The Feedback Group has released its latest national study of 1,230 online grocery shoppers, sharing key findings in consumer habits, channel performance and areas for improvement in the experience.

The research confirms that online grocery shopping is entrenched in consumer behavior, with 79 percent of shoppers planning to maintain or increase it over the next year.

In addition, the study highlights a shift in how consumers receive their orders. Delivery (52 percent) surpassed pickup (48 percent), a signal that shoppers continue to prioritize convenience.

Another finding: nearly half (48 percent) of respondents say they are spending more of their grocery budget online than they did last year. At the same time, 90 perce also shop at a physical food store.

Setting standard for online shopping satisfaction

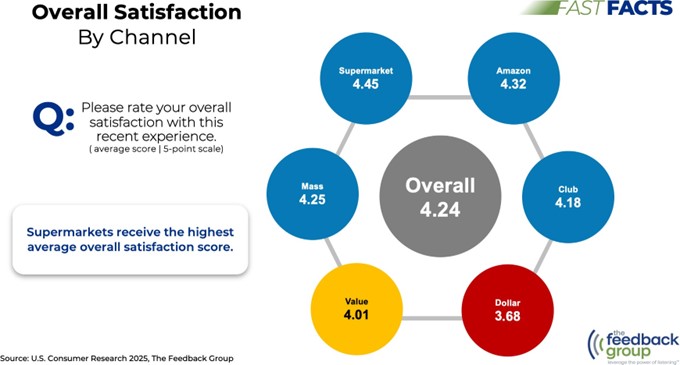

When rating their most recent online shopping experience, consumers gave supermarkets the highest satisfaction score (4.45 on a five-point scale), ahead of other channels such as Amazon (4.32), mass retailers (4.25), club stores (4.18), value retailers (4.01) and dollar stores (3.68).

“Supermarkets continue to lead the way in online grocery satisfaction, demonstrating strong execution in convenience, fulfillment and service,” said Brian Numainville, principal at The Feedback Group. “As a channel, supermarket investments in e-commerce capabilities have clearly paid off, but there’s still room for improvement.”

Older shoppers continue to be more satisfied with online grocery shopping than younger generations. Boomers (4.36) rated their experience highest, followed by Gen X (4.26), while Millennials (4.16) and Gen Z shoppers (4.05) were less satisfied.

This generational divide suggests that younger shoppers, who are more accustomed to digital experiences across industries, may have higher expectations for online grocery services.

Retailers should focus on personalization and enhanced usability to better cater to Millennials and Gen Z.

Technology’s role expands

Retailers looking to stay ahead should take note of shifting consumer preferences for artificial intelligence-driven shopping features and voice technology:

- Nineteen percent of online grocery shoppers used AI-powered features such as chatbots and smart shopping lists in their most recent orders.

- Forty-six percent of shoppers said they would be interested in using voice commands to add items to their carts if their online grocery provider offered the feature.

“Shoppers are gradually becoming more comfortable with AI-powered tools, and the demand for voice shopping capabilities is growing,” Numainville said. “Retailers who integrate these technologies thoughtfully can enhance convenience and drive stronger customer loyalty.”

Key challenges

While consumers appreciate the convenience of online shopping, product availability, order accuracy and confidence in fresh department quality remain major pain points:

- Thirty percent of shoppers did not receive all the items they ordered, with 11 percent stating they still wound up needing something.

- Confidence in fresh produce quality lags behind other grocery categories, with 73 percent of shoppers expressing confidence in the quality of produce ordered online, and produce is also the category with the highest percentage of falling short of the highest quality standard.

“Consumers rely on online grocery shopping for convenience, but when key items are missing or fresh produce quality falls short, it erodes trust,” said Doug Madenberg, chief listening officer at The Feedback Group. “Retailers must enhance inventory accuracy and quality control, particularly in fresh categories, to deliver a more reliable and satisfying experience.”

[RELATED: December Online Grocery Sales Climb 19% Versus Last Year]

Consumers would pay more

The study also revealed consumer preferences that online retailers can capitalize on:

- Forty-four percent of shoppers would pay an extra fee for guaranteed two-hour delivery.

- Twenty-five percent of shoppers said sustainable/recyclable packaging is important for their online orders.

- Fifty percent of shoppers noticed new items while shopping online.

These insights suggest shoppers value speed, sustainability and product discovery – areas where retailers can create differentiation and justify premium service tiers.