Sponsored content

Anne-Marie Roerink is a principal at 210 Analytics LLC – providing customized research with a specialty in food retailing for clients such as the National Confectioners Association, Food Marketing Institute, National Grocers Association, North American Meat Institute and many others.

Through numerous consumer studies, Roerink has developed a perspective on the ever-changing wants and needs of the grocery shopper in a one-size-fits-no-one world. Additionally, she offers a diverse, in-depth view on food retailing strategies, financials and operations.

Prior to founding 210 Analytics, Roerink was the head of research for the Food Marketing Institute. Roerink designs and authors studies in meat, produce, deli prepared, frozen, SmartFood, bakery, confections and other categories.

The Sweets & Snacks Expo explores how the snacks sector has continued to grow even in the face of macroeconomic headwinds and changing consumer behavior.

How has inflation impacted the snacks industry?

The year 2022 ended the way it started, with inflation taking the headlines. According to the December IRI primary shopper survey, 93 percent believe groceries cost somewhat or a lot more than last year and 97 percent are somewhat or a lot concerned about it – lower-income households in particular.

Consumers are noticing higher prices for all areas of the store. Whether these are perceptions or reality, consumers will adjust shopping behaviors based on what they believe, which is what makes the market even more unpredictable.

Inflationary concerns have prompted a host of money-saving measures when buying groceries among 82 percent of Americans, such as buying what’s on sale (53 percent), cutting back on non-essentials (45 percent), looking for coupons (35 percent) and switching to store brand items (31 percent).

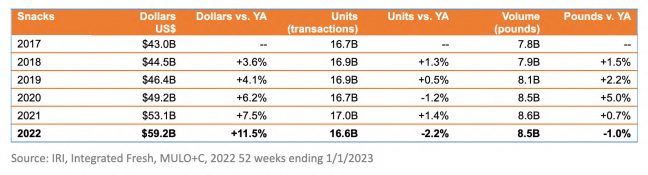

One thing, however, remained the same: the strength of the snack category and its ability to deliver growth for the total store. Snack sales, that include salty snacks, cookies, crackers, meat snacks and more, reached nearly $60 billion in 2022, which is an astounding additional $17 billion versus 2017. Though inflationary driven, the increases in prices have not put a dent in unit and pound sales that continue to trend above the pre-pandemic baseline of 2019.

How has the post pandemic return to office trend impacted store-bought snack sales?

The December IRI survey also noted a sharp uptick in the estimated share of meals prepared at home. Lunch is one of the areas where consumers are looking to save on restaurant meals. Among people who work away from home, 38 percent packed lunch more often – a big opportunity for store-bought snacks.

Retailers that are aware of the newest product offerings in the category will undoubtedly catch the eye of any consumer seeking to eschew the ordinary. Luckily, events such as the Sweets & Snacks Expo gather these types of innovative offerings in one place, giving retailers the chance to be the first to discover the next big thing.

Further, the vast majority of the nation’s school-aged children are also back in the classroom, and with its return, classroom treating has resumed for the majority of schools. But, it has returned with a twist as many schools require items to be individually packaged, which may move the dollar from the perimeter bakery into the snack aisle.

How is the snack category being impacted by online sales?

Another opportunity is the continued growth in online sales. While the number of people buying online has plateaued, about one-third of shoppers routinely buy items online and in-store. This favors the snack category as online baskets continue to see fewer fresh items and have a higher percentage of center store items.

Retail trends for 2023 are expected to favor choices, options and ease of purchase for the consumer, making it increasingly important for retailers to ensure they both on par with their competitors at a minimum, but ideally well-enough informed to be a step ahead. Trade events, including the aforementioned Sweets & Snacks Expo, offers extraordinary insights and forecasting of retail trends.

2022 in review

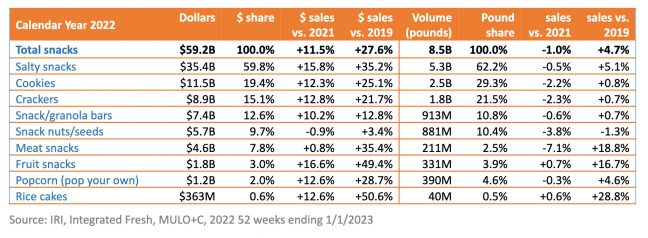

The $59.2 billion in total snack sales in IRI’s multi-outlet plus convenience stores universe represents an increase of 11.5 percent over 2021 and 27.6 percent over 2019 — the pre-pandemic baseline. Snacks have been performing very well when contrasted against total food and beverages.

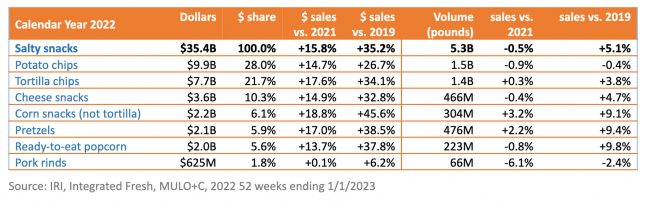

Four areas within snacks achieved double-digit dollar growth in 2022. The performance by salty snacks, which includes items such as potato chips, pretzels and ready-to-eat popcorn, was particularly impressive given the size of the category. Salty snacks rang up $35.4 billion in 2022, which represents 59.8 percent of total sales across all snack categories. And yet, dollars grew 15.8 percent versus year ago, while volume sales were virtually flat.

Total snack unit sales were down 2.2 percent year-on-year, while volume was off by just 1 percent. When volume is down less than units, it typically indicates a shift to larger pack sizes to use and save over time. Life is still more home centric than it was pre-pandemic. Foodservice recovery has been slow and spotty, and consumers are once more pulling back on foodservice spending in light of 40-year high inflation. This favors home-based celebrations whether birthdays, holidays, date nights or movie nights.

With more people opting for in-home entertainment and celebrations, retailers have the opportunity to offer new versions of traditional snacks, for instance ready-to-eat popcorn in varying flavors, that will keep consumers interested and returning to see what other new offerings are available in store.

While it can be a challenge to keep up with the new product launches or packaging trend, that need not make providing options intimidating. There are industry-focused events that are built around the snack category, including the Sweets & Snack Expo, where a countless number of products are debuted each year. Retailers in attendance are able to see firsthand where the category is going, essentially taking some of the guesswork out of what may be next top-seller.

Other categories with impressive growth statistics includes fruit snacks and rice cakes. These two areas sold more volume (measured in pounds) year-on-year. Fruit snacks have been making deep inroads into the traditional candy seasons in addition to being a popular lunch box item. The increase in volume sales versus 2019 is astounding at 16.7 percent.

Salty snacks

Salty snacks were the biggest seller at $35.5 billion, adding $4.8 billion to the 2021 record sales. Within salty snacks, potato chips were the largest seller, adding $1.3 billion in sales versus 2021. Tortilla chips also added more than a billion dollars in 2022.

Cookies

Cookies are the number two seller, up 12.3 percent in 2022. Volume was down but recovered to above 2019 levels.

Crackers

The dollar gains in crackers were inflation-driven, with volume down 2.9 percent. The highest growth within crackers was achieved by graham crackers, up 16.9 percent. The biggest seller, however, were filled crackers, that gained 12 percent over 2022.

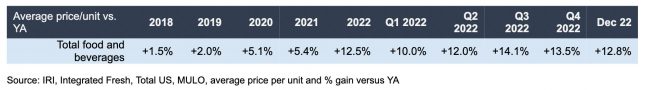

Inflation

The price per unit across all foods and beverages in the IRI-measured multi-outlet stores, including supermarkets, club, mass, supercenter, drug and military, increased 13.5 percent in the fourth quarter of 2022, which was down about a half point from the third quarter. Compared with December 2019, prices across all foods and beverages were up 27.5 percent.

Much like the rest of the store, inflation played a big role in snacks in 2022. The average price per unit increased as follows:

- Salty snacks: 15.9 percent;

- Cookies: 16 percent;

- Crackers: 16.9 percent;

- Snack/granola bars: 18.5 percent;

- Snack nuts/seeds: 4.5 percent;

- Meat snacks: 10.2 percent;

- Fruit snacks: 23.8 percent;

- Popcorn: 16.8 percent; and

- Rice cakes: 12.5 percent.

Source: IRI, Integrated Fresh, MULO+C, 2022 52 weeks ending Jan. 1, 2023.

For retailers to take advantage of the growing market segment it is important to have exposure to trends and innovative product launches. A can’t miss event like the Sweets & Snacks Expo affords a springboard for companies to look towards the future.

The show, which exclusively focuses on candy and snacks, is the largest of its kind in North America. It offers exceptional educational insights that explore snack, flavor and packaging trends as well as retail and consumer predictions for the coming year and beyond. Of equal importance is the exposure to new companies, products and innovations – many of which make their debut at the expo.

Being able to explore Startup Street and the specialty market areas of the show puts retailers in attendance at an advantage over their competitors. These aspects combined make the Sweets & Snacks Expo an unparalleled, premier experience for any retailer wanting to be attuned to industry trends and looking to push the boundaries of their product offerings.

To read more from our Experts, click here.