Jacksonville, Florida-based Southeastern Grocers (SEG), parent company of Bi-Lo, Fresco y Más, Harveys Supermarket and Winn-Dixie stores, has entered into an agreement with creditors to restructure its debt through a prepackaged Chapter 11 bankruptcy filing.

The agreement will give unsecured note holders ownership of the company by canceling the notes and exchanging them for equity in the company, reports the Jax Daily Record. The company is currently controlled by private equity firm Lone Star Funds. A company news release said the “holder” of its existing equity would receive a “five-year warrant and certain global settlement consideration,” without giving more details or naming Lone Star.

SEG says it will continue operating throughout this process, but 94 of its nearly 700 stores will close.

“Southeastern Grocers has conducted a thorough review of options for reducing our current debt. Taking this step was critical to our future and the long-term health of our business,” the company said in a statement. “After careful consideration, we have chosen to voluntarily implement a court-supervised, prepackaged restructuring agreement. We have not taken these steps without careful planning and consideration. As part of this restructuring, we have made the difficult but necessary decision to close 94 underperforming stores. It is our goal to work through our financial restructuring as quickly and efficiently as possible, and we will emerge from this process likely within the next 90 days. We will continue to thrive with 582 successful stores in operation and will continue to deliver a store experience our associates, customers and communities can count on.”

Southeastern said it will file its Chapter 11 petitions in U.S. Bankruptcy Court for the District of Delaware by the end of March. It expects to emerge out of bankruptcy within 90 days. Southeastern did not say how much debt is involved but ratings agency Moody’s Investors Service said in November the company had $900 million in debt coming due in the next two years.

Anthony Hucker, president and CEO of SEG, said on March 15, “The agreement we announced today is an important step in Southeastern Grocers’ transformation to put our company in the best position to succeed in the extremely competitive retail market in which we do business. With a foundation built on iconic, heritage banners, and with the strong support of our leadership team, we will work through this process as quickly and efficiently as possible. We are excited to emerge with the optimal store footprint and greater financial flexibility to invest in Southeastern Grocers’ growth.”

SEG believes that the transactions proposed under the restructuring support agreement (RSA) will strengthen the company’s balance sheet. The restructuring will decrease overall debt levels by more than $500 million and maintain the company’s liquidity position under the new post-emergence Revolving Credit Facility. The reduction in debt will result in reduced interest expense, allowing SEG to invest more cash flow back into the business in the form of increased capital expenditures for store remodels and new stores.

“Southeastern Grocers is faced with a critical milestone in its transformation, and we have made choices for our future and long-term growth potential,” said Hucker. “We conducted a thorough review of our strategic options and determined that this financial restructuring is in the best interests of our associates, customers, supplier partners and the communities in which we serve. Southeastern Grocers is a strong, viable business and is building momentum with robust performance and new store concepts that resonate with our associates, customers and communities. This course of action enables us to continue writing the story for our company and our iconic, heritage banners in the Southeast.”

Under the terms of the proposed restructuring:

- SEG’s outstanding secured debt obligations, including its secured notes and the 2014 revolving credit facility, will be paid in full.

- The company has secured 100 percent committed exit financing in the form of a senior secured six-year term loan facility in the original principal amount of $525 million and an asset-based lending (ABL) revolving credit facility.

- Holders of general unsecured claims, including supplier partners, contract counterparties, and all other trade creditors will receive payment in full on account of existing obligations in the ordinary course of business.

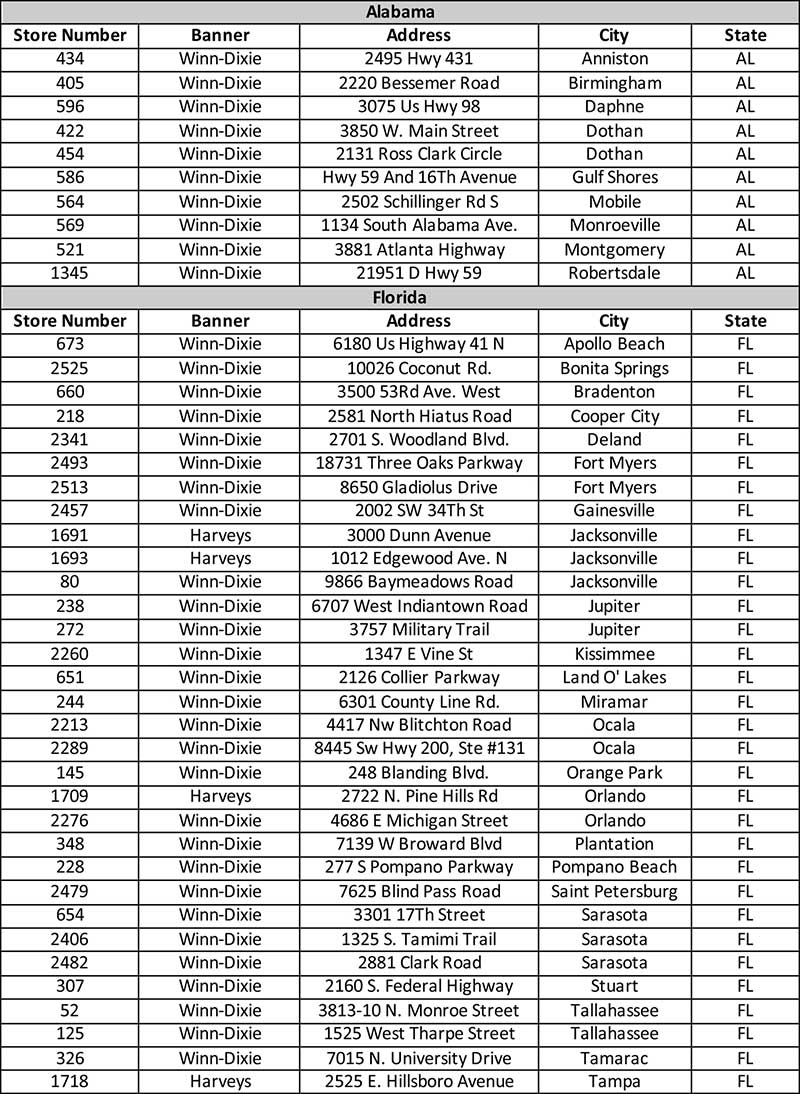

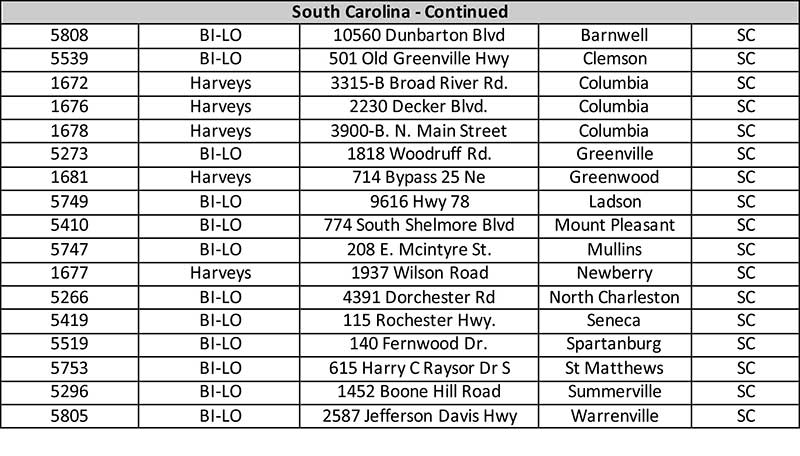

- 582 stores will continue to operate throughout the Company’s footprint. 94 stores will close, many of which will have their related leases rejected and lease rejection claims rendered unimpaired. A full list of stores closing is available at www.segrocers.com/restructuring.

Additional information about SEG’s restructuring efforts is available here.

See the full list of stores that are closing:

Keep reading:

https://www.theshelbyreport.com/2017/11/29/southeastern-grocers-800k-feeding-america-donation/

Southeastern Grocers Honors Vets, Military With ‘All For Honor’ Campaign

Southeastern Grocers Takes Home Five 2017 World Dairy Expo Awards