Overall grocery sales in the U.S. are forecast to grow at a compound annual growth rate of 1.6 percent through 2028, much slower than the 5.6 percent posted over the five years ending in 2023, which were powered by the COVID-19 pandemic and price inflation.

This is among the key takeaways from a new report, U.S. eGrocery Sales Forecast: 2024-28, developed by Brick Meets Click and sponsored by Mercatus.

The study also found that while slower growth is expected for overall grocery sales, the online segment is projected to increase at a CAGR of 4.5 percent – more than three times faster than the 1.3 percent rate anticipated for the in-store segment over the next five years.

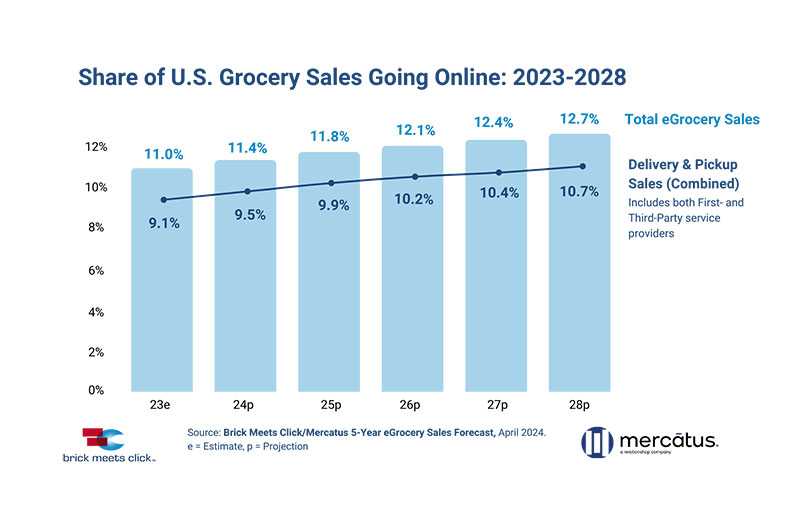

Total online sales – which includes delivery, pickup and ship-to-home – are projected to reach nearly $120 billion annually by the end of 2028. They will account for 12.7 percent of total grocery sales in the U.S., up 170 basis points versus 2023, the starting point for the five-year forecast.

Excluding ship-to-home, since most grocers do not offer the service, delivery and pickup sales combined will represent 10.7 percent of total grocery sales in five years.

“Two factors are creating significant headwinds that impact our eGrocery forecast. First, the market is maturing. Nearly all of the people interested in online grocery shopping have used it at least once by now,” said David Bishop, partner at Brick Meets Click.

“Second, even though inflation has recently fallen faster than expected, its cumulative effect continues to drive a flight-to-value behavior in grocery shopping and that will slow topline sales growth.”

For example, in the mass format, led by Walmart, online grocery has expanded its market share by 620 basis points since 2021, ending 2023 with 45.4 percent of online sales.

Per the report, continued share gains by mass will create further downward pressure on the topline as a comparable basket of groceries at Walmart (excluding charges, fees and tips) costs the customer 10- 20 percent less, depending on the rival supermarket banner.

Also, competing in a slower-growth online market likely will motivate more grocery retailers to focus on driving demand toward their first-party services to better control operating expenses and the customer experience.

Given that third-party marketplaces for supermarkets represented more than half of online sales on average in 2023, the report suggests this shift will create additional headwinds for sales growth as a basket of comparable groceries on the first-party platform costs on average 9 percent less than buying from the banner on a third-party marketplace (excluding charges, fees and tips).

Finally, according to the report, it is quite likely that third-party providers will find additional ways of reducing the product price gap with first-party sites to defend their base business, adding further disinflationary pressure on the topline measure.

Relative to the ways that customers receive online grocery orders, the report forecasts that pickup sales are expected to grow faster than delivery or ship-to-home through 2028. In addition, pickup is expected to remain the dominant method, accounting for about 47 percent of all online grocery sales at the end of five years.

Availability of pickup services continues to trail that of delivery in today’s market because most grocery retailers entered the online segment through delivery and third-party marketplaces.

The report shows that households in suburban markets have four times as many options to consider for delivery compared to pickup since most retailers are accessible through multiple third-party marketplaces. This distribution gap is expected to shrink by 2028 as retailers expand their pickup services, according to the report.

The forecast also identifies order frequency as the most important growth driver through 2028, as expanding the active user base will prove more challenging. In addition, building higher average order values will largely be the result of a customer mix that includes a higher share of repeat customers, who spend more compared to first-time customers.

“It’s clear that creating stronger connections with existing customers is essential to driving higher spending and order activity,” said Mark Fairhurst, global chief growth officer at Mercatus.

“Expanding personalization efforts to include targeted offers or tailored recommendations, will play a vital role in increasing repeat purchase behavior and eGrocery sales.”

About the report

The 2024 Brick Meets Click/Mercatus 5-Year eGrocery Sales Forecast is an annual initiative that projects how grocery sales are expected to change across in-store and online’s three segments.

The forecast is based on a proprietary model that uses Brick Meets Click research and insights, along with secondary sources from various government agencies.

Read more technology news from The Shelby Report.