FMI – the Food Industry Association hosted a briefing March 15, “Impact of Inflation on Grocery Shopper Buying Habits: Looking Inside Inflation’s Black Box,” to discuss what lies ahead for food prices in 2023.

The briefing looked at how higher prices have impacted shopper buying habits and how grocers are responding to the economic climate and evolving consumer trends.

While there are positive signs that the worst of food price inflation is over, the U.S. is not out of the woods yet, according to Andrew Harig, VP of tax, trade, sustainability and policy development at FMI. He was joined by FMI’s Rick Stein, VP of fresh foods, and Ricky Volpe, associate professor of agribusiness at CalPoly.

Harig said prices for key commodities like meat, poultry, fish and eggs declined over the past month. The latest CPI data, however, showed that inflationary price increases are not “resetting as quickly or as uniformly as consumers would like.” He added that, after a tough 2022, there could be more volatility in the coming months due to the rise and fall of inflation, with the likelihood of food prices remaining elevated in the short term.

“In 2022, we witnessed energy prices becoming increasingly volatile, creating uncertainty for one of the industry’s most critical input costs. We also continue to monitor severe weather events, trucking and labor issues, all of which serve as key influencers on inflation,” Harig said.

Food price concerns are front of mind for shoppers.

A recent FMI consumer poll on U.S. grocery shopper trends revealed:

- 48 percent of shoppers report being extremely concerned about grocery store prices rising;

- 43 percent of them are concerned about having enough money to pay for the food they need (up from 35 percent in October); and

- 76 percent of consumers are concerned about prices rising on the foods they prefer (up from 61 percent since October).

Even so, the food retail economic picture “is not all doom and gloom, and in fact there are some real bright points,” Harig said.

Recent FMI shopper data shows consumers are spending an average of $151 per week at the grocery store, which is not much higher than the average $148 weekly spend in October 2022. Harig noted that consumers also are having “a somewhat distorted perception of the inflationary environment, which is impacting their feelings toward the shopping experience.”

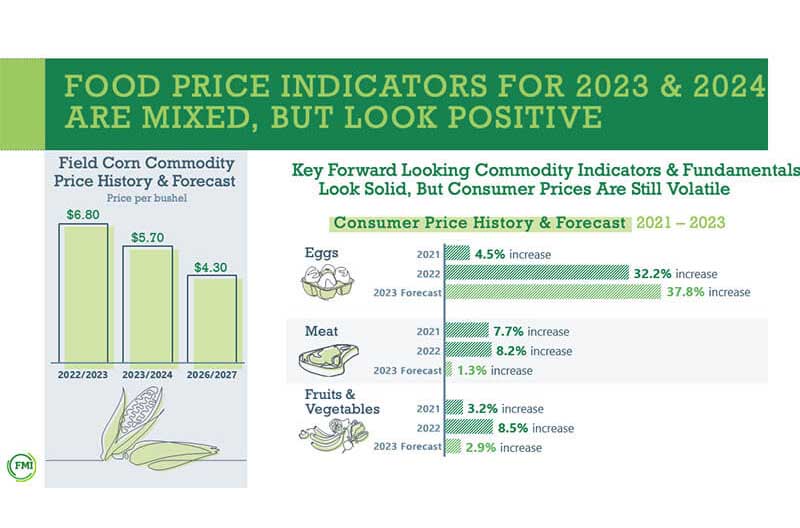

In looking at expectations regarding the cost of food at the grocery store in the coming months and year, Volpe said it is a complicated time for food prices, as the U.S. is coming out of a period of historical inflation.

“In 2022, we saw the highest year-over-year food price inflation that we’ve seen since the 1970s, and everybody’s waiting for it to come down. And it is coming down. But it’s coming down very slowly.”

He added that he is optimistic that inflation will fall as the year goes on. Looking at “the most upstream big picture indicators, we’re looking at relative normalcy.”

He noted, however, that as inflationary pressures decrease at the start of the food supply chain, it takes time for that to transmit down the chain to retail shelves.

Volpe said he also looks at the producer price indices, which are the measures of business-to-business prices paid within the food supply chain. This data is a more forward-looking gauge than looking directly at retail prices.

He also noted that for most major categories of food spending, the upstream farm and wholesale prices are flat or declining. On the other side, however, he said many structural challenges remain for the food supply chain and the agribusiness sector. Transportation and labor also present challenges for most food companies.

“I think the cost of doing business has gone up, and it’s become more challenging. It’s another reason why inflation and prices aren’t really coming down in a meaningful way,” Volpe said. “We’re really hoping for some relief in those regards for food companies of all stripes, from producers to manufacturers to retailers, as the year goes on.”

In some food categories, there are specific issues going on that are causing higher prices. These include eggs, largely because of the avian flu; wheat, which is under “tremendous price pressure globally because of the conflict in Ukraine;” and most foods that are soybean or oil based, Volpe said.

He said long-term, he thinks the U.S. is on track toward a “much more normal year-over-year food price inflation going into 2024. I don’t think we’ll hit it this year, but maybe next year.”

Private brands

Harig noted that inflation has cause some consumers to turn to private brands in an effort to save money. In a recent survey, 41 percent are buying more private brands due to inflation and other factors, such as the pandemic. He said this momentum is expected to continue in 2023.

However, the increased interest in private brands isn’t solely based on price and affordability. Harig said additional factors include quality, taste, sustainability and contributions to health and well-being. As a result, grocers have “dramatically improved” the quality of their private store brand offerings. In addition to the benefit for shoppers, he said grocers “increasingly see private brands as an avenue to reinvent themselves in the marketplace and differentiate them from the shop next door.”

Volpe said he thinks private labels are “very, very interesting.” He said in Western Europe and the UK, private labels or store brands are dominant, with the national brands being “almost more niche.” He mentioned the rise of vertically integrated store brands in the U.S. food system. “Almost every day you see this greater proliferation of these vertically integrated brands from retailers across the board.”

Volpe said retailers – mainly larger ones – are cutting out the middleman and investing in food production, processing and manufacturing, “actually making these private labels literally from the ground up.”

In addition to lower prices, this also makes them more competitive with national brands, which is a win for both retailers and consumers, Volpe said.

“That’s just one force sort of working to help moderate food prices and keep those prices down a little bit from within the black box of the food supply chain…it’s one of the ways that I see the food retail sector evolving in a really exciting and positive way.”

Innovation and buying local

Innovation in the U.S. food system is “one of the best tools we have to counter food price inflation and help ensure the availability of bountiful food for everybody,” Volpe said.

Harig noted that one area where there is a lot of innovation is in helping consumers make healthy choices. FMI consumer research shows that 49 percent of shoppers reported putting more effort into selecting nutritious and health food options during the pandemic. This trend has continued.

Stein said FMI’s Power of Produce 2023 report showed that the produce department grew about 4.8 percent in dollars to a total of $74.5 billion. Although overall volume was down about 4.2 percent, he said the category still remained strong.

While organic produces sales have decreased and some shoppers are turning to cheaper fresh produce, Stein said shoppers are willing to spend more on produce when it comes to convenience. About 68 percent of shoppers said they would like their store to carry a bigger selection of value-added items, such as pre-cut, pre-washed or packaged salads.

Volpe said that COVID-19 was “an enormous challenge” for specialty crop growers of fruits, vegetables and tree nuts. They learned that adaptability, flexibility and a “sort of wide Rolodex” of buyers and sellers is important in being prepared for “the next big shock.” Retailers and foodservice providers across the board are becoming more interested in developing local connections and being able to source locally.

He said that is one reason the availability of local foods has really exploded, with retailers across the U.S. “doing their best to “source, promote and make available whatever can be grown or made locally.” This ties into private labels.

Volpe said another growing trend is seeing grocery stores emphasizing that local connection and highlighting local partnerships.

Meat and seafood sales

Seafood sales dropped 3.8 percent in 2022, reversing a two-year trend that saw sales spike during the pandemic. Inflationary cost increases caused shoppers to turn toward more affordable proteins, rather than fresh or frozen seafood. However, seafood sales were still higher in 2022 than they were pre-pandemic in 2019.

“Given shoppers’ increasing interest in health and well-being, adding more variety to their diet, eating more sustainable foods in general, we expect the seafood category to rebound once inflationary pressures ease,” Stein said.

Meat “still reigns supreme” as the protein choice for most shoppers, he said, with nine out of 10 home-prepared dinners containing a portion of meat or poultry. Meat department sales reached a record $87.1 billion in 2022, up 5.7 percent from 2021.

However, due to increased costs, Stein said three quarters of the meat shoppers are making one or more changes to their meat or poultry purchases – 78 percent said they’ve adjusted how much meat and poultry they buy, 76 percent report changing the kind of meat they buy, and 74 percent have changed what cuts of meat they purchase.

Volpe agreed that demand for meat remains very strong, regardless of what’s going on with prices. He said he believes plant-based alternatives are not going anywhere and will continue to take up more shelf space, although demand may be more volatile over time.

Volpe said the industry needs to look at the factors that are keeping demand strong for meat and what’s resonating with consumers. When prices go up, what are consumers buying and why?

Stein pointed out that while inflation has boosted the popularity of store brand fresh and processed meat, this is a trend that has been building for more than 15 years. The number of shoppers who prefer store brands for fresh meat has nearly tripled since 2007. This illustrates “a massive shift in the shopper attitudes toward store and manufactured brands.”

Volpe noted that the pandemic demonstrated that there is a downside to consolidation in the meat processing industry, specifically for cattle and hogs. “I think that the supply chains for beef and pork should consider operations of varying sizes to allow for a greater availability geographically…that’s going to pay dividends in a couple of other ways.”

This will help alleviate the effect of shortages or shutdowns for any one individual operation but also factors in transportation issues. As these meats require very precise temperature control and are very heavy, it makes transportation a challenge, Volpe said. Truck transportation has become “a real pain point for the food supply chain.”

Looking to the future

Stein said he is optimistic for the future, especially in the fresh departments. Working in favor of retailers is the fact that consumers have decided to eat more at home and eat less processed foods. From a supply chain standpoint, he said the industry saw a lot of efficiency come out of the pandemic, especially on the meat side.

He noted that meat suppliers started to cull their SKU count, “making sure they could deliver on the demand that they were asked to deliver on.”

He said retailers have “figured out” their supply chain collaboration partners and are able to get products they want and get them on time.

Harig noted that, even as inflation plateaus, “the elevated cost of the black box inputs that cause food prices to increase in the first place will take time to recalibrate and work their way through the supply chain.” This means food prices likely will remain higher in the short term, even as inflationary pressures start to ease.

However, uncertainties will continue to impact food prices, Harig said. In the meantime, the food industry is working to advance technologies that save time, money and resources in getting fresh, safe, healthy food to consumers at prices they can afford.

“The food retail model is changing,” Harig said. “It’s undergone a tremendous amount of evolution since the start of the pandemic and continues to change on a daily basis. Grocers are continuing to expand their fresh and perimeter departments to cater to shoppers’ evolving tastes and behaviors, and this includes growing demand for store brand products.”

He said FMI will have more data in the coming months from its upcoming grocery shopper trend series.

For more FMI news from The Shelby Report, click here.