Online grocery sales continued their strong pace in May, powered by lower prices and an influx of new online food shoppers, according to e-commerce sales data from Signifyd.

Overall, grocery spending was up 30 percent year over year in May, according to Signifyd’s monthly E-Commerce Pulse data report. That far outstrips inflation and indicates that consumers’ robust spending in grocery has not let up. Together the trends may point to the long-discussed, post-COVID-19 pandemic “new normal.”

E-commerce sales in the grocery category, which include curbside pickup, surged during the pandemic. But now that the concern about in-person shopping has passed, there is no sign the category will go back to online sales remotely close to pre-pandemic levels.

“Grocery sales have remained consistently strong throughout the year – up 23 percent overall,” said Phelim Killough, Signifyd’s data analyst, who prepares its monthly Pulse report.

“This is being heavily driven by an increase in order count – and we found these orders are coming from a significantly higher number of online grocery shoppers than were buying online just a year ago.”

The evidence of a lasting transformation in grocery shopping can be found in Signifyd’s data through the first five months of the year.

Signifyd E-commerce Pulse data shows that since January:

- Online grocery sales are up 23 percent over the same period last year.

- The number of orders is up 31 percent over last year.

- The average value of each order is down 6 percent.

- The number of new online grocery shoppers is up 10 percent.

- Orders placed per shopper (as identified by a unique combination of digital signals) is up 19 percent.

- Home delivery orders grew by 25 percent while curbside pickup was up 21 percent.

The sales surge is happening as e-commerce inflation in grocery has flattened, down 0.1 percent from a year ago. That is compared to a year-over-year inflation rate that reached 6.7 percent in the grocery category in May 2023.

[RELATED: Online Grocery Sales Down Slightly Versus Last Year]

The numbers describe a growing group of shoppers who watch what they spend while turning to online ordering more frequently than a year ago. This trends mean retailers and brands need to approach pricing decisions strategically to appeal to the growing and increasingly price-sensitive market.

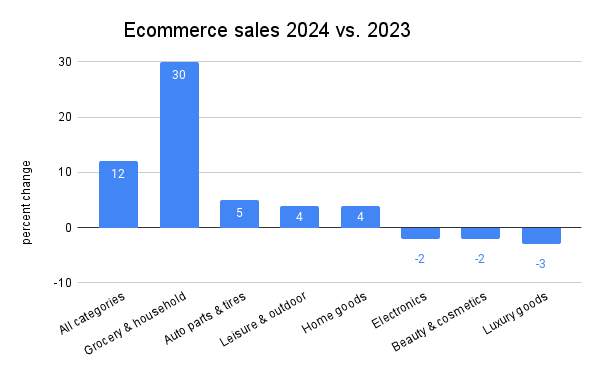

Overall, e-commerce sales for May were up 12 percent from a year ago, according to Signifyd Pulse data. Other popular categories, along with grocery, that saw gains included auto parts and tires, which were up 5 percent over May 2023. Home goods and leisure and outdoor were each up 4 percent. Luxury goods were down 3 percent. The beauty category and electronics were each down 2 percent annually.

Meanwhile, fraud pressure in May was up 35 percent from a year ago. Fraud pressure is a measure of the rise and fall of orders determined by Signifyd’s AI models to be risky and therefore likely fraudulent.

About the data

Signifyd’s E-Commerce Pulse data is derived from transactions on Signifyd’s Commerce Network of thousands of e-commerce retailers and brands. Commerce Network intelligence also powers Signifyd’s Commerce Protection Platform, which leverages AI-driven machine learning models and data from millions of transactions to detect and block fraudulent activity while increasing the number of good orders approved.