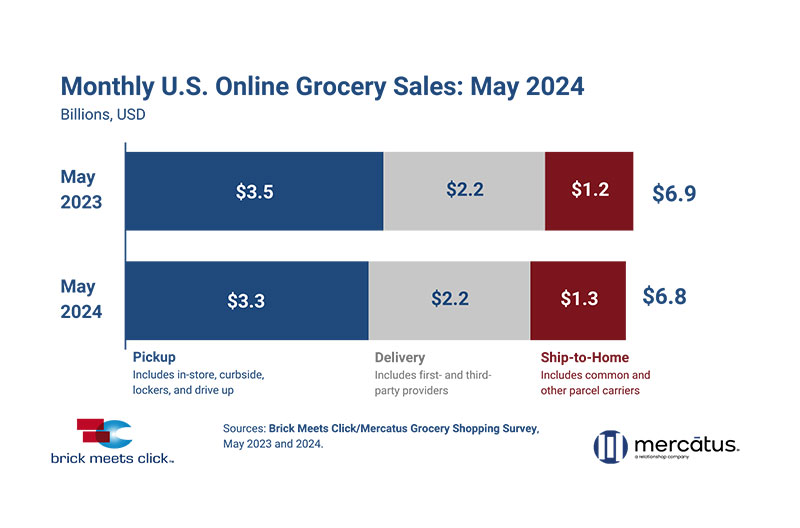

The U.S. online grocery market totaled $6.8 billion in sales for May, a 0.4 percent dip versus last year. Despite a year-over-year gain in overall monthly active users, sales growth was restrained by a pullback in order frequency across all receiving methods versus last year, according to the Brick Meets Click/Mercatus Grocery Shopper Survey, fielded May 30-31.

Pickup sales dropped 3.9 percent in May versus last year, despite an MAU base that grew by nearly 3 percent. What pulled down monthly sales results was a 6 percent decline in order frequency combined with a slight decline in AOV.

“During May, delivery benefited from deep discounts related to annual memberships offered first by Instacart (80 percent off) and later in the month by Walmart (50 percent off),” said David Bishop, partner at Brick Meets Click. “These promotions likely drove delivery’s strong jump in MAUs and show how players like Instacart and Walmart are attempting to keep active customers engaged by getting them to commit to 12 months instead of just one.”

[RELATED: Online Grocery Sales Decline 3.4 Percent In May Versus Year Ago]

The overall eGrocery MAU base rose over 3 percent on a year-over-year basis in May versus last year. However, the total pool of households that have ever bought groceries online grew just 15 bps during the month, indicating that the MAU growth was driven largely by lapsed users buying online again last month. The expanded MAU base was powered by gains in Amazon’s pure-play services and mass (across all three delivery methods) while the supermarket format’s online customer base contracted versus a year ago.

For May, cross-shopping remained elevated as three in 10 customers bought online from both grocery and mass during the past month. The share of grocery customers (which includes supermarkets and hard discounters) that also received an online grocery order from a mass retailer in May increased to 31.5 percent this year. Also, the cross-shop rate between grocery and Walmart climbed versus last year, reaching nearly 20 percent for May.

May’s repeat intent rates were down as the likelihood that a customer will complete another online order next month with the same grocery service used most recently fell over two percentage points to 57.8 percent, driven by a drop in repeat intent rates for the 30-44 age group, the heaviest users of these services. The grocery format fueled the overall decline as it dropped five percentage points while the mass format repeat intent rate remained essentially unchanged between May 2023 and 2024.

In terms of where households buy most of their groceries, whether in-store or online, mass retailers increased penetration on a year-over-year basis, growing 110 bps to finish the month at 39.7 percent. Meanwhile, supermarkets continued to hold the top spot with 41.1 percent despite losing 90 bps points since May last year.

“Customers appreciate the convenience of online grocery shopping, but they are increasingly looking for ways to save money as inflation has taken a toll on the household wallet,” said Mark Fairhurst, chief growth officer at Mercatus.

“While digital deals are a good start, it’s crucial to focus on more targeted, personalized, contextual offers based on past purchases, shopper profiles, preferences or search behavior to better engage and retain customers.”

About this research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus.

Brick Meets Click conducted the most recent survey on May 30-31 with 1,724 adults, 18 years and older, who participated in the household’s grocery shopping, and a similar survey in May 2023. Results are adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau.