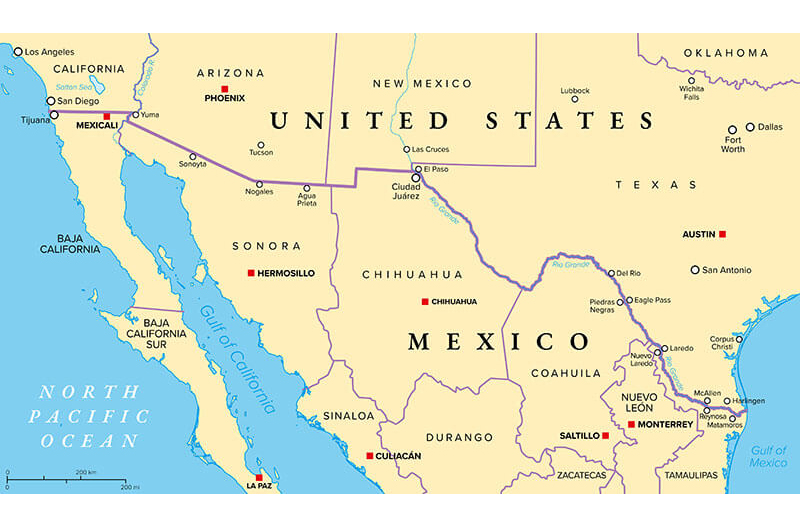

The United States-Mexico border stretches for more than 1,254 miles, the longest international border in the continental U.S. But it’s not just a physical line – it’s a vital economic artery, pumping billions of dollars in trade between Texas and Mexico. While binational trade relations between the two countries have historically been strong, the U.S.-Mexico-Canada Agreement (USMCA) implemented in 2020 further invigorated this partnership.

Some have gone so far as to say that it has revolutionized the trade landscape between Texas and Mexico in the past four years, creating a dynamic business environment for companies and residents on both sides of the border.

According to the U.S. Census Bureau, during the first six months of 2023, U.S. trade with Mexico increased 2.4 percent. Between 2019 and 2021, bilateral trade value surged 28 percent, reaching $515 billion.

Experts attribute this growth spurt largely to the USMCA, which streamlined customs procedures and reduced tariffs. A recent Market Edge report highlighted the positive changes driven by this shift in global supply chains.

“The USMCA replaced NAFTA and is playing a critical role in growth being seen. The agreement’s provisions incentivize trade by simplifying processes and lowering costs,” said Steve Triolet, SVP of research and market forecasting at Partners Real Estate, the group that published the report.

[RELATED: Driving Produce Sales As Parents Prepare For 2024-25 School Year]

Economic powerhouse

Trade is now the cornerstone of the economies in Texas and Mexico. More than 10 percent of Texas’ GDP hinges on trade, underlining its role in driving economic growth. The benefits also extend to employment on both sides of the border, with estimates indicating more than 400,000 Texans are employed in trade-related jobs.

As a result, border cities such as Brownsville, El Paso, Laredo and McAllen have witnessed economic transformation. A 2024 study by the Federal Reserve Bank of Dallas found that trade has been a major driver of economic growth in Texas border regions, with employment and per capita income in these areas more than tripling in the past decade.

Produce industry seeing direct benefits

According to data shared by the Texas International Produce Association, fresh produce imports from Mexico have led to the creation of more than 268,560 jobs across Texas, New Mexico, California and Arizona, with an economic output of nearly $40.8 billion.

The amount of fresh produce Texas imports from Mexico has increased dramatically, from four billion pounds in 2007 to 13.6 billion pounds in 2023. This means that U.S. grocers have benefited by not only seeing a wider diversity of fresh fruits and vegetables, but they also have more product available throughout the year, according to Dante Galeazzi, president and CEO of TIPA.

“This allows retailers to offer more fresh produce items consistently year-round, giving the U.S. consumer nearly limitless access, where only a few years earlier consumers were bound to the constraints of the domestic seasons,” he said.

Moreover, retailers near the U.S.-Mexico border have been able to realize a huge savings on freight. It also enables them to order smaller quantities more frequently, which ensures the produce on the shelves is always fresh, Galeazzi noted.

“Plus, when retailers combine domestic production from the state alongside the imports, it gives them access to hundreds of different commodities all year around,” he said.

“Independent grocers with a good understanding of the market can move more swiftly to drop items that have quickly increasing price rates and instead focus on commodities with economic value opportunities. Put another way, independent grocers are going to be better situated to capitalize on produce items that have an overabundance in supply and transition to ‘high volume, low dollar sales’ in order to take advantage of such situations.”

Rise of nearshoring

Another trend shaping border trade is the rise of nearshoring. This is evident in the surging demand for industrial space in and around Texas border cities.

“Laredo is home to one of the busiest U.S./Mexico land ports, facilitating $25 billion in trade per month, or nearly 60 percent of all annual trade between the two countries,” said Scott Senese, senior managing director, CBRE. “The region’s burgeoning industrial market benefits from near-shored manufacturing operations in Monterrey and other major Mexican markets within a two-hour drive.

“Laredo continues to see record demand and low vacancy rates for industrial space. Many developers are completing speculative bulk warehouse and distribution projects to support growing demand across the region,” Senese said.

The positive effects are not limited to Texas. Mexican border states Chihuahua and Nuevo Leon also have seen a rise in employment opportunities.

Moreover, in the four years since it was implemented, the USMCA has not only boosted trade volumes and created jobs, but it has also shifted the balance of power. Notably, Mexico has overtaken China as the U.S.’s leading import source.

This shift is attributed to several factors, including the cost effectiveness of manufacturing in Mexico and a growing desire by U.S. companies to diversify their supply chains away from a single source.

The proximity to the U.S. market, coupled with a skilled workforce and lower production costs, makes Mexico an attractive proposition for businesses looking to streamline operations.

“The cost savings associated with manufacturing in Mexico are apparent, further incentivizing companies to maintain strong ties with Mexico,” Triolet said.

Analysts following border economics believe the USMCA has ushered in a new era of prosperity for Texas and Mexico. The agreement, coupled with the Lone Star State’s strategic location and business-friendly environment, has fostered a dynamic trade environment that is anticipated to benefit businesses and residents on both sides of the border for years to come.