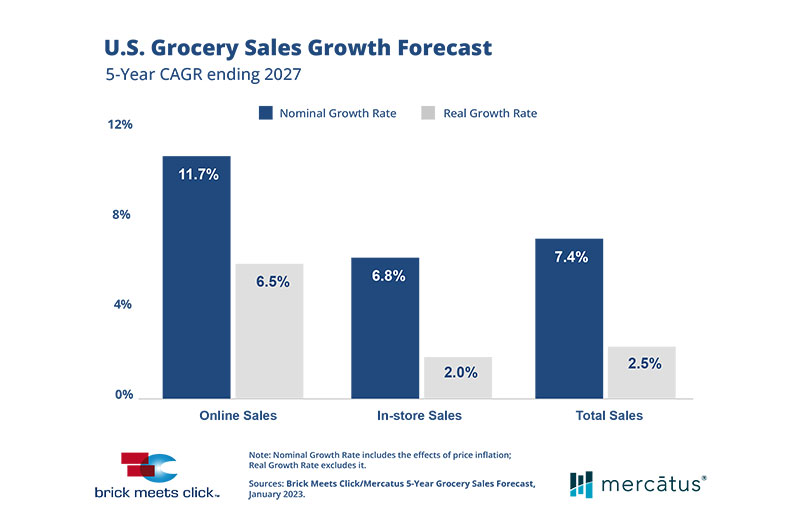

U.S. online grocery sales are forecast to grow at a compound average growth rate of 11.7 percent over the next five years, increasing online’s share of overall grocery spending from 11.2 percent in 2022 to 13.6 percent in 2027, according to the 2023 Brick Meets Click/Mercatus Five-Year Grocery Sales Forecast.

Persistent price inflation, ongoing concerns about illnesses such as COVID, RSV and the flu and a maturing online segment are factors contributing to the outlook.

“This forecast reflects that the projected growth of online grocery sales is slowing after the significant gains of the last two-plus years,” said David Bishop, partner at Brick Meets Click. “Now more than ever, grocers need a grounded view of the future market while simultaneously strengthening the customer experience to protect their base business and improving the profitability of this higher cost-to-serve mode of shopping.”

Total grocery sales, i.e., combined online and in-store sales, excluding the impact of price inflation, are projected to grow at a 2.5 percent CAGR over the next five years, driven by an approximately 1.7 percent increase in household spending and 0.8 percent gain in the number of households. An aging population and declining household size are weighing down both measures.

Persistent grocery-related inflation is expected to continue at a 5-year CAGR of 4.8 percent, starting from 2022’s rate of 10.9 percent versus the prior year and tapering down to 2.8 percent by 2027. The impact of this ongoing price inflation is not evenly distributed. Inflation fuels nearly three-quarters of the projected gains for in-store sales but accounts for less than half of the gains expected for online sales.

Health concerns drive the demand for online grocery to some degree, which is likely to continue. Concerns about contracting COVID-19 motivate about 10 percent of online grocery’s monthly active users, according to the October Brick Meets Click/Mercatus Grocery Shopping Survey. The recent rise of other respiratory illnesses, such as RSV and the seasonal flu, is also motivating customers to shop online for groceries.

“When it comes to achieving online channel profitability, my advice to grocery retailers is: work smarter, not harder, and focus on the fundamentals,” said Sylvain Perrier, president and CEO, Mercatus.

“Know who your customers are and the value you provide them. Use that insight to deliver a more personalized brand experience that is consistent and frictionless. Take steps to improve margins using simple tactics like offering lower cost pickup services, engaging with multiple third-party delivery providers, and leveraging first-party retail media to offset the cost to serve online customers.”

Visit the Brick Meets Click website for more insights from the forecast and information about the 2023 U.S. eGrocery Market Forecast report.