How are food retailers and suppliers reacting to inflation, as well as a myriad other challenges in this post-pandemic era? FMI–The Food Industry Association’s 74th annual The Food Retailing Industry Speaks report looks at what’s happening in the industry to better understand the issues, challenges and goals of its member companies in the industry as a whole.

The FMI Speaks report cited concerns over workforce challenges, inflation, supply chain hurdles, increasing competition and shifting consumer buying habits. It also reported companies are “investing in more creative and proactive approaches to future-proof their businesses.”

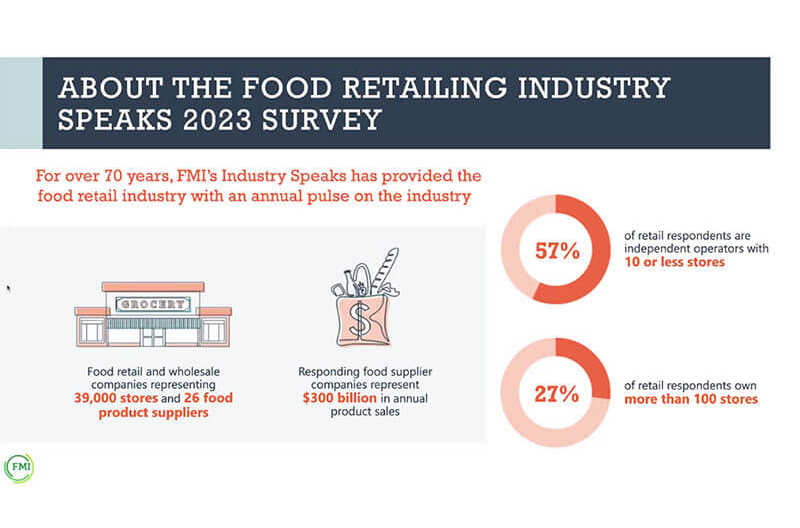

More than 100 food retailers, representing over 39,000 stores across the country, and 26 food suppliers, with more than $300 billion in food product sales, responded to the 2023 Speaks survey.

Inflation concerns

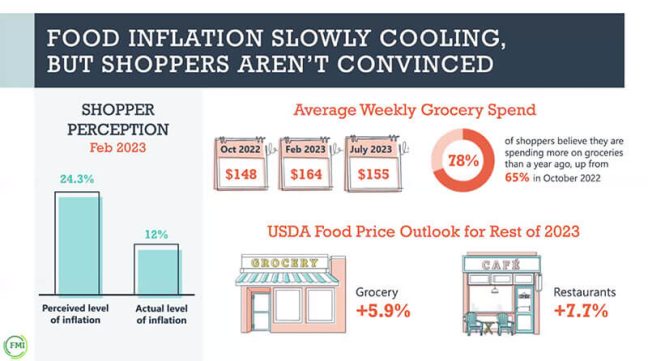

FMI President and CEO Leslie Sarasin noted that food inflation peaked a year ago at 15.7 percent, and prices have continued to level off, with June at 5.7 percent, according to recent CPI numbers. She also said consumer weekly spend on groceries has decreased, with July FMI shopper data reporting an average of $155 a week spent at the grocery store.

Despite the decrease in some food category prices since last July, Sarasin said a national FMI survey of 1,500 grocery shoppers in June showed 78 percent believe they are spending more on groceries than they did a year ago. This is an increase from the 65 percent reported in October 2022.

“It’s also important to note that while consumers have had to stretch their food dollars, shoppers have a somewhat distorted perception of the inflationary environment. A survey by dunnhumby conducted in February found that consumers’ perceived level of inflation was 24.3 percent, while the actual level of inflation at the time was 12 percent.”

FMI SVP of Industry Relations Mark Baum shared that both retailers and suppliers expect inflation will continue to pressure margins and increase operating costs for the remainder of the year.

Workforce, supply chain challenges

Sarasin addressed some of the strategies retailers and suppliers are implementing to battle persistent workforce and supply chain challenges, as noted in the FMI Speaks report. She said that while U.S. unemployment was at a historic low in December (3.5 percent), food retailers reported a record 65 percent employee turnover. Food suppliers reported turnover at 36 percent, driven primarily by their lower turnover rate for part-time employees.

“To address these challenges, retailers and suppliers continue to invest in technology for recruiting, training and skills development; employee wellness programs; hiring and retention incentives; and in strategic third-party partnerships to support teammate experiences. Additionally, retailers and suppliers say they’re focused on strategies to boost recruiting, hiring and retention,” Sarasin said.

About 91 percent of retailers reported providing increased wages and salaries for their full-time workers in 2022, and nearly 70 percent are offering improved benefits and flex time. To help with hiring and retaining part-time employees, 88 percent of retailers increased wages and salaries in 2022, and 77 percent offered flex time.

Suppliers also changed their approach in hiring and retaining part-time workers, with 82 percent increasing wages and 76 percent offering more flex time.

According to Sarasin, the industry is invested in training its workers, with those costs averaging nearly $500 per employee for food retailers and $1,400 for suppliers. Almost all food retailers and 100 percent of suppliers surveyed in the FMI Speaks report have in-house training and development programs, and a majority have purchased training programs from third-party vendors.

These costs are expected to increase further this year.

Baum said supply chain and trucking issues continue to pose challenges for the industry, as noted in the FMI Speaks report. Out-of-stock rates have been an ongoing concern for retailers and consumers alike.

“From a retail standpoint, distribution issues are one reason for higher out-of-stock rates, with an ongoing shortage of truck drivers…and order selectors at the root cause. From the supply side, supply chain disruptions continue to be prevalent due to scarce raw materials and higher prices for those commodities when they are available,” he said.

Baum said the good news is that these issues have been improving, and the overall outlook for supply chain disruptions is more positive.

Future-proofing operations

Retailers are navigating higher costs due to inflation by monitoring margin levels and finding ways to strategically reduce expenses. They are looking at cost rationalization in areas including services and assortments, and “many are negotiating the influence of cost increases to limit the impact on customers, when possible,” Sarasin said.

More efficiency initiatives to help relieve gross margin pressures and labor limitations are on the horizon. These include retailers reducing labor costs by outsourcing labor-intensive food preparation and adding solar power to lower electricity costs.

Suppliers are looking at capacity expansion and waste reduction efforts as strategies, along with investments in technologies to create efficiencies.

Technology is another tool for retailers and suppliers to leverage to improve operations and the customer experience.

“We like to say these days, if you’re not technology enabled, you’re competitively disadvantaged,” Baum said.

He noted that in 2022, retailers devoted an average of about 1.3 percent of total sales, more than $13 billion, in technology investments. Food suppliers spent about twice that much as a percentage of sales, about 2.4 percent.

They are becoming “somewhat optimistic about the impact these investments are having on their bottom lines, with maybe a shorter horizon for return on investment. They are leveraging technology to measure productivity and waste elimination. They’re looking to expand their capacity rapidly. They’re optimizing their product mix when necessary, and they are looking for breakout innovation,” he said.

On the food retail side, about 83 percent of those surveyed expect their technology expenses to increase in 2023, according to the FMI Speaks report. Baum said this technology focus encompasses a wide range of applications.

Since 2019, most food retailers have at least been experimenting with new technologies to improve customer service and efficiency, relieve margin pressure, shore up labor limitations and improve their e-commerce capabilities and capacity, he said.

“Additionally, one quarter of retailers and more than a third of their product suppliers are using artificial intelligence or AI to leverage customer data, tracking trends and product preferences, spending and ways to anticipate consumer wants and needs to improve sales and loyalty,” Baum said.

AI has been in the national news recently, and Baum said while it has been used by retailers and manufacturers for some time, he believes concerns center around “next generation, and what the promise and potential and threat that AI holds going forward…there’s no doubt that it will have a profound impact and will change the business in many ways. But the responsible, ethical use of these technologies is also a topic that’s on the mind of our C-suite executives.”

Sarasin agreed, noting some of the commentary from the CEOs of companies responsible for developing AI technology, and their concerns about the responsible use of AI.

“I think we are now at an inflection point where we have to really think through what are the capabilities and which are the ones that are appropriate to be used in our industry, and which are ones that our customer base are going to be comfortable with. Because at the end of the day, we respond to our customers, and we have to meet them where they are.”

Engaging with customers

Sarasin pointed out that the “notion of value” has changed among customers. “And of course, everything in our business revolves around what our customers are thinking.”

“So increasingly, eating well – whether it’s related to a more detailed concept of quality that incorporates aspects of health, nutrition, freshness or sustainability, as well as considerations like convenience, family food preferences, individual cooking skills and habits, and overall shopping and eating experience – have become major factors in how shoppers determine what constitutes a good value for each of them.”

Retailers are using perimeter departments to differentiate themselves, build a competitive advantage and draw shoppers to their brick-and-mortar locations. Many are reinvesting in and expanding their food service departments to increase fresh prepared, ready-to-eat offerings, according to the FMI Speaks report.

They also are working to maintain customer loyalty, with nearly 70 percent showcasing private brand products as high-quality value alternatives, while 65 percent are emphasizing price differentiation.

FMI’s 2022 The Power of Private Brands reported 35 percent of consumers said higher prices due to inflation have led them to buy more private brands. Sarasin said this momentum is expected to continue during 2023.

A vast majority of food retailers and manufacturers responding to the survey agreed on the importance of private brands and said they anticipate significant investments in the future.

Baum noted that the “brick-and-mortar experience continues to be the foundation of a food retailers’ image and reputation. Retailers are paying more attention than ever to that in-store experience.”

They are using strategies such as in-store technologies to enhance the customer shopping experience, increasing local SKU allocation and items, and increasing labor allocations to in-store specialty help by department. Retailers also are focusing on shopper engagement and loyalty programs, and a fast, frictionless checkout experience.

Suppliers have continued to accelerate digital commerce and direct-to-consumer efforts and improve technology for online ordering, Baum said.

SEG commitment

Another imperative issue in the FMI Speaks report is the food industry’s commitment to social and environmental change.

“I think we’re all aware that more and more in today’s world, consumers expect that the businesses they buy from and are loyal to will be good corporate citizens. To address this trend, many food retailers and suppliers have been leveraging social and environmental responsibility to differentiate their businesses and also to meet consumer demands,” Sarasin said.

FMI has worked with its members on a set of industry commitments to support the goals of the 2022 White House Conference on Hunger, Nutrition and Health. This includes donating 2 billion meals in 2023 to food banks and other community organizations and sharing evidence-based messages to support healthy eating patterns by reaching more than 100 million consumers. Other commitments focus on improving food access to underserved communities, leveraging federal feeding and food-as-medicine programs, and promoting consumer education and transparency.

Addressing environmental concerns, Sarasin noted most food retailers and suppliers have “quantifiable goals” for future waste reduction, responsible sourcing, product transparency and packaging waste reduction, with many already taking steps toward sustainable packaging.

“So while the food industry certainly has a lot on its plate, I think it’s fair to say that it’s aggressively taking many different approaches to meet challenges and drive successes in ways that positively impact the business and support the needs of their customers…,” Sarasin said.

“The food industry is always committed to support families in the communities in which we operate by providing access to healthy and affordable foods, and we continue to do everything we can to make significant investments across our operations to create value, enhance customer and engagement and improve the overall shopping experience for our customers.”

Food Retailers Pursuing Strategic Differentiation Strategies