

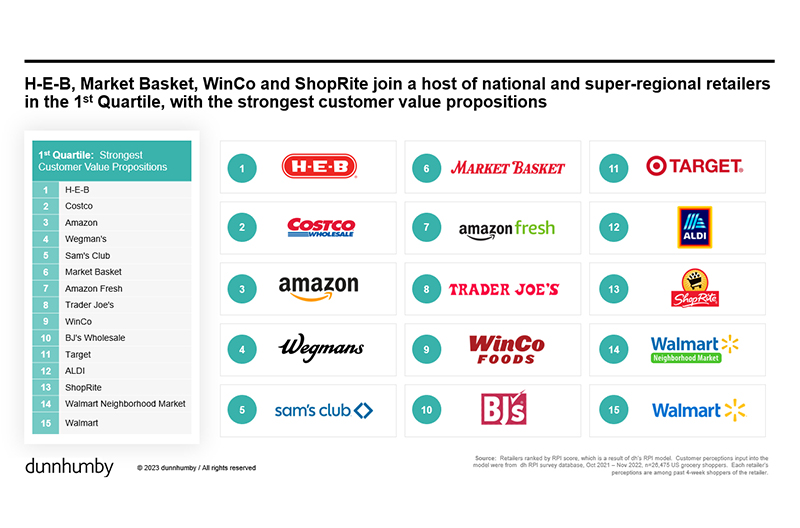

Three years after the COVID-19 pandemic upturned the grocery industry, H-E-B has regained its leadership position from Amazon, with Costco following behind in second place. Amazon fell to third while Wegmans took the fourth spot for the third year in a row.

The 11 additional retailers with the highest overall customer preference index scores are: Sam’s Club, Market Basket, Amazon Fresh, Trader Joes, Winco, BJ’s Wholesale, Target, Aldi, Shoprite, Walmart Neighborhood Market and Walmart.

“In 2017, we set out on a journey to understand how customers’ preferences and retailers’ financial results predicted which retailers would last,” said Matt O’Grady, dunnhumby’s president of the America’s.

“But little did we know that in the ensuing six years consumers and retailers would have a lifetime of difficulties including a pandemic that shook consumer behavior and the global economy, a prolonged period of supply change struggles, and a once-in-a-generation inflation crisis. We believe this report can serve as a blueprint to help grocers improve their competitive positions, while providing key findings for marketing and consumer preferences.”

The dunnhumby RPI ranks grocers that combines financial results with customer perception. The financial data used in the dunnhumby model comes from Edge Ascential, and the customer perception data is sourced from dunnhumby’s annual survey of 10,000 American grocery shoppers that was conducted in November.

In addition, dunnhumby analyzed survey data from an additional 20,000 consumers surveyed in October 2021 (10,000 consumers) and May (10,000 consumers) and combined that data with the November survey (10,000 consumers) to understand the five drivers of the value proposition: No. 1: price, promotions, and rewards, No. 2: speed and convenience, No. 3 quality, No. 4 digital and No. 5: operations.

Key findings from the study:

- Over the six-year history of the U.S. Grocery RPI, there has been a battle between the top retailers. In 2020 and 2021, the pandemic helped propel and solidify Amazon as the top grocery retailer over H-E-B, Trader Joe’s and Wegmans. But in 2022, H-E-B reclaimed the top spot due to its ability to deliver a combination of better savings and better-quality experience/assortment.

- Digital is no longer as important to driving short-term retailer momentum as it was from 2020-21. The pandemic increased the percentage of Americans shopping online for groceries from 39-50 percent of the country and, despite record inflation, more than half of those people remained online grocery shoppers in 2022. As a result, there are 9.4 million more omnichannel households today than there were in 2019 with a combined grocery budget of $4.9 billion.

- Fifty-two percent of customers of first quartile retailers reported they have an easy online shopping experience, an increase of 13 percent from 2019. The top six retailers for digital are No. 1: Amazon, No. 2: Amazon Fresh, No. 3: Target, No. 4: Sam’s Club, No. 5: Walmart and No. 6: Walmart Neighborhood Market.

- Club stores are gaining momentum with three of the top 10 spots in the first quartile now occupied by club stores. Costco, Sam’s Club and BJ’s Wholesale achieved a high rank through a combination of top-notch dependability and saving customers money while delivering a seamless experience. In dunnhumby’s 2019 RPI, no club store ranked higher than seventh.

- BJ’s Wholesale was the biggest mover in the RPI over the last three years, climbing from 27th place to 10th place in 2022, a 17 -point jump in rankings. Schnucks climbed 16 spots and sits in the second quartile overall. Other big ranking movers not in the first quartile overall but improving were: Food Lion, Food4Less/FoodsCo, Weis and Food City.

The full RPI report can be accessed here.