FMI – The Food Industry Association has released the first in a six-part “2022 U.S. Grocery Shopper Trends” series conducted in partnership with The Hartman Group Inc.

The series is designed to explore food shoppers’ journeys and behaviors. Expanding on this annual report, the first analysis focuses on the shopper landscape and finds Americans are balancing a mix of concerns, including their health and safety as it relates to COVID-19, higher food prices and out-of-stocks.

“As of mid-February, shoppers tell us they have the lowest level of concern about COVID-19 since the pandemic began,” said Leslie Sarasin, president and CEO of FMI. “However, while shoppers’ concerns about contracting the virus have subsided compared to a year ago, their expressed anxiety regarding food prices has returned to similar levels witnessed during the summer of 2020. Further exacerbating this stress, Americans’ frustration regarding out-of-stocks has not abated.”

Concerns for COVID-19, inflation and out-of-stocks

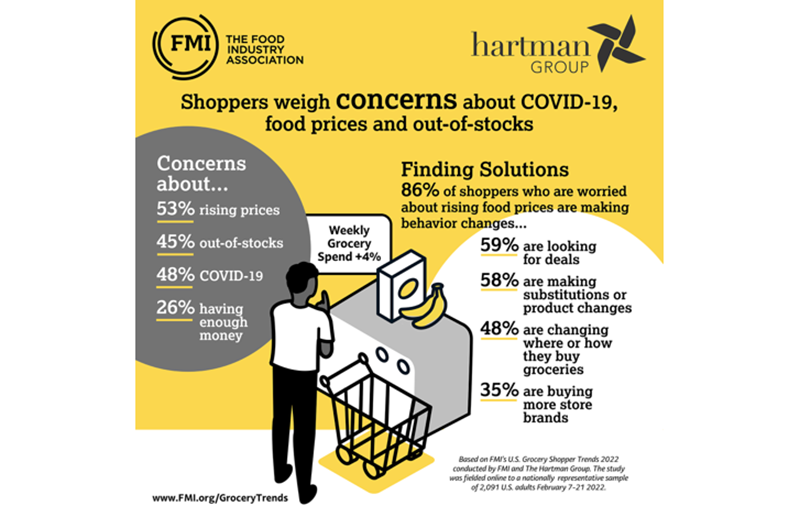

As of mid-February, 48 percent of shoppers report being extremely or very concerned with COVID-19, which is the lowest level of concern measured since the pandemic began but down only slightly from October 2021. At the same time, more than half of Americans cite their worries about rising food prices, and 45 percent are concerned about out-of-stocks.

Consumers report their weekly grocery spending has gone up by 4 percent compared to early last year and 72 percent of those who have noted increased spending point to rising prices on specific items or brands as the cause of the increase.

Shoppers seek solutions to mitigate rising food prices

Eighty-six percent of shoppers who are worried about rising food prices are making behavior changes, including 59 percent who were looking for deals, 58 percent who were making substitutions or product changes, 48 percent who were changing where or how they buy groceries or the 35 percent who were buying more store brands. Notably, shoppers continue to use and rely on many of the go-to grocery stores and grocery shopping methods they adopted during the pandemic.

2022 Trends Series

FMI’s 2022 U.S. Grocery Shopper Trends includes a series of six-monthly analyses to provide ongoing context for the food shopper’s journey.

Each report will be posted online and users can sign up to be notified when the next report is available.

U.S. Grocery Shopper Trends 2022 Report Schedule:

- April – Shopper Landscape

- May – Shopping Trends 2022

- June – Navigating a Hybrid World

- July – Future Outlook

- August – Back to School

- October – Holiday Shopping

As the food industry association, FMI works with and on behalf of the entire industry to advance a safer, healthier and more efficient consumer food supply chain. FMI brings together a wide range of members across the value chain – from retailers that sell to consumers, to producers that supply food and other products, as well as the wide variety of companies providing critical services – to amplify the collective work of the industry.

For more information, visit FMI.org.

For more association news from The Shelby Report, click here.