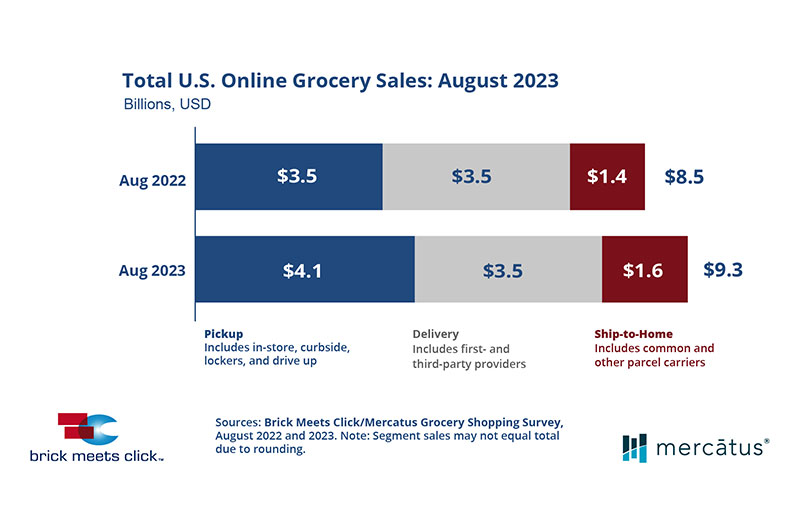

As many households engaged in back-to-school activities, online grocery sales in the U.S. grew 8.7 percent compared to last year, tallying $9.3 billion in sales, according to the latest monthly Brick Meets Click/Mercatus grocery shopping survey.

Household demand for pickup and ship-to-home was strong, while delivery experienced a slowdown in order volume and mass continued to attract many more customers than supermarkets.

Shopper interest in buying groceries online remained strong, as the August monthly active user base expanded nearly 5 percent compared to a year ago. This reflects households that completed one or more online orders received through pickup, delivery or ship-to-home.

Analyzing the respective MAU bases for each of the three methods showed that ship-to-home expanded by more than 9 percent and pickup increased by nearly 6 percent, while delivery was up less than 1 percent.

The total volume of online grocery orders placed during August grew 5 percent versus 2022, driven by the expansion of the MAU base rather than a change in order frequency by MAUs which was essentially flat versus last year.

Order volume growth was unevenly distributed. Delivery, the only method to post a decline in order volume, fell nearly 5 percent, while pickup and ship-to-home climbed 9 percent and 10 percent, respectively, compared to 2022.

The results also revealed that Amazon’s pure-play segments (e.g., marketplace, Subscribe & Save) contributed to ship-to-home’s strong performance as its order volume finished up more than 10 percent higher than last year.

“The combined average order value for all three fulfillment methods grew 3 percent versus the prior year in August, which is below the current rate of inflation for the wider variety of grocery-related products that regional grocers often sell and extends beyond the food-at-home category,” said David Bishop, partner at Brick Meets Click.

“For grocers, it is important to see the specific trends for each method as pickup posted the highest gain of 6 percent, followed by delivery, up 4 percent, and ship-to-home, up 3 percent, compared to a year ago.”

Driven by the uneven gains in MAU bases and AOV for each receiving method, there were shifts in online grocery sales across the market. Delivery lost sales share, ceding 360 basis points year-over-year to end August, with 38 percent of total eGrocery sales.

Pickup captured more than three-quarters of the share lost by delivery and finished with 45 percent of online grocery sales while ship-to-home claimed the remainder, ending with almost 18 percent.

Trends for the two formats with the largest MAU bases, mass and supermarket, continued to diverge from each other in two of three key performance indicators. The mass MAU base increased by nearly 20 percent in August while supermarkets contracted by more than 10 percent.

Similarly, order frequency for mass rose in the low single-digits but fell in the mid-single digits for supermarkets versus the prior year. AOV was the only metric where both mass and supermarkets reported comparable gains versus last year.

Cross-shopping rates between grocery (which includes supermarket and hard discount formats) and mass continued to climb, increasing 490 basis points versus last year to finish the month at 34 percent. This is the highest level of cross-shopping to date and more than twice that of pre-COVID levels recorded in August 2019.

The gap in repeat rates shrank in August as the share of grocery customers who indicated that they are extremely or very likely to use the same service next month improved nearly two points to 60 percent while mass remained relatively unchanged at 68 percent.

“Online customer loyalty is increasingly elusive, and grocers should focus on creating more seamless experiences that keep shoppers – especially the first timers coming back,” said Sylvain Perrier, president and CEO, Mercatus.

“By providing personalized recommendations and promotions, based on shopping history and personal preferences, grocers can strengthen connections with their customers that go beyond simply the transaction and increase the likelihood of repeat business.”

The share of spending that online captured in August versus the same period last year slipped 20 bps to 13.9 percent. Excluding ship-to-home, since most conventional supermarkets don’t offer it, the adjusted contribution from pickup and delivery finished at 11.5 percent, down 20 basis points compared to a year ago, due to delivery’s weaker performance during the month.

About the research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey Aug. 30-31, with 1,704 adults (18 years and older) participating in the household’s grocery shopping.

Read more technology news from The Shelby Report.