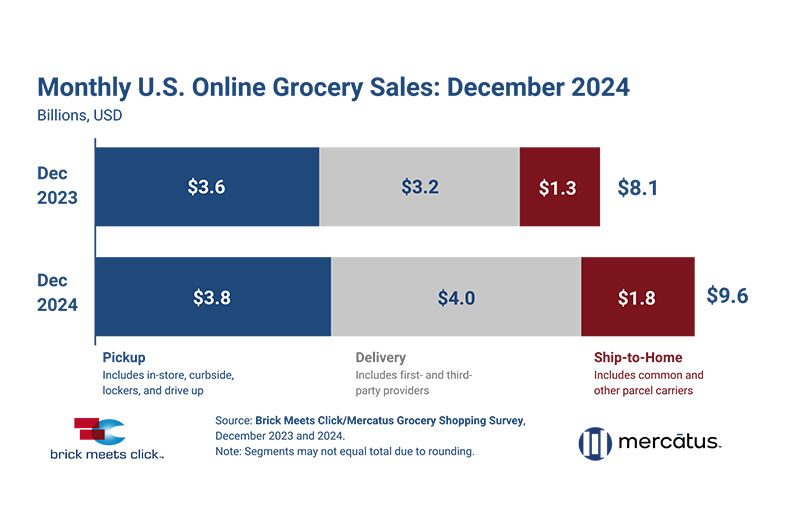

The U.S. online grocery market ended December with $9.6 billion in monthly sales, an 18.7 percent increase over last year, as all three fulfillment methods posted year-over-year (YOY) sales gains, according to the Brick Meets Click/Mercatus grocery shopper survey fielded Dec. 30-31.

December marks the fifth straight month of online grocery sales above $9.5 billion and caps off a year that reflected two periods – before and after the appearance of discounted promotions on subscriptions and/or membership programs.

Overall online grocery sales during the first half of 2024 were basically flat, posting a 0.3 percent gain versus the same time period in 2023. However, during the second of 2024, online grocer sales surged 17.7 percent YOY, driving annual sales up 9.1 percent versus 2023.

All three receiving methods reported similar shifts in their sales performance between the first and second half of the year.

Delivery’s growth rate increased from less than 4 percent in the first half of 2024 to more than 25 percent in the second half. Ship-to-home’s growth rate also jumped, increasing from 5 percent to about 20 percent between the two periods. And pickup, which declined 4 percent during the January-June period, posted a nearly 8 percent gain during the latter half of the year.

The main difference between the two periods was the broad presence and aggressive promotion of annual subscriptions or memberships that began in mid-year and have continued off and on since then. Discounts, ranging from 33 percent to 80 percent, were seen from a variety of marketplace providers and mass retailers, plus national and regional supermarkets.

“While subscriptions and memberships aren’t new, the deep discounts were new, and they resonated with customers by offering the opportunity for significant savings,” said David Bishop, partner at Brick Meets Click.

“As a result, customers are more vested in their provider of choice, motivating many to place more orders which helps those providers to gain a larger share of the grocery wallet and improve engagement and retention rates.”

[RELATED: November Online Grocery Sales Reach $9.6B, Climb 18% From 2023]

Looking at the monthly sales results for December, each receiving method posted YOY gains, reversing the sales decline that all three reported in the prior year.

Delivery grew 24.6 percent YOY in December to $4 billion, accounting for 41.7 percent of total online grocery sales, up from 39.8 percent last year.

Pickup monthly sales climbed 5.3 percent YOY to $3.8 billion, as it ceded 500 basis points of share versus last year and finished with 39.4 percent.

Ship-to-home sales surged 40 percent YOY to $1.8 billion, contributing 18.9 percent of total online grocery sales, up from 15.9 percent in December 2023.

Grocery operators continue to face increasing challenges to online growth, particularly given the competition from mass retailers. In terms of penetration, more than half of all monthly active users (MAUs) completed one or more online grocery orders with a mass retailer during December, while about one-third of MAUs completed at least one online order with a grocery operator.

“Regional grocers looking to boost [online grocery] sales should focus on delivering real savings and targeted loyalty perks,” said Mark Fairhurst, chief growth marketing officer at Mercatus.

“By leveraging AI-driven personalization and integrated loyalty solutions, grocers can convert occasional shoppers into loyal digital customers, driving repeat orders and larger baskets across both online and in-store channels, to fuel sustained growth.”

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by the team at Brick Meets Click and sponsored by Mercatus.