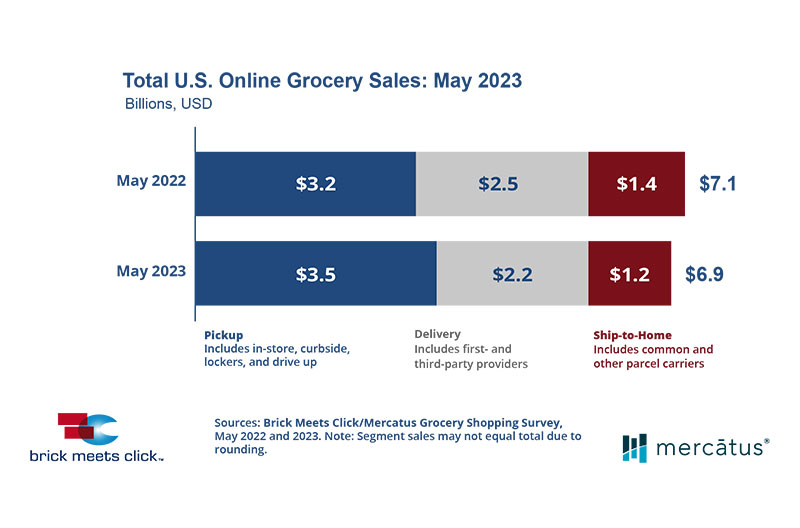

The U.S. online grocery market finished May with $6.9 billion in total sales, down 3.4 percent compared to last year’s $7.2 billion, according to the latest monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded May 30-31.

The dip in overall sales for May was driven by a combination of fewer households buying groceries online during the month than last year and a decline in the average number of orders placed by active shoppers.

Results were mixed across the three receiving segments. Pickup recorded year-over-year growth and captured its largest share of sales to date, climbing 9.1 percent and contributing 50.7 percent of total eGrocery sales.

Ship-to-home fell 17 percent versus last year and accounted for 16.8 percent of eGrocery sales during the month, continuing to post weaker results each year since 2020. Delivery declined 11.7 percent compared to last year, and its dollar share dropped nearly two points to 32.5 percent for the month.

The overall base of monthly active users for online grocery contracted 5 percent as all three segments experienced pullbacks in their MAU bases. In addition, the share of MAUs who used just one receiving method in May rose nearly 6 percentage points to 72 percent.

Along with fewer households buying groceries online, the average number of orders placed by MAUs fell 5 percent to 2.51 versus May 2022, continuing a downward trend from the record high of 2.91 in May 2020.

“The decline in order frequency is the result of the growing number of MAUs who placed only one eGrocery order during the month. This accounted for one-third of all active customers and caused headwinds across all the segments,” said David Bishop, partner, Brick Meets Click.

Overall spending per order increased by about 8 percent in May versus the prior year, largely due to higher prices for grocery products.

Overall repeat intent rates declined 270 basis points in May versus last year, marking the third straight month in which customers indicated a lower likelihood of using the same pickup or delivery service again within the next 30 days compared to the same periods in 2022.

“Given the decreasing number of online customers and the decline in repeat intent rates, it is imperative for regional grocers to gain a deeper understanding of their customers’ evolving needs and effectively adapt,” said Sylvain Perrier, president and CEO, Mercatus.

“As customer expectations continue to rise, it is crucial for grocers to reassess their current service standards and ensure that the shopping experience aligns closely with these elevated expectations.”

Online’s share of total grocery spending dropped in May, falling 270 basis points to 12.1 percent versus last year. Excluding ship-to-home, the adjusted contribution from pickup and delivery finished at 10 percent, down 190 basis points compared to a year ago, due to delivery’s weaker performance for the month.

Visit the Brick Meets Click eGrocery Dashboard for May or visit the eMarket/eShopper page for additional insights and information about the full report.