For the first quarter of 2023, prices in several food and personal care categories topped the overall rate of inflation in the U.S. and Europe, according to the Catalina Shopping Basket Index.

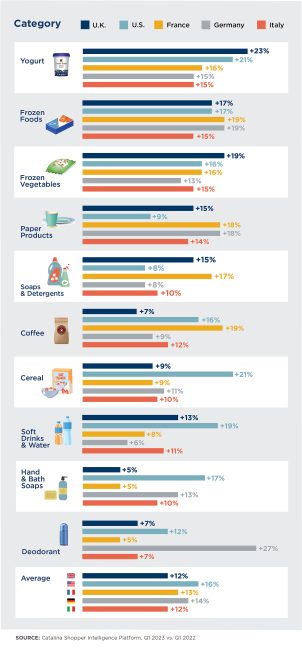

To compile its latest economic report, Catalina tapped into its Shopper Intelligence Platform to look at the aggregate price increase of 10 common product categories in the U.S., UK, Italy, France and Germany compared to the same period in 2022.

“A number of factors have been driving up prices in Europe and the U.S., including the war in Ukraine, lingering supply chain disruptions and rising aluminum, ingredient, labor and energy costs,” said Sean Murphy, chief data and analytics officer at Catalina.

“In response, we’re seeing CPG marketers and retailers place more emphasis on promotions and price incentives, and we’re working more closely with them to earn the loyalty of value-conscious shoppers with highly personalized offers.”

Double-digit price hikes across U.S. and Europe

On average, yogurt prices rose the most in Q1 2023, up 18 percent, closely followed by frozen food (17 percent) and frozen vegetables (16 percent). The biggest individual country price jumps posted were for cereal in the U.S., up 21 percent from a year ago, and deodorant in Germany, which rose 27 percent.

Q1 inflation rate trends higher in certain categories

The Catalina Shopping Basket Index shows prices for these 10 common grocery items were at least twice the inflation rate for food at home reported by their respective governments.

For all countries surveyed, food prices rose on average 1 percent from Q3 2022, but are now stabilizing in Italy (6 percent), France and Germany, both 5 percent. UK food prices have continued to rise to 7 percent, with the U.S. dropping from 7.4 percent in Q4 2022 to 7.2 percent in Q1 2023.

U.S. inflation rate for groceries slows in Q1

Inflation is hitting shopping baskets unevenly in the U.S. Cereal and yogurt had the biggest jumps, up 21 percent from a year ago. But the rate of inflation is slowing across categories, when compared with Q3 2022. All categories fluctuated no more than two percentage points, an indicator that inflation continues to slow in the U.S. But the Catalina Shopping Basket Index, which averages 16 percent, is higher than the Consumer Price Index’s 7 percent Q1 inflation rate for food at home.

“With the worldwide increase in inflation starting back in mid-2021, our insights about traditionally price-sensitive and value-seeking shoppers apply to even more consumers now. We continue to advise our customers that these challenging economic times are an opportunity for brands to fine-tune their omni-channel approach to deliver relevant offers and valuable incentives to help shoppers make the most of their dollars,” Murphy said.

For more information, visit catalina.com.