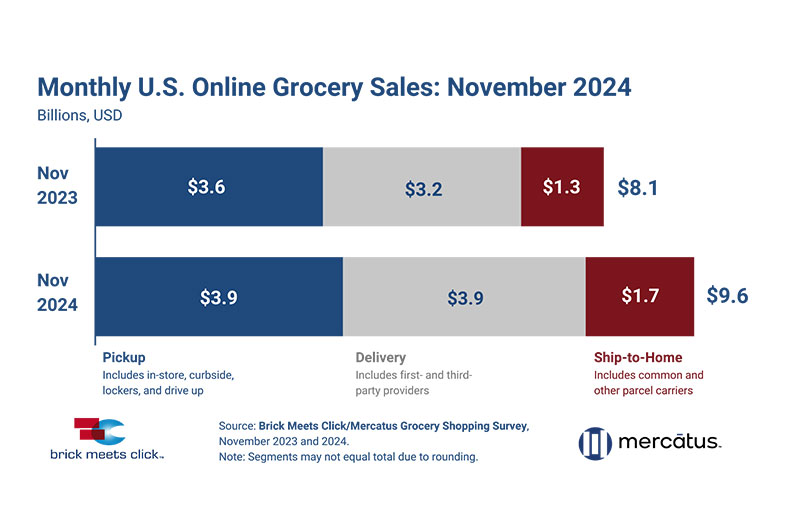

The U.S. online grocery market ended November with $9.6 billion in monthly sales, a 17.8 percent increase over last year, as all three fulfillment methods posted year-over-year sales gains, according to the Brick Meets Click/Mercatus Grocery Shopper Survey fielded Nov. 29-30.

The survey found the uptick was powered by strong expansion of the monthly active user (MAU) base as order frequency rates inched up and overall spending per order remained unchanged versus last year.

The overall MAU base, which includes households that used any of the three fulfillment methods during November, surged 15 percent, the second strongest YOY percentage change since August 2021.

The new record of 77.8 million households that bought groceries online in November broke the previous record high set during April 2020, the first full month of the COVID-19 pandemic. During November, 72 percent of overall MAUs used only one fulfillment method, up more than 400 basis points (bps) versus 2023.

Delivery sales jumped to $3.9 billion, up 22 percent compared to a year ago, accounting for 40.6 percent of all online grocery sales. An 8 percent increase in the MAU base and higher order activity led to the surge in sales, while the average order value (AOV) remained flat versus last year.

Delivery results for November extend the segment’s strong growth trend that began in June 2024, fueled by the waves of deep-discounted offers on membership and subscription programs from various retailers and providers that started appearing in May.

Pickup posted $3.9 billion in sales, an 8 percent YOY increase, ending the month with 41.3 percent of total online grocery sales. A 9 percent expansion of pickup’s MAU base drove order volume gains despite a slight contraction in order frequency. AOV fell by about 4.5 percent compared to 2023, due mainly to a pullback among the youngest household group (18–29-year-olds).

Ship-to-home continued to reclaim lost share after bottoming out during 2022, as sales jumped to $1.7 billion in November, up more than 30 percent YOY to end the month with 18.1 percent of online sales. According to the survey, the MAU base for ship-to-home expanded at the fastest rate of all three fulfillment methods in November, increasing more than 11 percent.

A slight increase in order frequency, combined with the rapid MAU growth, aided in generating a strong surge in order volume. And, the nearly 12 percent lift in AOV suggests that other factors, like product mix, may have played a role in November’s results.

[RELATED: 2023 November Online Grocery Sales Up 5% From 2022]

“Supermarkets experienced a significant surge in their MAU base, benefiting from widespread and deep discounts on membership and subscription programs offered by both national and regional grocers throughout November,” said David Bishop, partner at Brick Meets Click. “And while that’s a positive sign for supermarkets, the race to retain customers and grow share-of-wallet with them is only intensifying among rivals.”

Customer satisfaction with eGrocery services climbed in November as the overall repeat intent rate reached 65.2 percent, the highest score on the survey in the last four years and the third highest since the onset of COVID in March 2020. The gain was driven largely by a more than five percentage point increase in the share of MAUs who have completed four or more orders with a specific service within the last three months. More than 80 percent of this user group indicated that they are very/extremely likely to reuse the same service within the next month, compared to under 30 percent in the first-time user group.

In terms of customer loyalty, the survey found supermarkets made gains with the households that rely on them as their primary grocery store. Nearly 56 percent of those households that were active online in November also ordered online from their primary store, almost a 7-percentage point gain versus last year. Despite the gains for supermarkets, households that rely on a mass retailer as their primary grocery store are at least 30 percent more likely to order groceries online from mass compared to supermarkets.

“Driving larger orders and fostering repeat purchases requires creating a more personalized and seamless online grocery shopping experience,” said Mark Fairhurst, chief growth officer at Mercatus.

“By offering tailored product recommendations based on customer preferences and lifestyles, alongside easy-to-use rewards programs and intuitive navigation, grocers can strengthen customer loyalty, build trust and sustain long-term growth in the online grocery space.”

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by the team at Brick Meets Click and sponsored by Mercatus.

Brick Meets Click conducted the survey with 1,704 adults, 18 years and older, who participated in the household’s grocery shopping, and a similar survey in November 2023. Results are adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, according to the U.S. Census Bureau.