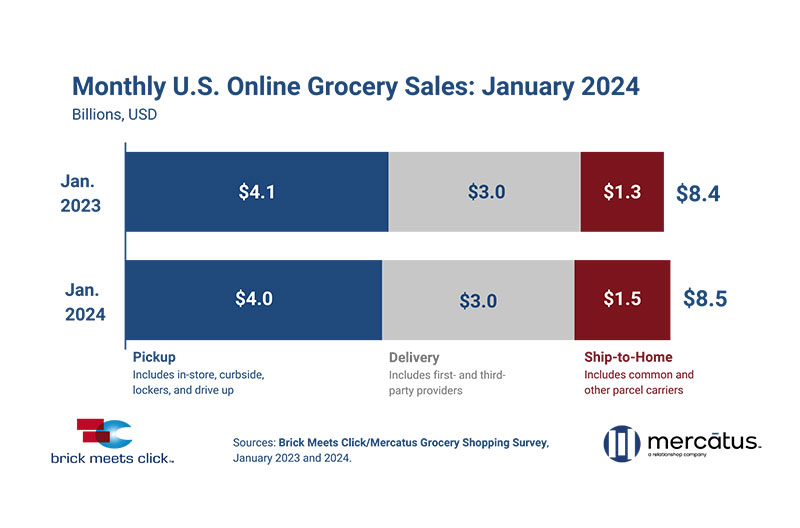

The U.S. online grocery market finished January with $8.5 billion in total sales, up 1.8 percent compared to 2023, according to the recent Brick Meets Click/Mercatus Grocery Shopper Survey.

Despite a jump in the number of households buying groceries online during the month, January’s overall sales growth was moderated year over year by a downward trend in order frequency and a composite average order value that was nearly flat compared to the prior year.

Ship-to-home was the only segment to grow year over year, as sales climbed to $1.5 billion in January, up 7.8 percent compared to a year ago. Higher order volume, driven by a surge in monthly active users and a more than 7 percent increase in AOV, helped the segment capture 224 additional basis points (bps), to end the month with 17.4 percent of total online grocery sales.

January’s delivery sales of $3 billion slipped, down 0.5 percent versus 2023, as the 3 percent growth in its AOV could not offset the larger decline in order volume. While the delivery MAU base expanded slightly, the gain was eclipsed by the decline in order frequency among MAUs. As a result, delivery’s share of eGrocery sales slipped 82 bps to 35.3 percent for the month.

Pickup remained in the top spot, but its sales fell 1.9 percent to $4 billion for January, mainly due to lower order frequency by MAUs and a 1.8 percent contraction in AOV, despite a moderate expansion of its MAU base. Pickup finished the month with 47.3 percent of online grocery sales, down 142 bps versus January 2023.

“When more than 10 percent of U.S. households have less money to spend on groceries this year than they did last year, changes in buying behavior are certainly expected,” said David Bishop, partner at Brick Meets Click.

“The reduction in SNAP payments that took effect at the end of February 2023 is one of the factors driving the flight-to-value trend, which we’ve observed and tracked since mid-2023.”

The mass format, led by Walmart, continued to outperform the broader market. In total, mass expanded its MAU base by nearly 10 percent while it also posted a healthy uptick in AOVs. And the growth in its MAU base more than compensated for flat year over year order frequency among customers.

In contrast, supermarkets endured ongoing headwinds as key performance indicators all struggled versus last year. The number of supermarket MAUs contracted by more than 5 percent, the average number of orders completed by MAUs during the month fell by a larger rate and the average dollars spent per order pulled back slightly.

Amazon’s pure-play online services, which account for the largest share of the ship-to-home segment, also saw improvements in performance compared to the prior year, but those need to be put into context. Given the large MAU drop Amazon experienced in January 2023, this month’s MAU surge was driven partially by easier comparable results. Overall, Amazon’s year-over-year MAU gains more than offset the drop in order frequency, and moderate AOV gains also helped drive its positive sales results.

“Competing online is only getting more challenging for regional grocers as customer expectations continue to increase,” said Mark Fairhurst, global chief growth officer at Mercatus.

“So, beyond improving key elements of the experience, like fill rates, wait time and product quality, regional grocers also need to work even harder to identify additional ways to help their customers save money.”

Online sales across all formats accounted for 13.4 percent of total weekly grocery spending during the last week of January, increasing 120 bps versus last year. The combined contribution of pickup and delivery, since most supermarkets do not ship to home, also grew 72 bps, to finish the month at 11.1 percent.

About this report

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by the team at Brick Meets Click and sponsored by Mercatus.

Brick Meets Click conducted the most recent survey on Jan. 30-31 with 1,745 adults who participated in the household’s grocery shopping and a similar survey in January 2023, with a sample of 1,735.

Read more technology news from The Shelby Report.