Sponsored content

Increasing customer loyalty is a top priority for grocers. When asked, they consistently rate the following as their top priorities:

- Building brand affinity

- Increasing return visits

- Boosting customer lifetime value

During the pandemic, grocery retailers made forward-thinking pivots like differentiated digital experiences and special promotions that helped them win new and loyal customers.

Post-pandemic, the way forward for grocers is less clear. Inflation has been stubborn, and labor costs continue to rise, while supply chain disruptions have only narrowly improved. These intense pressures on your operations make cost control a top priority, so your loyalty investment decisions become even more important.

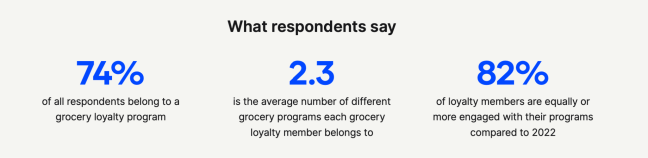

A survey of 1,900 consumers showed that today’s shoppers ARE hungry for value, and retailers are right to invest in loyalty. But just because a customer belongs to a given program doesn’t mean they’ll actually behave loyally.

Which leads us to question: is having a loyalty program alone enough?

Consumers are hungry for value

Of the 16 different retail categories listed in the survey, the category with the most loyalty participation was grocery, at 74 percent. The next closest was pharmacy, with 39 percent of those surveyed participating. Consider the size of that gap between the first- and second-most popular options.

As prices increase across the board, consumers want better bang for their buck, and they often turn to loyalty programs to find it. This makes sense—when consumers hear “loyalty,” they think “discount,” so these programs are likely to appeal.

Why do grocery shoppers join a loyalty program?

Of course, there are other reasons that consumers consider membership in a loyalty program. After discounts and pricing considerations, which are always top-of-mind, the survey shows that the top three factors for consumers considering grocery loyalty memberships are:

- Location: Can I shop conveniently?

- Item variety: Are there lots of reward opportunities within the categories I care about?

- Customer service: Does the retailer take care of me as a loyal shopper?

When it actually comes time to shop, more than half of consumers in a loyalty program say they make decisions about where to transact, which items to buy, and how much to buy based on that program and its related promotions. Even more, nearly 40 percent of loyalty members said they’d stop shopping at a given location if that store got rid of their program.

A deep dive on loyalty shopper engagement

Grocery perks appeal largely because food for the home is an inelastic purchase, but they might also attract consumers with a growing number of fuel partnerships that offer rewards for both brands on one membership.

Of those surveyed who participate in a grocery loyalty program, 79 percent said their program comes with associated fuel rewards – and two-thirds of all grocery loyalty members say that they use those fuel rewards.

Although more than half of grocery loyalty members recommended their program to someone they know, grocery had the highest percentage of members (45 percent) who didn’t recommend their programs.

The loyalty space race

Clearly, grocery shoppers say that they want loyalty programs. Additional data backs that up, showing that consumers added new loyalty programs to their wallets in 2023.

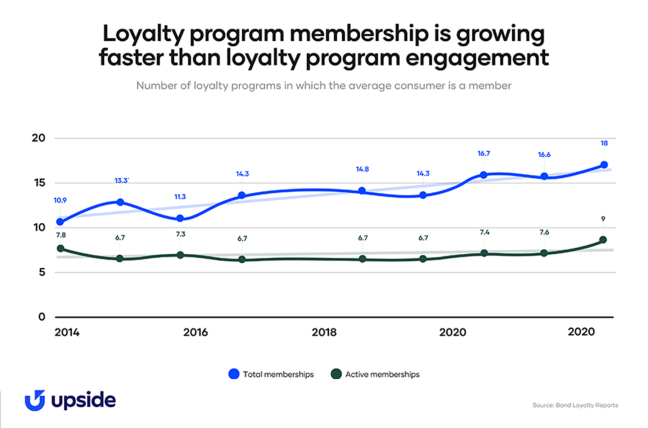

According to the 2023 Bond Loyalty Report, the loyalty space is more competitive than ever. In the United States, Bond reports that the average consumer claims membership in 18 loyalty programs, and that they actively participate in about half of those.

Consider how the space has changed in just a matter of years — in 2014, Bond reported that consumers belonged to about 11 programs; in 2020, that number was just above 14 programs. Based on those numbers, the average shopper has almost doubled the number of memberships in their wallet over the past decade. Furthermore, the Bond report shows that the rate of active engagement has been steadily increasing the past three years.

All of this data indicates investing in loyalty is a good idea, and those who have made the investment made the right choice. For retailers, loyalty is an incredible tool for engaging frequent customers and building a brand; consumers often choose to shop based on the existence or appeal of those programs.

The trick is that a traditional loyalty program isn’t enough on its own, because consumers aren’t just loyal to you.

Loyalty membership isn’t loyal behavior

Consider the flip side of the active engagement statistic — about half of the memberships in the average consumer’s wallet are inactive. Additional performance data from an Upside grocery partner suggests that more than 50 percent of customers who join a loyalty program churn within 12 months of signup.

Not only are these customers failing to exhibit loyal behavior, but they’ve completely stopped visiting your location altogether in just a matter of months. Said plainly, consumers join a lot of programs, but those programs don’t change behavior on their own.

What’s to blame for this mismatch in the loyalty program value proposition and the value they actually deliver?

It may just come down to the fact that loyalty programs aren’t all that different from one another. Try searching online for a list of the “best loyalty programs,” and peruse any of the hundreds of options. The publications lack any real consensus about what makes a program “the best,” since each list mentions different stores with similar perks.

Retailers are in an arms race: they continue to add perks such as free delivery or bigger buy-one-get-one savings to their programs, but those additions often overshadow any return on investment that loyalty programs might provide.

How can you make your loyalty members more loyal?

The question is: How do you make sure that your loyalty programming has the impact that you need it to have — changing customer behavior so you win more share of wallet — given the high costs associated with building and maintaining it?

More on that in another Shelby Report article.

Read more from The Shelby Report’s Industry Leaders.