Sponsored content

In Part I of the series, the data showed that there’s a mismatch between loyalty membership and loyalty behavior. Here in Part II, we take a closer look at those loyalty customers to explore what grocers can do to make super-users out of those infrequent loyalty members.

For any given grocer, there are two primary groups of people that exist within your orbit: your loyalty customers and everyone else.

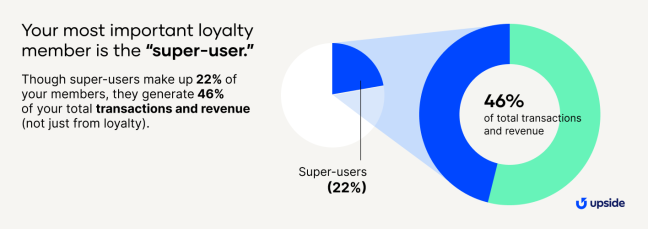

Digging a bit deeper, though, we quickly see that “loyalty customer” is an overly simplistic label. Within that group, there are two more distinct subgroups: loyalty “super-users” and everyone else. Your super-users are, well, pretty super — these are regular customers who do most (if not all) of their business at your locations.

Taking a weighted average across five large grocery retailers, loyalty super-users made up 22 percent of loyalty customers overall, but they generated nearly half (46 percent) of the retailers’ total transactions and revenue. These are model customers for whom loyalty programming is a really powerful tool.

But what about the nearly 80 percent of loyalty members who aren’t regulars? These customers behave a lot like your average customer. Using that same weighted average, we see that more than 60% of loyalty members are lapsed (not visiting at all) or infrequent (visiting fewer than twice a month).

Why is that the case, and how can grocers use this knowledge to achieve their lofty growth goals? To answer those questions, Upside conducted surveys and analyzed millions of transactions from loyalty and non-loyalty customers alike.

The big takeaway: When you look at your entire pool of loyalty participants (not just super-users), loyalty only marginally improves engagement and retention. Creating more of those super-users represents a huge opportunity for grocers.

The key metrics for long-term growth

In analyzing dozens of popular loyalty programs and retailers, we found many different measures of “success” — some focus on signups, some think about clicks and so on. Ultimately, our research determined that there are two key measures that dictate the long-term sustainability of a loyalty program: customer retention and visit frequency.

What might surprise you is that not all loyalty programs drive the necessary results in these key areas. Outside of the subset of loyalty super-users, we see that the majority of the loyalty member base is often unaffected by loyalty programing.

Key takeaway: Sign-ups are an imperfect success metric for loyalty programming, because most members don’t actively use their cards. Retention and frequency are two better indicators of success, although each is more difficult to achieve.

Key Metric No. 1: Retention

It’s just a fact of business, even for model brands: customers churn over time. Working to retain as many customers as possible is important because it’s cheaper to bring an existing customer back in-store than it is to acquire a new one; grocers should aim to maximize retention for cost-effective growth.

Even when we look at loyalty members alone, it’s clear that retention is difficult. Performance data from Upside grocery partners suggests that more than 50 percent of customers who join a loyalty program churn within 12 months of signup. Data from Antova’s 2024 Global Customer Loyalty Report supports that sentiment — among members who have enrolled in loyalty programs, more than 40 percent did not make any purchases in the previous year.

“Any way you slice it, a large portion of your loyalty members aren’t transacting at your locations at all,” said Dr. Thomas Weinandy, a research economist at Upside. “That should raise some eyebrows about the independent effectiveness of these programs.”

Top-performing grocers are not immune from churn, either. We tracked debit and credit transactions at two different Upside grocery partners from September 2021 to August 2022, then compared that shopping activity with transactions from September 2022 to August 2023. At one of these grocers, more than one third of loyalty customers either shopped less frequently than in the prior year or didn’t return to the grocer at all; at the other, nearly half of loyalty customers shopped less or not at all.

Key takeaway: Retaining existing customers is an important but difficult task, and loyalty programs only marginally improve retention.

Key Metric No. 2: Frequency

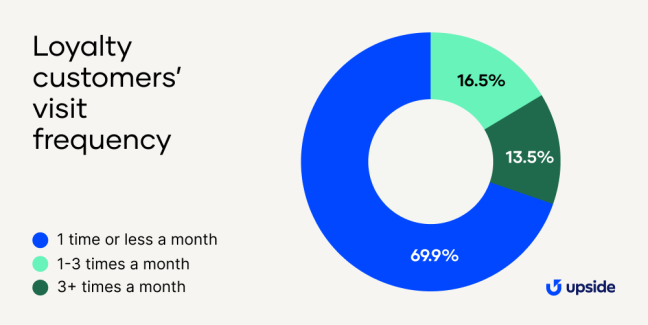

While it’s inevitable that some customers regularly churn from any retail location, you might presume that loyalty members are “loyal” and shop most often at your stores. The data shows otherwise. Instead, we find that 70 percent of customers already in a loyalty program behave like most non-loyalty customers, only shopping once a month or less.

Let’s visualize frequency by taking a closer look at the debit and credit transactions made at some of Upside’s top-performing grocery partners.

Transactions per month for loyalty customers are broken down by frequency; even among loyalty shoppers, nearly 70 percent of them transact just once a month or less. They are, by definition, not showing the retailer much loyalty. That means for a significant portion of loyalty members, loyalty programming isn’t able to catalyze the change in behavior that grocers hope for.

How much additional growth could grocers drive for their business if all these infrequent loyalty members looked more like super-users?

Key takeaway: Most grocery loyalty members transact once per month or less. There’s a big opportunity to win more of those trips from these members.

Turning loyalty customers into super-users

The key to creating super-users out of average loyalty members is to give customers a reason to behave differently. In order to drive long-term customer behavior change, grocers first need to base “success” on outcomes, not just sign-ups. And in order to drive the right outcomes, they need to prioritize:

- True personalization. Segmentation, which breaks down a population in small groups based on standard demographic information, doesn’t go far enough. Personalization allows you to influence one individual at a time by meeting their unique value points without impacting sales expected to take place anyway.

- Relevance. Creating real behavior change requires interacting with consumers at their moment of need, with the right selection, using the right medium.

- Reach. Moving beyond your physical location and on-site marketing, successful grocers employ strategies that can be scaled to thousands (or even millions) of frequent customers.

Final takeaway: In order to drive long-term customer behavior change — turning average customers and infrequent loyalty members into super-users — grocers need to focus on creating the right outcomes. They can do that by personalizing their interactions with customers, making those interactions relevant, and doing so at scale.